- Enbridge (ENB, Financial) offers a high-yield investment opportunity amidst market volatility.

- Analysts provide a varied price target range, reflecting potential market fluctuations.

- GuruFocus estimates indicate a possible downside relative to current trading prices.

Enbridge Inc. (ENB) stands out in the investment landscape for its robust high-yield potential, presenting an enticing opportunity for investors, even amidst fluctuating earnings. Its stable, bond-like attributes make it a viable choice during uncertain market conditions.

Analyst Price Targets and Recommendations

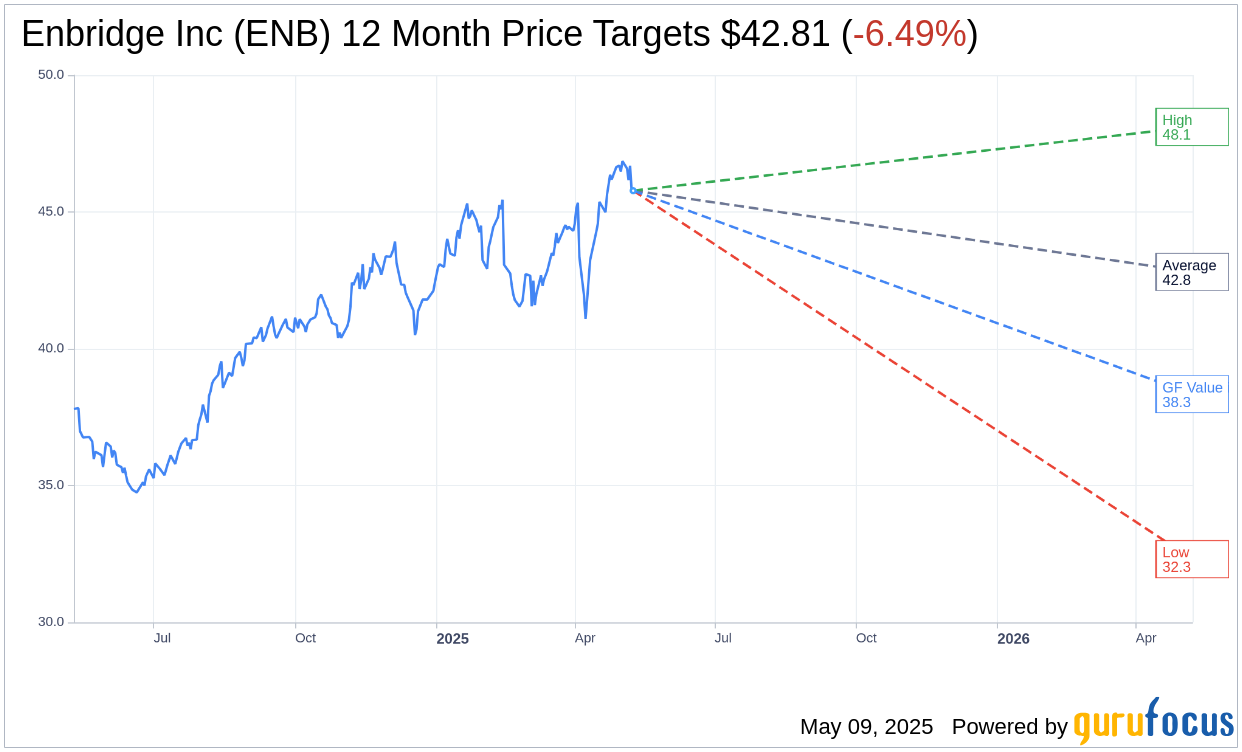

According to data from eight analysts, the one-year price target for Enbridge sits at an average of $42.81. This projection encompasses a high of $48.11 and a low of $32.31. Currently, with shares priced at $45.78, the average target suggests a potential downside of 6.49%. For more comprehensive projections, visit the Enbridge Inc (ENB, Financial) Forecast page.

The consensus among 14 brokerage firms assigns Enbridge Inc. a "Hold" status, with an average recommendation score of 2.6 on a scale where 1 indicates Strong Buy and 5 represents Sell. This consensus reflects a cautious yet stable outlook for the stock.

GF Value Assessment

The GF Value for Enbridge over the next year is estimated at $38.34, suggesting a possible downside of 16.25% from its current market price of $45.78. The GF Value metric is derived from historical trading multiples, past growth trends, and forecasts for future performance. This valuation suggests a critical evaluation is necessary for potential investors. Detailed insights are available on the Enbridge Inc (ENB, Financial) Summary page.

In summary, while Enbridge presents attractive high-yield characteristics, investors should weigh analyst projections and GF Value assessments when considering their portfolio strategies.