BTIG has increased its price target for Insulet (PODD, Financial) to $330, up from $310, while maintaining a Buy rating following the company’s better-than-expected first-quarter earnings. The analyst notes that Insulet is strategically positioned to navigate macroeconomic uncertainties, largely because the majority of its U.S. products are manufactured in Acton, MA, potentially exempting the company from certain market risks.

Although tariffs are expected to have a minor impact on this year's gross margins—estimated at 50 basis points—Insulet has managed to counterbalance this challenge. The company has actually raised its gross margin forecast by the same 50 basis points, demonstrating its ability to sustain a strong financial outlook. Insulet also maintains its solid operating margin projections, allowing flexibility for future investments.

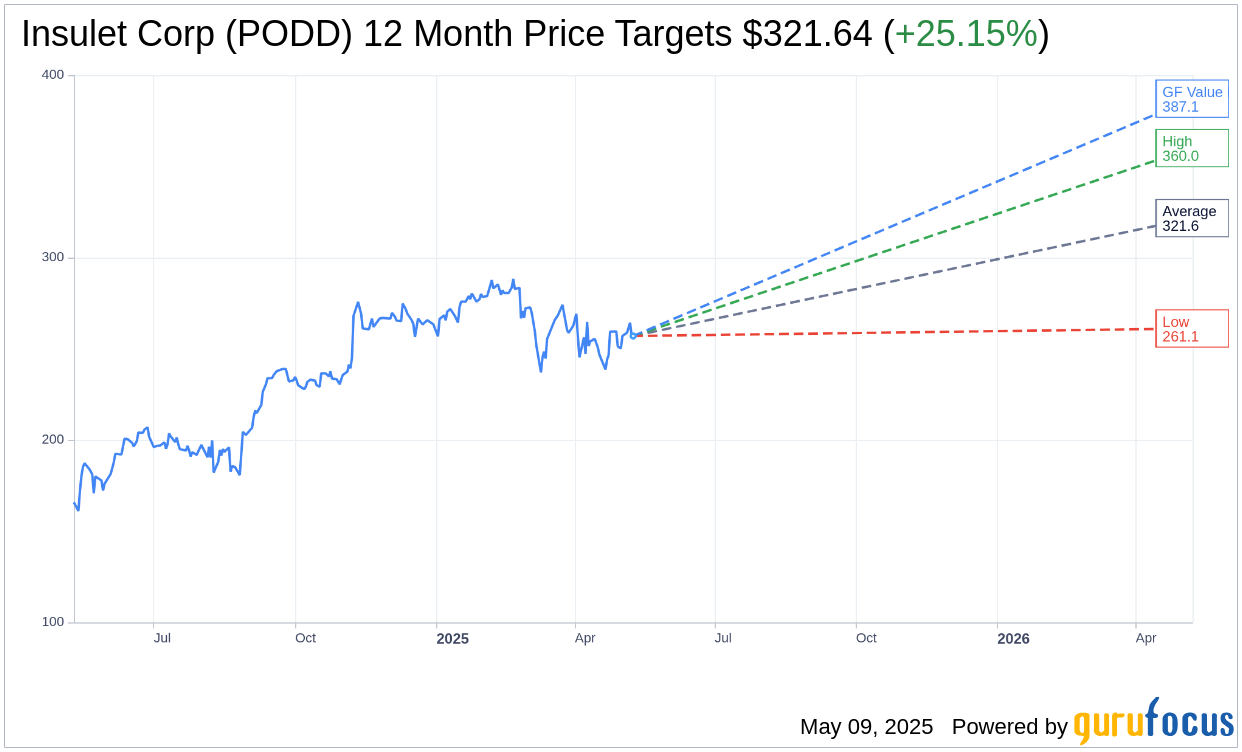

Wall Street Analysts Forecast

Based on the one-year price targets offered by 22 analysts, the average target price for Insulet Corp (PODD, Financial) is $321.64 with a high estimate of $360.00 and a low estimate of $261.11. The average target implies an upside of 25.15% from the current price of $257.00. More detailed estimate data can be found on the Insulet Corp (PODD) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, Insulet Corp's (PODD, Financial) average brokerage recommendation is currently 1.8, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Insulet Corp (PODD, Financial) in one year is $387.12, suggesting a upside of 50.63% from the current price of $257. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Insulet Corp (PODD) Summary page.

PODD Key Business Developments

Release Date: May 08, 2025

- Revenue: $569 million, 30% growth over prior year.

- Omnipod Growth: 29% total growth.

- Gross Margin: 71.9%, up 240 basis points.

- Adjusted Operating Margin: 16.4%.

- Adjusted EBITDA: 23.5% in the first quarter.

- US Omnipod Revenue Growth: 26%.

- International Omnipod Revenue Growth: 36%.

- New Customer Starts: Over 85% from MDI in the US; over 30% were type 2.

- Cash and Liquidity: Approximately $1.3 billion in cash.

- Full Year Revenue Growth Guidance: Raised to 19% to 22%.

- Full Year Gross Margin Guidance: Raised to approximately 71%.

- Non-GAAP Adjusted Tax Rate: 22.6% for the first quarter.

- Senior Unsecured Notes: $450 million issued.

- Revolving Credit Facility: Upsized to $500 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Insulet Corp (PODD, Financial) reported a strong 30% revenue growth in the first quarter, driven by a 29% increase in Omnipod sales.

- The company achieved an impressive gross margin of 71.9%, showcasing improved manufacturing and supply chain efficiencies.

- Insulet Corp (PODD) successfully expanded its international presence, launching Omnipod 5 in Canada and Switzerland, with plans to enter the Middle East.

- The company raised its full-year revenue growth guidance to 19% to 22%, reflecting confidence in continued strong performance.

- Insulet Corp (PODD) is making significant investments in manufacturing and automation, enhancing its supply chain resilience and capacity.

Negative Points

- The company faces a potential 50 basis point impact on gross margin due to tariffs, although it plans to offset this through efficiencies.

- There is a slight concern about higher attrition rates among type 2 diabetes users compared to type 1, although it remains within expectations.

- Insulet Corp (PODD) anticipates a $30 million increase in net interest expense for 2025 due to recent debt transactions.

- The guidance for the second half of the year implies lower growth rates, raising questions about potential conservatism or underlying challenges.

- The company is still in the early stages of its type 2 diabetes market penetration, with uncertainties about the pace of adoption and market expansion.