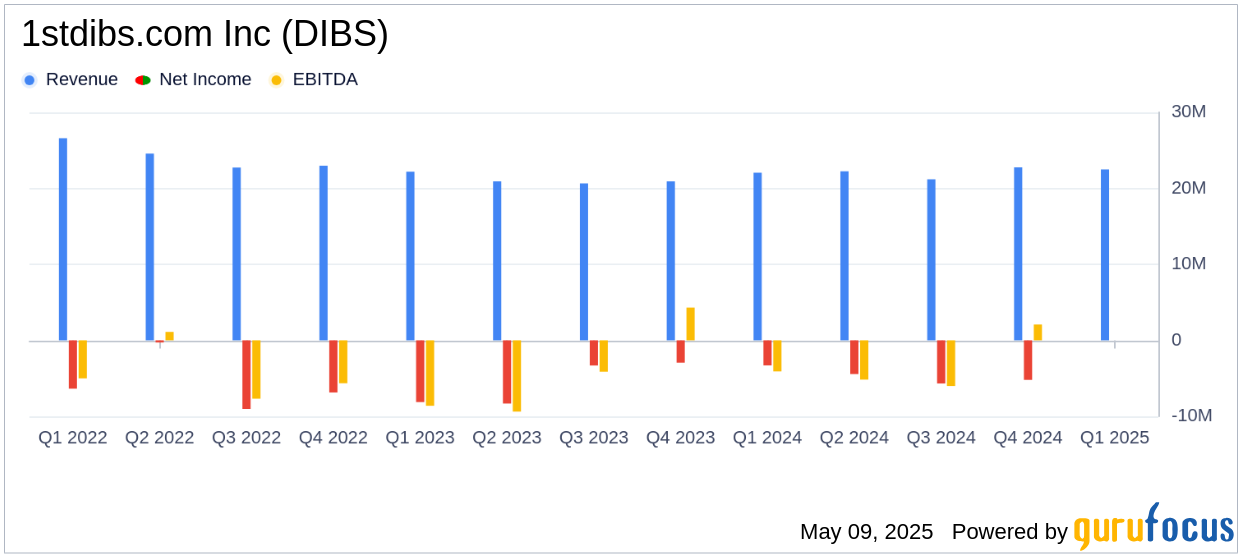

On May 9, 2025, 1stdibs.com Inc (DIBS, Financial) released its 8-K filing detailing the financial results for the first quarter ending March 31, 2025. As a prominent online marketplace, 1stdibs.com Inc connects design enthusiasts with sellers of vintage, antique, and contemporary luxury items. The company reported a net revenue of $22.5 million, slightly exceeding the analyst estimate of $22.36 million, marking a 2% year-over-year increase. However, the GAAP net loss widened to $4.8 million, compared to a net loss of $3.3 million in the same quarter last year.

Performance and Challenges

1stdibs.com Inc's performance in the first quarter of 2025 highlights both achievements and challenges. The company achieved a gross profit of $16.3 million, maintaining a gross margin of 72.4%, which is slightly lower than the previous year's 72.5%. Despite the revenue growth, the increased net loss indicates ongoing challenges in managing operational expenses and achieving profitability. The company's ability to navigate these challenges is crucial for sustaining growth and enhancing shareholder value.

Financial Achievements and Industry Context

The company's financial achievements, such as the 2% increase in net revenue and a 3% rise in Gross Merchandise Value (GMV) to $94.7 million, underscore its resilience in the Retail - Cyclical industry. These metrics are vital as they reflect the company's capacity to capture market share and drive economic activity through its online marketplace. The increase in active buyers by 7% year-over-year to approximately 65,000 further demonstrates growing consumer engagement.

Key Financial Metrics

1stdibs.com Inc's financial statements reveal important metrics that provide insights into its operational health. The balance sheet shows cash, cash equivalents, and short-term investments totaling $101.0 million, indicating a strong liquidity position. However, the company's accumulated deficit increased to $337.2 million, reflecting the ongoing challenge of achieving profitability.

| Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Net Revenue | $22.5 million | $22.1 million |

| Gross Profit | $16.3 million | $16.0 million |

| Net Loss | $(4.8) million | $(3.3) million |

| Adjusted EBITDA | $(1.7) million | $(1.8) million |

Analysis and Commentary

Despite the challenges, 1stdibs.com Inc's management remains optimistic about the company's strategic direction. CEO David Rosenblatt stated,

Our momentum continued in the first quarter, with strong execution, market share gains, and steady progress on our roadmap."CFO Tom Etergino added,

We delivered a solid quarter, gaining market share while diligently managing expenses and making progress against our 2025 plan."These statements reflect the company's focus on executing its strategy efficiently amidst an unpredictable macroeconomic environment.

Conclusion

1stdibs.com Inc's first-quarter results highlight its ability to grow revenue and maintain a strong market position despite widening losses. The company's focus on strategic execution and market share expansion is crucial for navigating the challenges of the Retail - Cyclical industry. Investors and stakeholders will be keenly watching how the company manages its expenses and drives profitability in the coming quarters.

Explore the complete 8-K earnings release (here) from 1stdibs.com Inc for further details.