Raymond James has increased its price target for Grindr (GRND, Financial) from $22 to $26, maintaining an Outperform rating for the shares. Although Grindr's first-quarter earnings slightly missed the firm's revenue expectations, the company has enhanced its projections for 2025, forecasting improved revenue growth and EBITDA margins. Despite the minor shortfall compared to consensus estimates, Raymond James suggests any potential dip in the stock could present a buying opportunity.

Wall Street Analysts Forecast

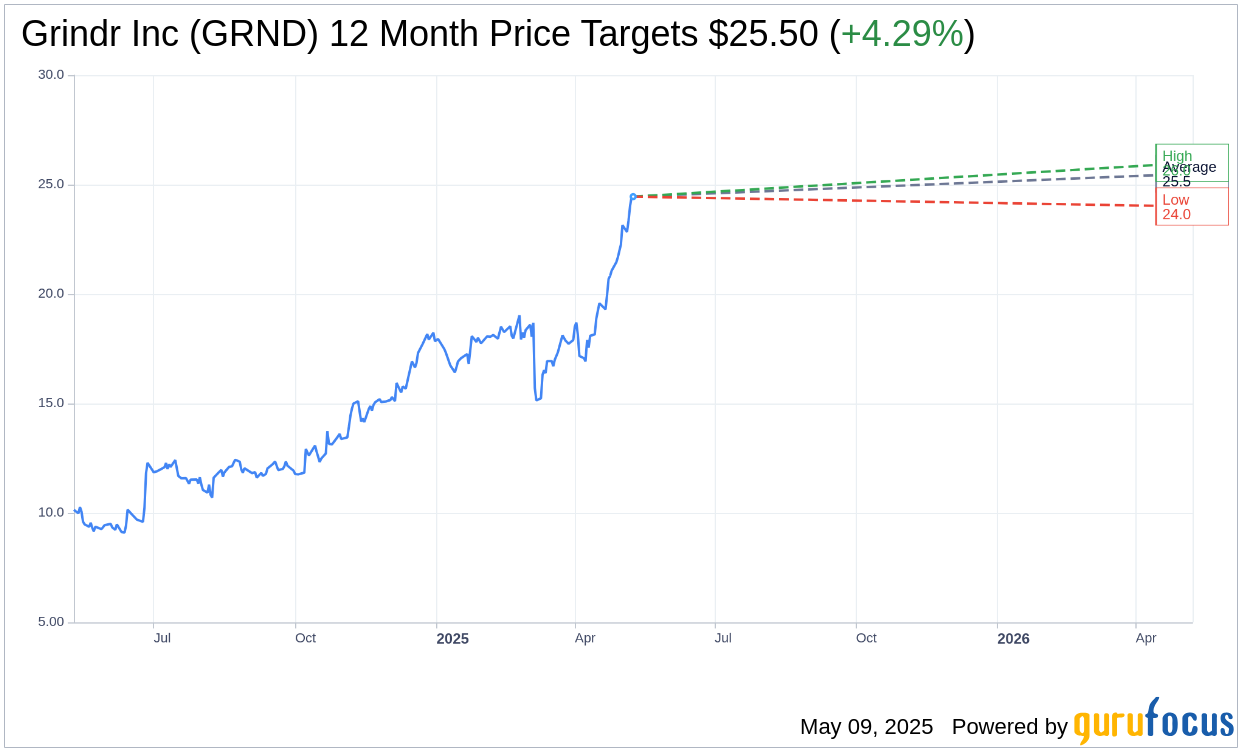

Based on the one-year price targets offered by 4 analysts, the average target price for Grindr Inc (GRND, Financial) is $25.50 with a high estimate of $26.00 and a low estimate of $24.00. The average target implies an upside of 4.29% from the current price of $24.45. More detailed estimate data can be found on the Grindr Inc (GRND) Forecast page.

Based on the consensus recommendation from 4 brokerage firms, Grindr Inc's (GRND, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

GRND Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Grindr Inc (GRND, Financial) reported a 25% year-over-year revenue growth in Q1 2025, reaching $94 million.

- The company raised its full-year outlook to 26% or greater revenue growth and at least 43% adjusted margins.

- Grindr Inc (GRND) successfully launched 'Right Now,' an intent-based feature, in 17 major cities, with plans to expand to 50% of weekly active users.

- The company introduced a suite of AI-native products, including A-list, which enhances user chat activity and connections.

- Grindr Inc (GRND) reported a net income of $27 million for Q1 2025, compared to a net loss of $9 million in the same period last year.

Negative Points

- Operating expenses in Q1 2025 increased by 21% year over year, primarily driven by compensation-related expenses.

- The Woodwork initiative, a men's health subscription service, is in its early stages and not expected to contribute significantly to revenue in the near term.

- Grindr Inc (GRND) faces potential challenges in integrating direct payment systems due to pending court rulings.

- The company acknowledges the need for better localization of its app for international markets, which is not yet a focus for 2025.

- Grindr Inc (GRND) anticipates elevated costs related to cloud services as it invests in becoming an AI-first company.