Match Group (MTCH, Financial) has unveiled a comprehensive reorganization plan aimed at evolving into a more cohesive, product-driven organization. This initiative focuses on boosting innovation, enhancing operational effectiveness, and improving user experiences, particularly for Gen Z audiences. The restructuring is designed to streamline the company, making it less hierarchical and more agile, thereby empowering teams and clarifying execution pathways.

The reorganization entails a significant workforce reduction of 13% alongside the centralization of crucial operations such as technology and data services, customer care, and content moderation. By minimizing redundancy and achieving scale, Match Group aims to reinforce its commitment to focus and long-term growth. These changes are expected to enhance the company's efficiency across its diverse range of brands.

Through breaking down internal barriers and improving communication, Match Group seeks to maximize the benefits of its scale, ultimately enriching the experience for the millions using its apps to forge meaningful connections. This strategic shift underscores Match Group's leadership in nurturing authentic and effective connections in the digital age.

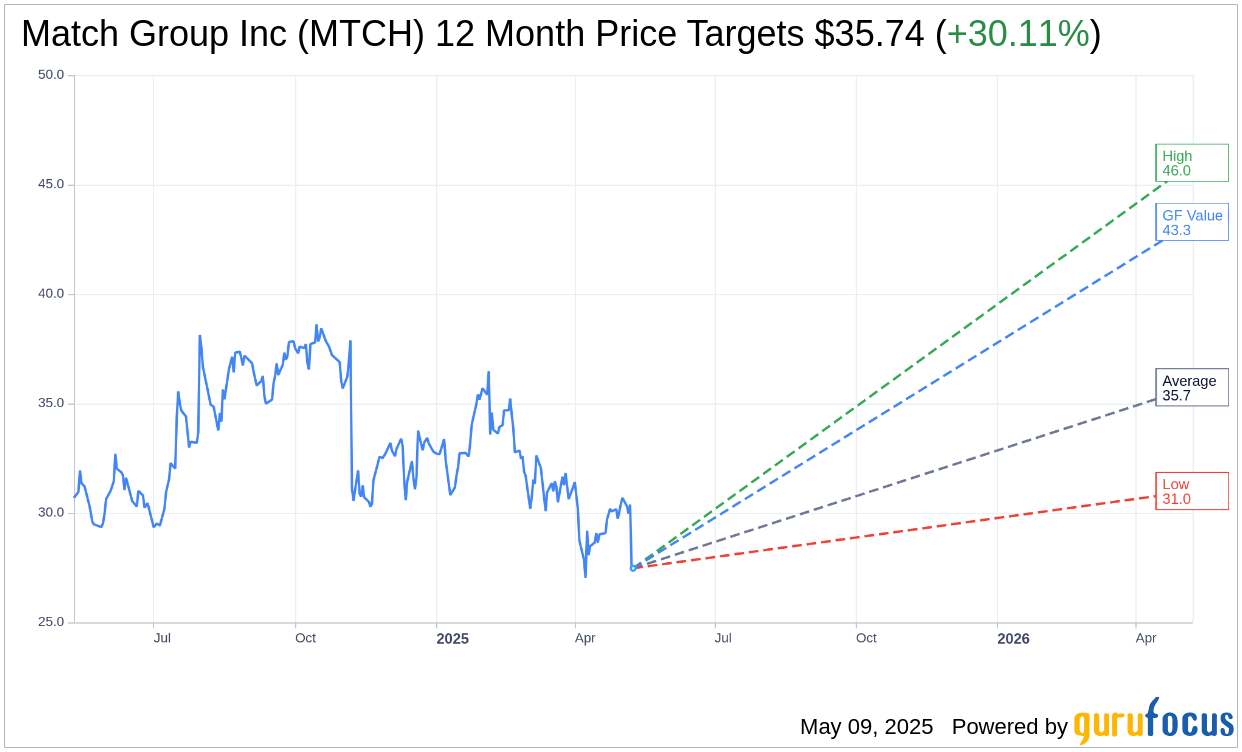

Wall Street Analysts Forecast

Based on the one-year price targets offered by 18 analysts, the average target price for Match Group Inc (MTCH, Financial) is $35.74 with a high estimate of $46.00 and a low estimate of $31.00. The average target implies an upside of 30.11% from the current price of $27.47. More detailed estimate data can be found on the Match Group Inc (MTCH) Forecast page.

Based on the consensus recommendation from 23 brokerage firms, Match Group Inc's (MTCH, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Match Group Inc (MTCH, Financial) in one year is $43.30, suggesting a upside of 57.63% from the current price of $27.47. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Match Group Inc (MTCH) Summary page.

MTCH Key Business Developments

Release Date: May 08, 2025

- Total Revenue: $831 million, down 3% year-over-year (Y/Y), down 1% Y/Y FX-neutral.

- Adjusted Operating Income (AOI): $228 million, down 5% Y/Y, representing an AOI margin of 49%.

- Tinder Direct Revenue: $447 million, down 7% Y/Y, down 4% FX-neutral.

- Hinge Direct Revenue: $152 million, up 23% Y/Y, up 24% FX-neutral.

- Operating Income (OI): $193 million, down 8% Y/Y, representing an OI margin of 42%.

- Cost of Revenue: Decreased 8% Y/Y, representing 29% of total revenue.

- Cash and Cash Equivalents: $414 million at the end of Q1.

- Share Repurchase: 1 million shares repurchased at an average price of $32 per share.

- Q2 Revenue Guidance: $850 million to $860 million, down 2% to flat Y/Y.

- Q2 AOI Guidance: $295 million to $300 million, representing a Y/Y decline of 3%.

- Full Year Revenue Guidance: $3.375 billion to $3.5 billion.

- Full Year AOI Margin Target: 36.5% excluding restructuring costs.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Match Group Inc (MTCH, Financial) exceeded the high end of their guidance for both total revenue and adjusted operating income in Q1 2025.

- The company announced a reorganization to centralize key functions, aiming for more than $100 million in annualized savings.

- Tinder's new features, such as Double Date and The Game Game, are showing positive engagement, particularly among younger users.

- Hinge continues to show strong momentum with a 23% year-over-year increase in direct revenue and a 19% increase in payers.

- Match Group Inc (MTCH) is expanding internationally, with plans to launch Hinge in Brazil and Mexico, and The League in the Middle East and India.

Negative Points

- Match Group Inc (MTCH) reported a 3% year-over-year decline in total revenue for Q1 2025.

- Tinder's direct revenue decreased by 7% year-over-year, with a 6% decline in payers.

- The company announced a 13% reduction in workforce as part of cost-cutting measures.

- Tinder's monthly active users declined by 9% year-over-year in Q1 2025.

- There are early signs of weakening Tinder a la carte revenue trends among younger users, potentially due to macroeconomic pressures.