Summary:

- TELUS International (TIXT, Financial) outperformed Q1 expectations with a Non-GAAP EPS of $0.06.

- Revenue rose to $670 million, marking a 2.0% year-over-year growth.

- Analysts provide a "Hold" recommendation with an optimistic forecast for significant upside potential.

TELUS International (TIXT) delivered promising results in the first quarter, with a Non-GAAP EPS of $0.06, exceeding expectations by $0.01. The company reported revenue of $670 million, a commendable 2.0% increase from the prior year, outperforming predictions by $19.73 million. Despite a decline in adjusted EBITDA to $90 million, TELUS International remains focused on its optimistic 2025 outlook.

Wall Street Analysts Forecast

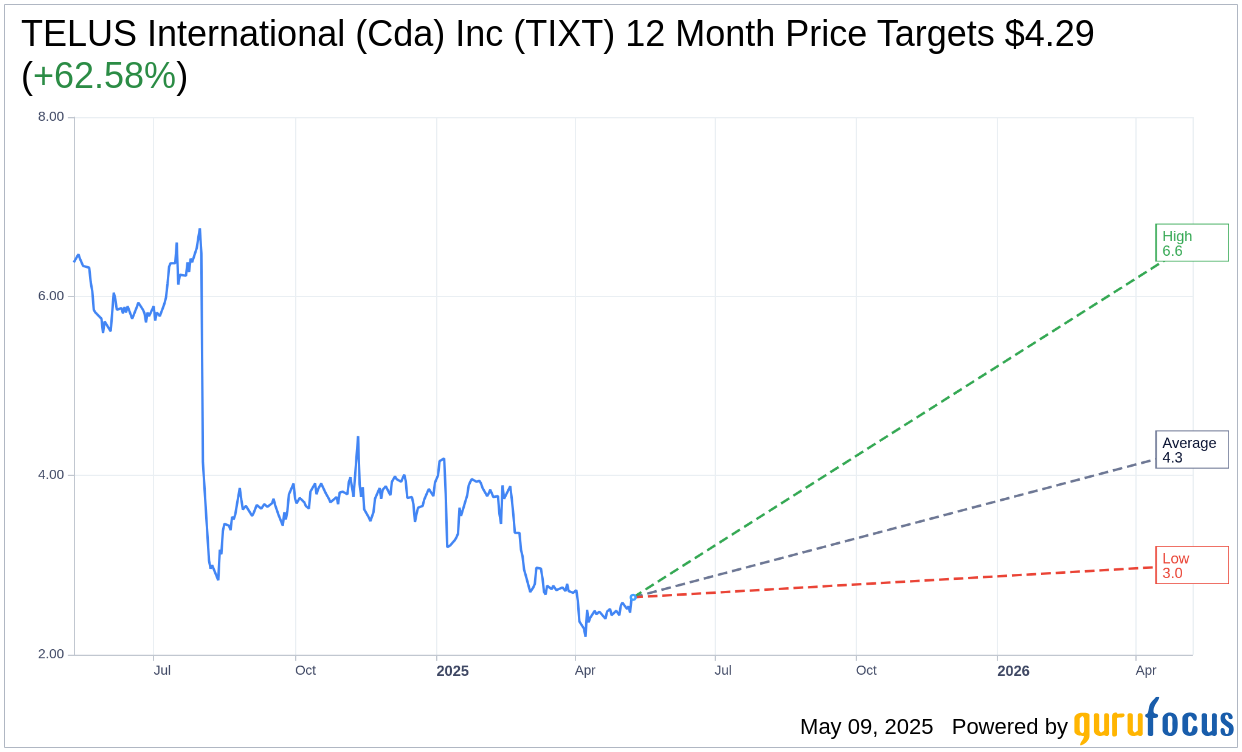

According to the analysis of nine experts, TELUS International (Cda) Inc (TIXT, Financial) is projected to reach an average target price of $4.29 within a year. The range of estimates includes a high of $6.60 and a low of $3.00, indicating a substantial average potential upside of 62.58% from its current market price of $2.64. For a more comprehensive view of these projections, visit the TELUS International (Cda) Inc (TIXT) Forecast page.

The consensus among 12 brokerage firms positions TELUS International (Cda) Inc's (TIXT, Financial) average recommendation at a 3.0, signifying a "Hold" status. This rating falls within a scale from 1 to 5, where 1 denotes a Strong Buy, and 5 indicates Sell. This consensus reflects a cautious yet stable outlook for the company.

Looking at more optimistic perspectives, GuruFocus estimates suggest that TELUS International (Cda) Inc (TIXT, Financial) could reach a GF Value of $9.58 within a year. This suggests an upswing potential of 262.88% from its current price of $2.64. The GF Value is GuruFocus's calculated fair value of the stock, derived from historical trading multiples, past business growth, and future performance forecasts. Further insights and details are available on the TELUS International (Cda) Inc (TIXT) Summary page.