Wedbush has revised its price target for Expedia (EXPE, Financial), lowering it from $180 to $165, while maintaining a Neutral rating on the company's stock. This adjustment follows Expedia's mixed performance in the first quarter, where gross bookings did not meet expectations, although the adjusted EBITDA exceeded forecasts. The company faces challenges in critical U.S. inbound travel markets, with a notable decrease in bookings from Canada, which dropped nearly 30%. Additionally, Vrbo and Brand Expedia recorded weaker room night growth year-over-year, and Hotels.com experienced declines in this period, according to Wedbush's analysis.

Wall Street Analysts Forecast

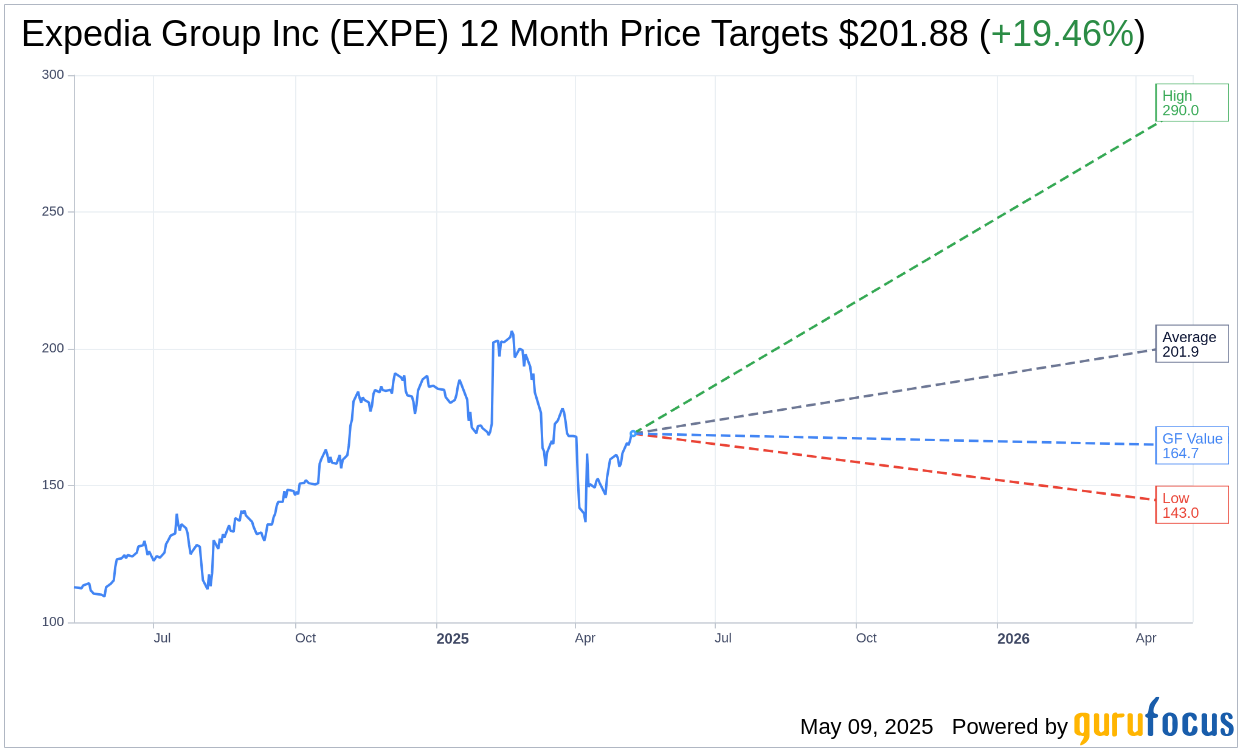

Based on the one-year price targets offered by 31 analysts, the average target price for Expedia Group Inc (EXPE, Financial) is $201.88 with a high estimate of $290.00 and a low estimate of $143.00. The average target implies an upside of 19.46% from the current price of $168.99. More detailed estimate data can be found on the Expedia Group Inc (EXPE) Forecast page.

Based on the consensus recommendation from 37 brokerage firms, Expedia Group Inc's (EXPE, Financial) average brokerage recommendation is currently 2.4, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Expedia Group Inc (EXPE, Financial) in one year is $164.69, suggesting a downside of 2.54% from the current price of $168.99. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Expedia Group Inc (EXPE) Summary page.

EXPE Key Business Developments

Release Date: May 08, 2025

- Revenue: $3 billion, up 3% year-over-year.

- EBITDA Growth: 16% increase.

- Earnings Per Share (EPS): 90% growth.

- Booked Room Nights: 6% growth to 108 million.

- Gross Bookings: $31.5 billion, up 4%.

- B2B Bookings Growth: 14% increase.

- Advertising Revenue Growth: 20% increase.

- Average Daily Rates: $214, down 1% (up 1% on an FX neutral basis).

- EBITDA Margin: 9.9%, expanding by more than 1 point.

- Cash and Short-term Investments: $6.1 billion.

- Debt Level: $6.3 billion with a leverage ratio of 2.1 times.

- Share Repurchases: $330 million or 1.7 million shares in Q1.

- Dividend: $0.40 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Expedia Group Inc (EXPE, Financial) achieved 16% EBITDA growth and a 90% increase in earnings per share, surpassing bottom-line expectations.

- The B2B segment demonstrated strong performance with 14% bookings growth, significantly outperforming the industry.

- The advertising business experienced robust growth, with a 20% increase in revenue and a record number of $1 million-plus deals.

- Expedia's strategic partnerships, such as with Southwest Airlines and Ryanair, have successfully attracted new customers and enhanced supply offerings.

- The company is leveraging AI to enhance product experiences, streamline operations, and improve marketing effectiveness, positioning it well for future growth.

Negative Points

- Overall bookings and revenue growth were at the lower end of guidance due to weaker-than-expected travel demand in the US.

- The consumer business, particularly in the US, saw only 1% bookings growth, impacted by declining consumer sentiment.

- Hotels.com experienced negative growth due to softer US demand and foreign exchange headwinds.

- The US market softness and macroeconomic headwinds led to a revision of full-year guidance for gross bookings and revenue.

- Inbound travel to the US faced significant pressure, with bookings from Canada falling nearly 30%.