An analyst from Piper Sandler, Peter Keith, has adjusted the price target for Yeti (YETI, Financial), reducing it from $38 to $36 while maintaining an Overweight rating on the stock. This revision comes after Yeti reported a strong performance in the first quarter, surpassing expectations on several key measures. However, the company has revised its 2025 projections significantly downward, primarily due to the impact of tariffs.

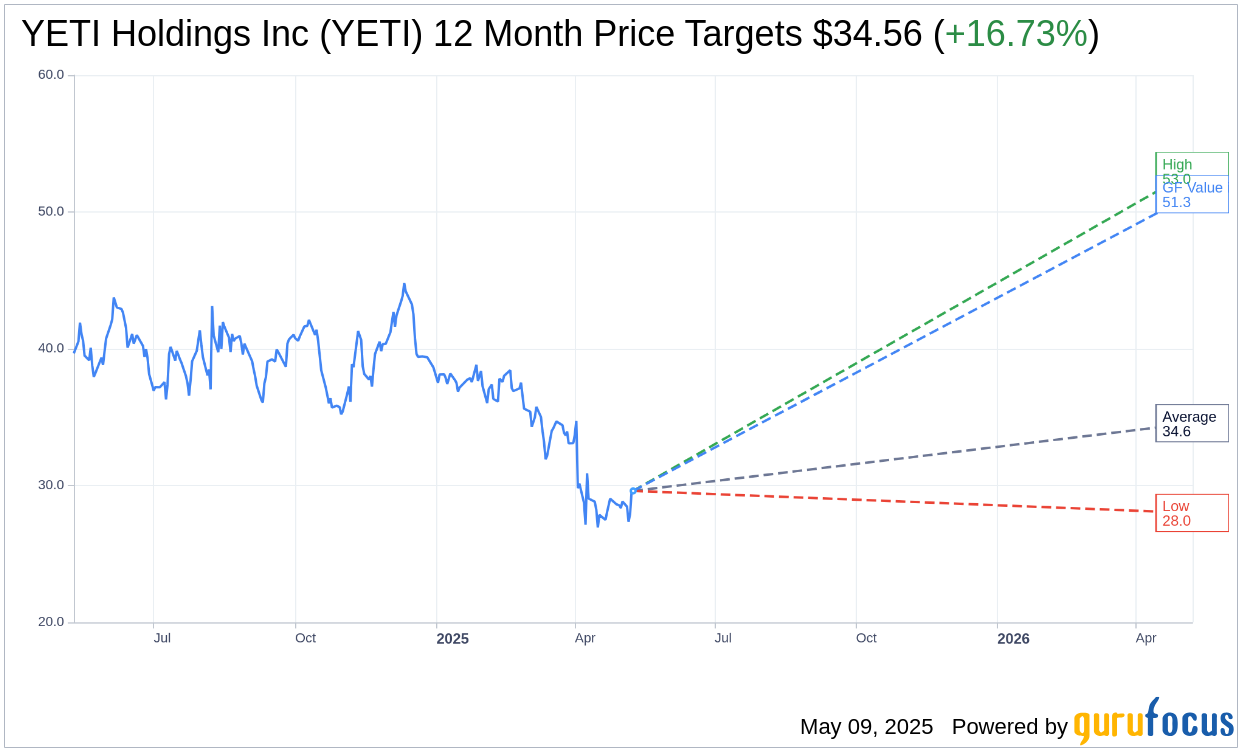

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for YETI Holdings Inc (YETI, Financial) is $34.56 with a high estimate of $53.00 and a low estimate of $28.00. The average target implies an upside of 16.73% from the current price of $29.61. More detailed estimate data can be found on the YETI Holdings Inc (YETI) Forecast page.

Based on the consensus recommendation from 17 brokerage firms, YETI Holdings Inc's (YETI, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for YETI Holdings Inc (YETI, Financial) in one year is $51.29, suggesting a upside of 73.22% from the current price of $29.61. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the YETI Holdings Inc (YETI) Summary page.

YETI Key Business Developments

Release Date: May 08, 2025

- Revenue: Increased 3% to $351 million.

- Coolers & Equipment Sales: Increased 17% to $140.2 million.

- Drinkware Sales: Decreased 4% to $205.6 million.

- Direct-to-Consumer Sales: Grew 4% to $196.2 million, representing 56% of total sales.

- International Sales: Grew 22% to $79.9 million.

- Gross Profit: Increased 3% to $201.3 million or 57.3% of sales.

- SG&A Expenses: Increased 6% to $166.2 million or 47.3% of sales.

- Operating Income: Decreased 11% to $35.2 million or 10% of sales.

- Net Income: Decreased 12% to $25.8 million or $0.31 per diluted share.

- Cash Position: Ended the quarter with $259 million in cash.

- Inventory: Decreased 9% year-over-year to $330.5 million.

- Total Debt: $77 million, compared to $81.2 million in the prior year.

- Store Openings: Opened 25th store in Short Hills, NJ, and 26th store in King of Prussia, PA.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- YETI Holdings Inc (YETI, Financial) delivered high-quality growth with strong gross and operating margins in the first quarter of 2025.

- The company saw excellent performance in Coolers & Equipment and international business, showcasing the impact of product innovation and global expansion strategies.

- YETI Holdings Inc (YETI) is on pace for a record number of new product releases in 2025, with over 30 new product introductions planned.

- The company has accelerated efforts to shift Drinkware production out of China, expecting 90% of US Drinkware capacity to be ex-China by the end of the year.

- YETI Holdings Inc (YETI) continues to invest in global growth, with new teams and facilities in Japan, the UK, and Europe to support future expansion.

Negative Points

- Drinkware sales decreased by 4% due to challenging market conditions in the US and supply chain diversification efforts impacting growth.

- The company expects a 300 basis point impact on growth for the year due to inventory supply disruptions from accelerated supply chain diversification.

- YETI Holdings Inc (YETI) anticipates a decline in gross margins by approximately 450 basis points due to the impact of tariffs.

- Operating income decreased by 11% in the first quarter, with FX having a significant impact on operating income growth.

- The company revised its full-year sales outlook to increase between 1% and 4%, down from previous expectations, due to supply chain disruptions and potential consumer demand softness.