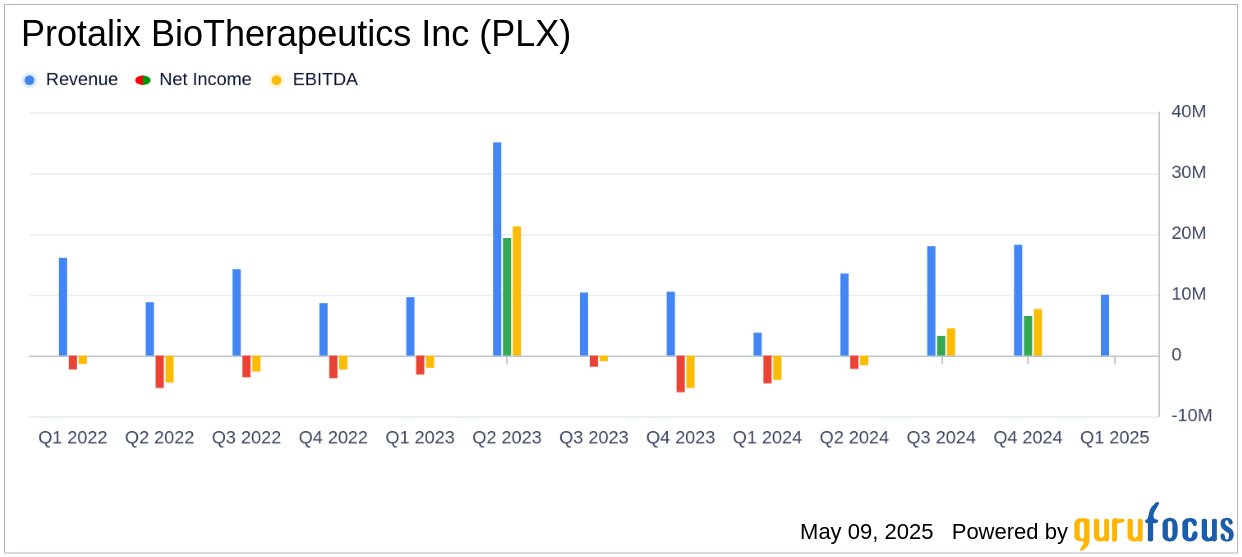

On May 9, 2025, Protalix BioTherapeutics Inc (PLX, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. The biopharmaceutical company, known for its development and commercialization of recombinant therapeutic proteins using its proprietary ProCellEx protein expression system, reported significant revenue growth but a net loss that exceeded analyst expectations.

Company Overview

Protalix BioTherapeutics Inc is a biopharmaceutical company focused on developing and commercializing recombinant therapeutic proteins. Its proprietary ProCellEx protein expression system is central to its operations. The company has developed taliglucerase alfa for Gaucher disease and has a pipeline that includes treatments for Fabry disease and cystic fibrosis. Revenue primarily comes from sales of BioManguinhos alfataliglicerase in Brazil and drug substances to Pfizer under an amended agreement.

Financial Performance and Challenges

Protalix BioTherapeutics Inc reported a revenue of $10.1 million for the first quarter of 2025, a substantial increase from $3.7 million in the same period of 2024. This growth was primarily driven by a $5.9 million increase in sales to Pfizer and a $0.4 million increase in sales to Fundação Oswaldo Cruz in Brazil. Despite this revenue growth, the company reported a net loss of $3.6 million, or $0.05 per share, which was below the analyst estimate of $0.03 earnings per share.

Key Financial Achievements

The company's revenue growth is a significant achievement in the biotechnology sector, where product development and commercialization can be lengthy and costly. The increase in sales to Pfizer and Fiocruz highlights the company's successful partnerships and market penetration. However, the net loss indicates ongoing challenges in managing costs and achieving profitability.

Income Statement and Balance Sheet Highlights

Protalix BioTherapeutics Inc's cost of goods sold increased to $8.2 million, up from $2.6 million in the previous year, reflecting higher sales volumes. Research and development expenses rose by 21% to $3.5 million, driven by advancements in the clinical pipeline. Conversely, selling, general, and administrative expenses decreased by 16% to $2.6 million, indicating improved operational efficiency.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Total Revenue | $10.1 million | $3.7 million |

| Net Loss | $(3.6) million | $(4.6) million |

| Loss Per Share | $(0.05) | $(0.06) |

Analysis and Commentary

Protalix BioTherapeutics Inc's revenue growth is a positive indicator of its market strategy and product demand. However, the net loss underscores the challenges of high operational costs and the need for continued investment in research and development. The company's focus on advancing its clinical pipeline, particularly with PRX-115 for gout, is crucial for future growth and profitability.

“We had another solid quarter, with an increase in revenues from selling goods compared to the prior year quarter,” said Dror Bashan, Protalix’s President and Chief Executive Officer.

Overall, while Protalix BioTherapeutics Inc has demonstrated strong revenue growth, the company must address its cost structure and continue to advance its product pipeline to achieve sustainable profitability in the competitive biotechnology industry.

Explore the complete 8-K earnings release (here) from Protalix BioTherapeutics Inc for further details.