In April 2025, Bitdeer (BTDR, Financial) successfully completed energizing two major power capacity projects, one in Tydal, Norway and another in Jigmeling, Bhutan. These expansions added 70 MW and 132 MW, respectively, pushing their global power capacity to nearly 1.1 GW. The company anticipates energizing an additional 473 MW at these sites by the end of June 2025, which will boost their total capacity to 1.6 GW, with over half of this capacity located outside the United States.

This strategic move towards global diversification is already showing benefits, enhancing Bitdeer's operational flexibility amid changing global trade conditions. In the immediate future, the company is focusing on deploying their SEALMINER A2 units in Norway and Bhutan. This deployment is expected to elevate their self-mining hashrate to over 40 EH/s during the year 2025.

Additionally, Bitdeer has decided to temporarily halt Bitcoin mining construction activities at their 570 MW site in Clarington, Ohio. This pause is a strategic decision as the company engages in discussions with potential partners and end users regarding High-Performance Computing (HPC) and Artificial Intelligence (AI) opportunities. Nevertheless, Bitdeer retains the option to reconsider and resume Bitcoin mining development at the site at a future date.

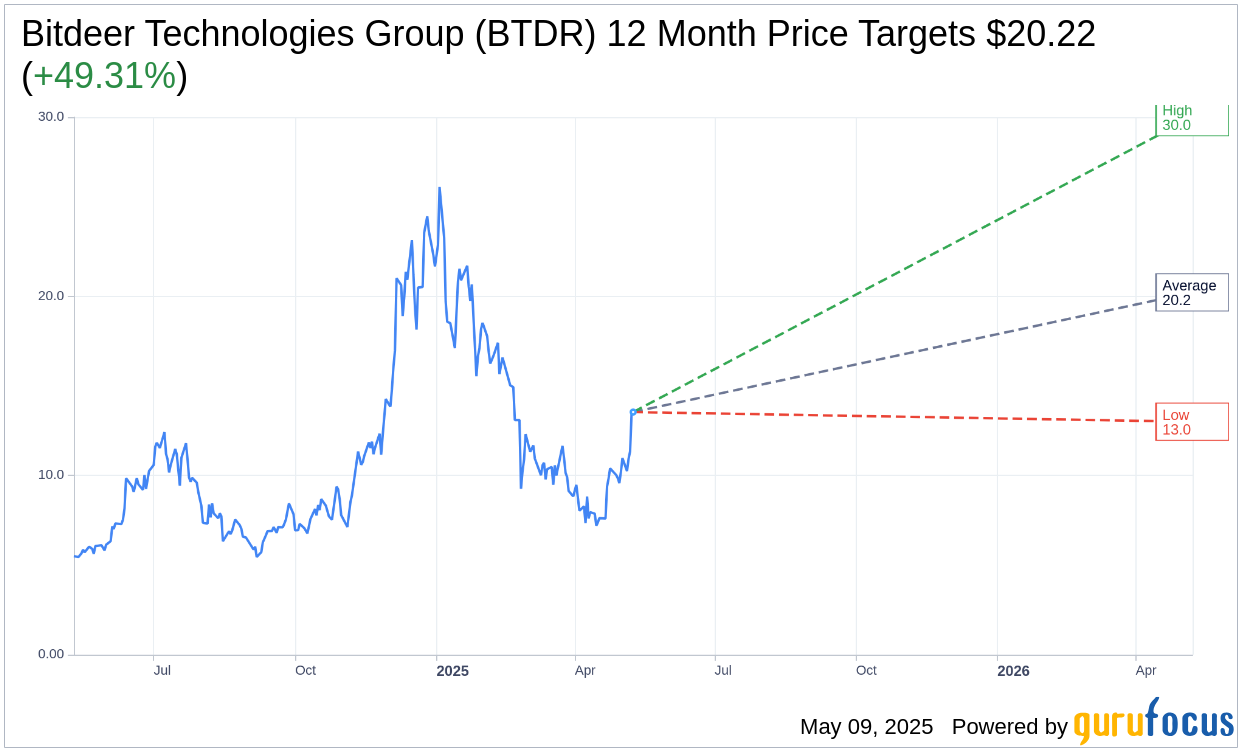

Wall Street Analysts Forecast

Based on the one-year price targets offered by 12 analysts, the average target price for Bitdeer Technologies Group (BTDR, Financial) is $20.22 with a high estimate of $30.00 and a low estimate of $13.00. The average target implies an upside of 49.31% from the current price of $13.54. More detailed estimate data can be found on the Bitdeer Technologies Group (BTDR) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Bitdeer Technologies Group's (BTDR, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

BTDR Key Business Developments

Release Date: February 25, 2025

- Total Revenue (Q4 2024): $69 million.

- Gross Profit (Q4 2024): $5.1 million.

- Adjusted EBITDA (Q4 2024): Negative $3.8 million.

- Self-Mining Revenue (Q4 2024): $41.5 million.

- Cloud Hash Rate Revenue (Q4 2024): $2.3 million.

- General Hosting Revenue (Q4 2024): $8.5 million.

- Membership Hosting Revenue (Q4 2024): $12.4 million.

- Gross Margin (Q4 2024): 7.4%.

- Total Operating Expenses (Q4 2024): $42.5 million.

- Net Loss (Q4 2024): $531.9 million.

- Cash and Cash Equivalents (End of 2024): $476.3 million.

- Cryptocurrencies Holdings (End of 2024): $77.5 million.

- Borrowings (Excluding Derivatives, End of 2024): $208.1 million.

- Cash Used in Operations (Q4 2024): $325.1 million.

- Net Cash Used in Investing Activities (Q4 2024): $10 million.

- Net Cash Generated from Financing Activities (Q4 2024): $522.8 million.

- Capital Expenditures (2025 Estimate): $340 to $370 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Bitdeer Technologies Group (BTDR, Financial) has prioritized the development of its own ASIC technology, which is expected to provide a significant cost advantage and differentiate its business in the sector.

- The company successfully acquired a 19-acre site in Alberta, Canada, for a 101-megawatt gas-fired power plant, positioning it as the world's first fully vertically integrated Bitcoin miner at scale.

- Bitdeer Technologies Group (BTDR) plans to implement a carbon utilization system at its new site, aiming to make the project a net zero carbon producer and potentially generate revenue through carbon credits.

- The company has secured a globally diversified power portfolio with over 2.6 gigawatts of total power capacity, allowing for significant expansion in self-mining and AI data center power.

- Bitdeer Technologies Group (BTDR) has received strong demand for its SealMiner A2, with pre-orders oversubscribed by a factor of six, indicating robust market interest in its products.

Negative Points

- Bitdeer Technologies Group (BTDR) reported a decline in Q4 2024 revenue to $69 million from $114.8 million, primarily due to the impact of the April 2024 halving and higher global network cash rate.

- The company's adjusted EBITDA for Q4 2024 was negative $3.8 million, reflecting challenges in maintaining profitability amid increased R&D expenses and lower hosting and cloud mining revenue.

- Gross profit for Q4 2024 decreased to $5.1 million from $27 million, with a gross margin drop to 7.4% from 23.5%, largely due to the expiration of high-margin cloud hash rate contracts.

- Bitdeer Technologies Group (BTDR) experienced a significant net loss of $531.9 million for Q4 2024, driven by non-cash derivative losses on tether warrants and convertible notes.

- The company faces potential challenges in financing its wafer orders from TSMC, with concerns about stock price fluctuations affecting its ability to secure necessary funds.