- Rapid Micro Biosystems (RPID, Financial) recorded a substantial revenue growth in Q1, enhancing financial stability.

- Analyst predictions show significant potential upside from the current stock price.

- Company maintains a strong cash position with no outstanding debt, bolstering future prospects.

Key Financial Highlights for Rapid Micro Biosystems (RPID)

Rapid Micro Biosystems (RPID) has demonstrated commendable financial performance in the first quarter, reporting a 28% increase in revenue, bringing the total to $7.2 million. The firm's strategic initiatives have also led to an improvement in the gross margin, now at 6%. Notably, the company effectively reduced its net loss to $11.3 million while preserving its cash reserves of $42 million, with the advantage of having no outstanding debt obligations. The annual revenue target remains steadfast at $32 million.

Wall Street Analysts Forecast

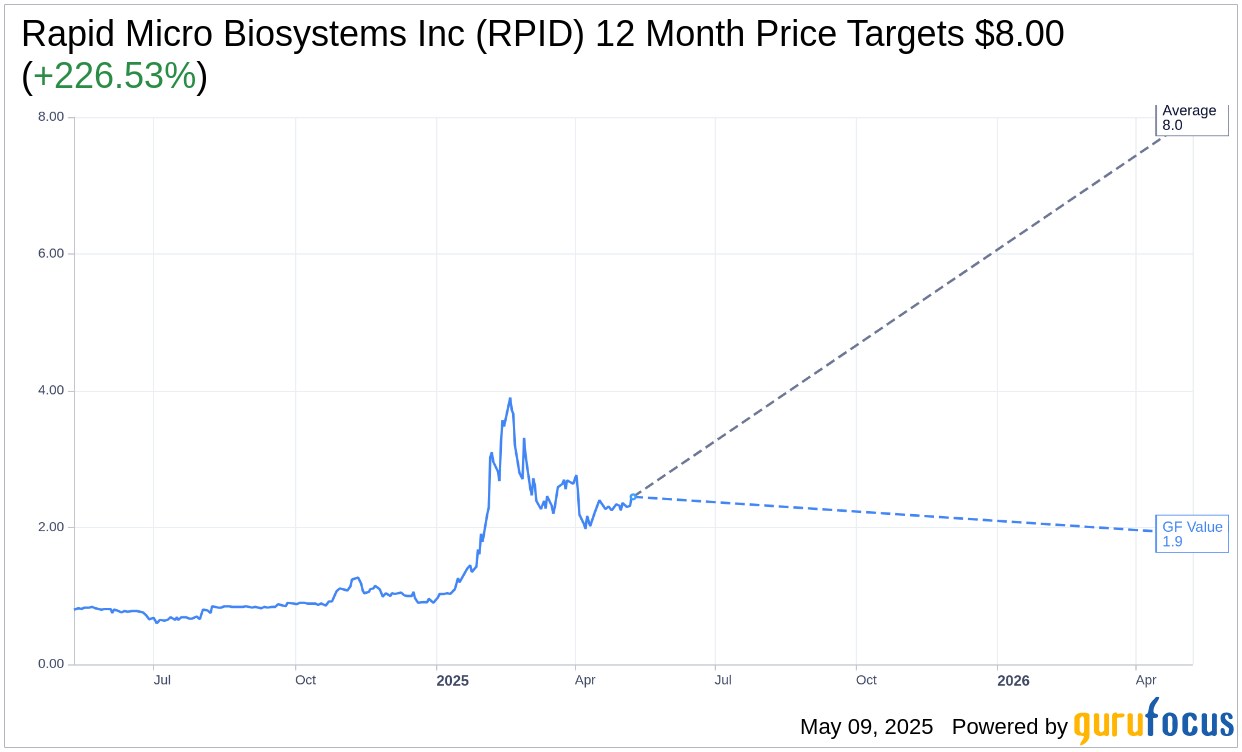

Wall Street's perspective is favorable. According to price targets provided by one analyst, Rapid Micro Biosystems Inc (RPID, Financial) is expected to reach an average target price of $8.00, which remains consistent across high and low estimates. This projection implies a significant upside of 226.53% from the current market price of $2.45. For detailed forecasts, visit the Rapid Micro Biosystems Inc (RPID) Forecast page.

The consensus among three brokerage firms positions Rapid Micro Biosystems Inc's (RPID, Financial) average brokerage recommendation at 1.7, indicating an "Outperform" status. This rating is based on a scale where 1 signifies Strong Buy and 5 denotes Sell.

Valuation Insights from GuruFocus

Despite the optimistic outlook, GuruFocus provides a more conservative valuation estimate. The estimated GF Value for Rapid Micro Biosystems Inc (RPID, Financial) in one year is projected at $1.91, suggesting a potential downside of 22.04% from the current trading price of $2.45. The GF Value represents GuruFocus' estimation of the fair value for the stock, derived from historical trading multiples, past business growth, and future performance projections. For more information, navigate to the Rapid Micro Biosystems Inc (RPID) Summary page.