Wells Fargo has adjusted its price target for Outfront Media (OUT, Financial), decreasing it from $22 to $17 while maintaining an Overweight rating. The decision comes after the company posted a weaker-than-anticipated performance in the first quarter. Despite anticipated fluctuations in reported growth over the coming quarters, Wells Fargo remains optimistic about the long-term prospects of the Out-of-Home advertising sector.

Wall Street Analysts Forecast

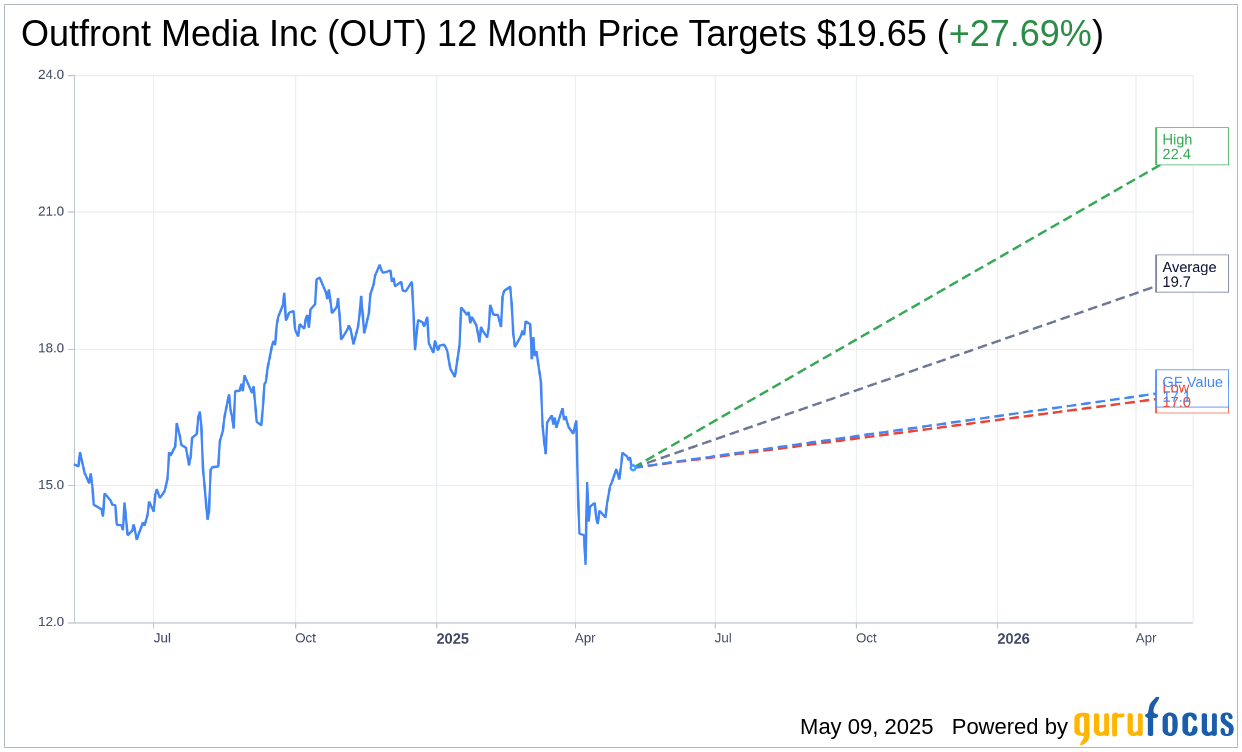

Based on the one-year price targets offered by 5 analysts, the average target price for Outfront Media Inc (OUT, Financial) is $19.65 with a high estimate of $22.44 and a low estimate of $17.00. The average target implies an upside of 27.69% from the current price of $15.39. More detailed estimate data can be found on the Outfront Media Inc (OUT) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Outfront Media Inc's (OUT, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Outfront Media Inc (OUT, Financial) in one year is $17.13, suggesting a upside of 11.31% from the current price of $15.39. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Outfront Media Inc (OUT) Summary page.

OUT Key Business Developments

Release Date: May 08, 2025

- Organic Revenue Growth: Slight growth, in line with guidance.

- OIBDA: $64 million.

- AFFO: $24 million.

- Billboard Revenue: Down 1%, impacted by exit of a New York contract.

- Transit Revenue: Up 2.6%, with strong growth in New York MTA.

- Digital Billboard Revenue: Up 5.4%.

- Static Billboard Revenue: Down 3.5%.

- Digital Revenue Performance: Grew almost 7%, representing 33% of total organic revenues.

- Programmatic and Digital Direct Automated Sales: Up nearly 20%.

- Local Revenue: Down 3% year-on-year.

- National Revenue: Up 4%.

- Billboard Yield Growth: Up about 2% to over $2,600 per month.

- Billboard Expenses: Down over $5 million or 2.4% year-over-year.

- SG&A Expenses: Rose about $2 million or 3.2%.

- Billboard Adjusted OIBDA Margin: Increased by 100 basis points to 31.9%.

- Transit Expenses: Up almost $1 million or 1% year-over-year.

- Capital Expenditures: Q1 CapEx spend was $17 million.

- Committed Liquidity: Over $600 million.

- Total Net Leverage: 4.8 times.

- Dividend: $0.30 cash dividend announced.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Organic revenues grew slightly, aligning with the company's guidance.

- Digital Billboard revenues increased by 5.4%, indicating strong performance in digital advertising.

- Transit revenue grew by 2.6%, with New York MTA showing a robust 10% growth.

- Programmatic and digital direct automated sales rose nearly 20%, representing 16% of total digital revenues.

- Billboard adjusted OIBDA margin increased by 100 basis points year-over-year to 31.9%.

Negative Points

- Billboard revenues declined by 1% due to the exit of a large New York contract.

- Static Billboard revenues decreased by about 3.5%.

- Local revenues were down 3% year-on-year, with Billboard weakness offsetting New York City transit growth.

- SG&A expenses rose by about $2 million due to higher compensation-related expenses and a higher allowance for bad debt.

- Consolidated adjusted OIBDA declined by 3% compared to the prior year.