Raymond James analyst Rick Patel has raised the price target for Tapestry's stock (TPR, Financial) from $74 to $85, while maintaining an Outperform rating. The analyst highlights anticipated strong growth in revenue, margins, and earnings per share. Patel notes that the brand Coach, a part of Tapestry, is experiencing heightened growth thanks to improved consumer insights that are shaping its product development, marketing strategies, and market entry approaches.

Wall Street Analysts Forecast

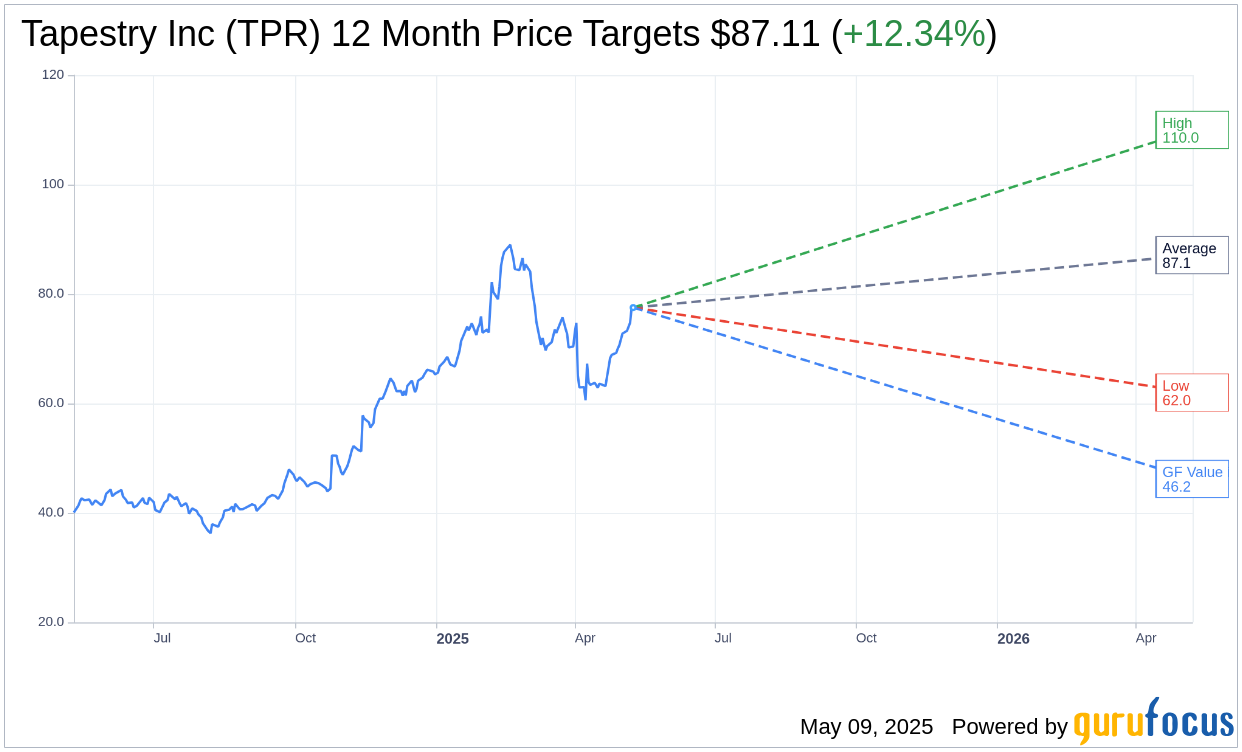

Based on the one-year price targets offered by 18 analysts, the average target price for Tapestry Inc (TPR, Financial) is $87.11 with a high estimate of $110.00 and a low estimate of $62.00. The average target implies an upside of 12.34% from the current price of $77.54. More detailed estimate data can be found on the Tapestry Inc (TPR) Forecast page.

Based on the consensus recommendation from 22 brokerage firms, Tapestry Inc's (TPR, Financial) average brokerage recommendation is currently 2.0, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Tapestry Inc (TPR, Financial) in one year is $46.22, suggesting a downside of 40.39% from the current price of $77.54. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Tapestry Inc (TPR) Summary page.

TPR Key Business Developments

Release Date: May 08, 2025

- Total Revenue Growth: 8% at constant currency.

- Coach Revenue Growth: 15% increase.

- International Revenue Growth: 8% increase, with Europe up 35%.

- North America Revenue Growth: 9% increase.

- Greater China Revenue Growth: 5% increase.

- Gross Margin: 76.1%, highest in over 15 years, up 140 basis points.

- Operating Margin: Increased 140 basis points.

- EPS: Record third quarter EPS of $1.03, up 27% year-over-year.

- Adjusted Free Cash Flow: Over $1 billion year-to-date.

- New Customers in North America: Over 1.2 million, with two-thirds Gen Z and millennials.

- Digital Revenue Growth: Mid-teens percentage increase.

- Direct-to-Consumer Business Growth: 9% increase at constant currency.

- Inventory Levels: 6% above prior year, excluding Stuart Weitzman inventory.

- Fiscal Year 2025 Revenue Guidance: Approximately $6.95 billion, 4% growth.

- Fiscal Year 2025 EPS Guidance: In the area of $5, high teens growth.

- CapEx and Cloud Computing Costs: Approximately $160 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Tapestry Inc (TPR, Financial) reported record third-quarter results, with revenue gains of 8% at constant currency, surpassing expectations.

- The Coach brand achieved a 15% revenue growth, driven by strong consumer engagement and product innovation.

- Tapestry Inc (TPR) acquired over 1.2 million new customers in North America, with a significant portion being Gen Z and millennials.

- Digital sales grew at a mid-teens rate, representing approximately 30% of total revenue, indicating strong omnichannel performance.

- The company increased its fiscal year 2025 earnings outlook, projecting earnings per share in the area of $5, consistent with long-term targets.

Negative Points

- Kate Spade's revenue declined by 12% at constant currency, indicating challenges in brand repositioning and market conditions.

- The company faces an increasingly complex external environment, including potential impacts from tariffs and global trade dynamics.

- Japan sales declined by 2%, highlighting regional challenges in the Asia market.

- Despite strong performance, Tapestry Inc (TPR) remains cautious about the rapidly shifting market and has taken a conservative approach to future outlooks.

- The company is undergoing a strategic reset for Kate Spade, which may take time to yield sustainable growth.