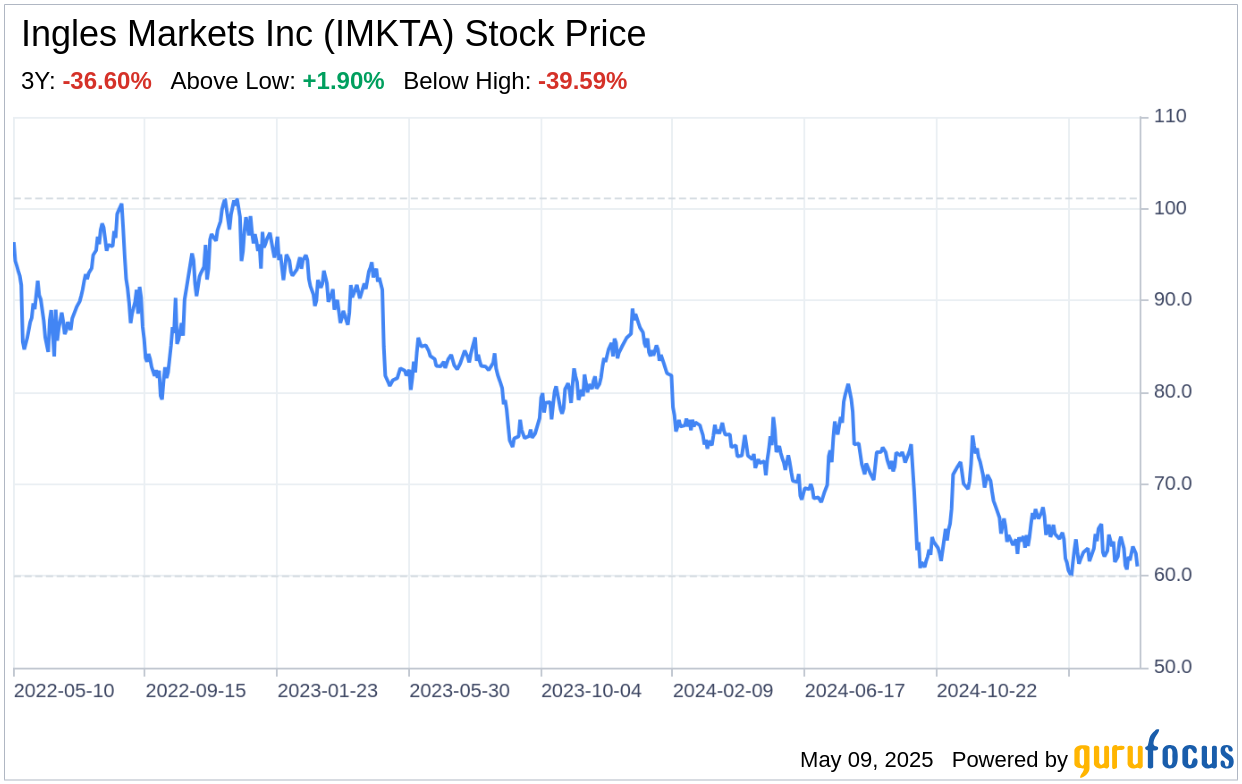

Ingles Markets Inc, a leading supermarket chain operating primarily in the southeastern United States, filed its 10-Q report on May 8, 2025. This SWOT analysis delves into the company's financial performance and strategic positioning based on the latest quarterly data. Ingles Markets Inc reported a decrease in net sales by $36.2 million, or 2.7%, to $1.33 billion for the three months ended March 29, 2025, compared to the same period in the previous year. The company's net income also saw a significant decrease, from $31.9 million in the second quarter of fiscal 2024 to $15.1 million in the same quarter of fiscal 2025. Despite these challenges, Ingles Markets Inc continues to invest in capital expenditures, with plans to allocate approximately $120 to $160 million towards store improvements and technology enhancements. The company's real estate ownership remains a strength, providing a stable source of rental income and contributing to its overall financial stability.

Strengths

Real Estate Ownership: Ingles Markets Inc's strategic ownership of the majority of its store properties provides a competitive edge in the form of rental income and cost control. This real estate portfolio not only reduces reliance on lease agreements but also offers the company flexibility in managing its store locations and potential expansion.

Stable Rental Income: The company's ability to lease out portions of its shopping center properties to other businesses creates an additional revenue stream. As of March 29, 2025, Ingles Markets Inc owned and operated 101 shopping centers, with non-cancelable leases providing future minimum operating lease receipts, ensuring a steady flow of income outside of its core retail operations.

Capital Investment Strategy: Despite a challenging fiscal period, Ingles Markets Inc has not shied away from investing in its future. The company's capital expenditure plans, including store improvements and technology upgrades, demonstrate a commitment to maintaining a modern and competitive store base, which is crucial for long-term growth and customer satisfaction.

Weaknesses

Impact of Natural Disasters: The recent Hurricane Helene has had a significant negative impact on Ingles Markets Inc's operations, with store closures and disruptions leading to a decrease in sales and increased expenses for cleanup and repairs. This vulnerability to natural disasters highlights the need for robust contingency planning and insurance strategies.

Increased Operating Expenses: The company's operating and administrative expenses have risen, partly due to the aftermath of the hurricane and investments in technology transformation projects. While these investments are necessary for future growth, they currently strain the company's profitability, as evidenced by the increase in operating expenses as a percentage of sales.

Dependence on Vendor Allowances: Ingles Markets Inc relies heavily on vendor allowances to reduce merchandise costs. Any substantial reduction or elimination of these allowances could force the company to reassess its advertising strategies and potentially increase expenditures, impacting its bottom line.

Opportunities

Technological Advancements: Ingles Markets Inc's ongoing investments in technology present an opportunity to enhance operational efficiency and customer experience. Implementing new systems and upgrading existing infrastructure can lead to improved inventory management, streamlined checkout processes, and personalized marketing efforts, all of which can drive sales growth.

Store Modernization and Expansion: The company's capital expenditure plans for store modernization and expansion, including the re-opening of stores closed due to Hurricane Helene, position Ingles Markets Inc to capture increased market share and cater to evolving consumer preferences, particularly in the growing southeastern U.S. market.

Health and Wellness Trend: As consumer interest in health and wellness continues to rise, Ingles Markets Inc can leverage its product offerings in fresh produce, organic items, and pharmacy services to meet this demand, potentially increasing customer loyalty and attracting new health-conscious shoppers.

Threats

Competitive Grocery Market: The grocery sector is highly competitive, with players ranging from large national chains to local specialty stores. Ingles Markets Inc must continually innovate and differentiate its offerings to retain and grow its customer base in the face of aggressive competition.

Economic Sensitivity: As a retailer primarily focused on food and everyday essentials, Ingles Markets Inc's performance is closely tied to economic conditions. Any downturn can lead to reduced consumer spending, impacting sales and profitability.

Regulatory Changes: The company operates in a heavily regulated industry, and any changes in food safety, labor laws, or environmental regulations can lead to increased compliance costs or operational adjustments, potentially affecting its financial performance.

In conclusion, Ingles Markets Inc (IMKTA, Financial) faces a mixed financial landscape, with the strength of its real estate ownership and strategic capital investments counterbalanced by the challenges of natural disasters and increased operating expenses. Opportunities for growth through technological advancements and store modernization are tempered by the threats posed by a competitive market and economic sensitivity. As Ingles Markets Inc navigates these dynamics, its ability to adapt and innovate will be critical in maintaining its market position and driving future success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.