Summary:

- Plains All American Pipeline's Q1 earnings and revenue underperformed expectations.

- Analysts maintain an optimistic long-term price target, suggesting a potential 26.59% upside.

- The GF Value indicates a possible short-term downside of 6.73%.

Plains All American Pipeline (PAA, Financial) recently reported a first-quarter Non-GAAP EPS of $0.39, missing estimates by $0.06. Despite generating revenue of $12.01 billion—a modest year-over-year increase of 0.2%—the company fell short of expectations by nearly $2 billion.

Wall Street Analysts Forecast

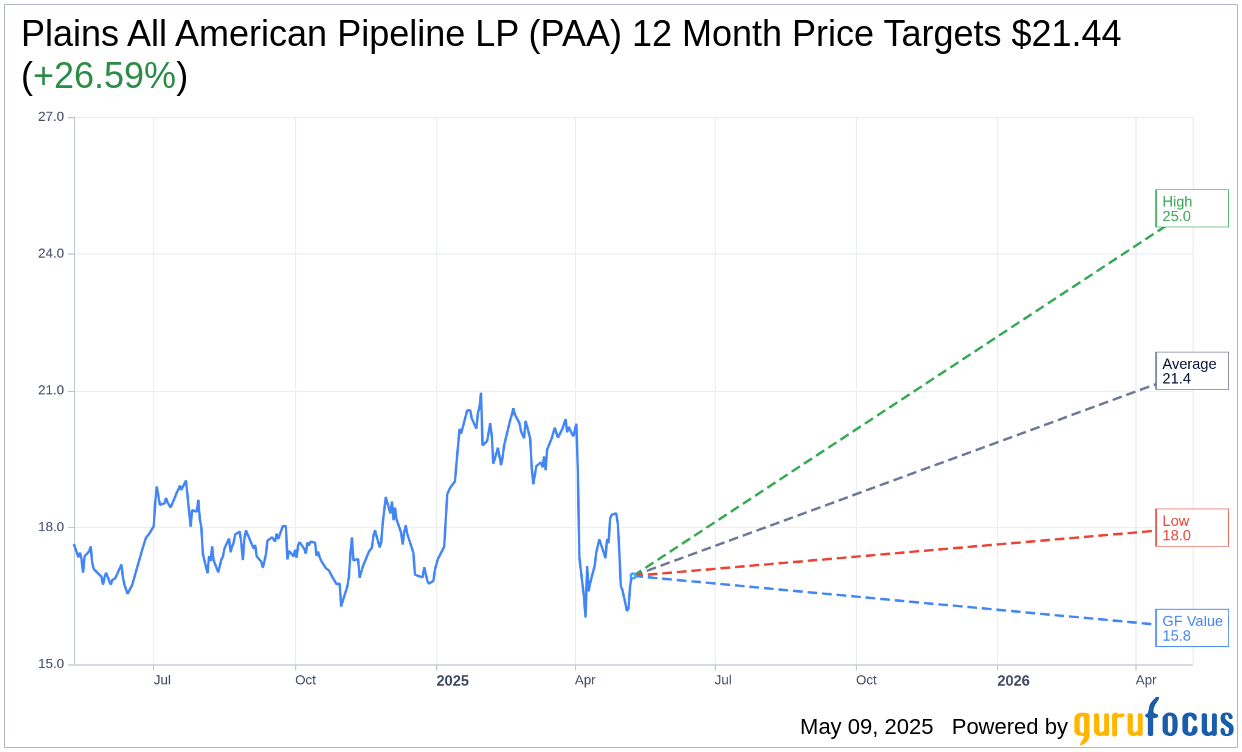

In evaluating Plains All American Pipeline LP (PAA, Financial), 17 analysts have provided a one-year price target with an average estimate of $21.44. The projections range from a high of $25.00 to a low of $18.00, indicating a potential upside of 26.59% from its current trading price of $16.94. For further details, see the Plains All American Pipeline LP (PAA) Forecast page.

Brokerage Recommendations

According to consensus data from 19 brokerage firms, Plains All American Pipeline LP (PAA, Financial) holds an average brokerage recommendation of 2.5, categorized as "Outperform." This rating scale ranges from 1, representing a Strong Buy, to 5, indicating a Sell.

GF Value Estimate

The GuruFocus value assessment suggests that the GF Value for Plains All American Pipeline LP (PAA, Financial) stands at $15.80 for the upcoming year. This valuation predicts a possible downside of 6.73% from its current price of $16.94. The GF Value is derived from historical trading multiples, previous business growth, and future performance forecasts. Further insights are available on the Plains All American Pipeline LP (PAA) Summary page.