Oppenheimer's analyst, Martin Yang, has adjusted the price target for Turtle Beach (TBCH, Financial) to $17.50, down from the previous $20, though he maintains an Outperform rating for the stock. This decision follows a robust first quarter where the company reported a 14% rise in revenue compared to the same period last year and an increase in gross margins by nearly 500 basis points.

In response to the "Liberation Day" tariff announcement affecting Chinese imports, Turtle Beach promptly moved its manufacturing operations for U.S. products to Vietnam. Additionally, the company has revised its annual guidance downwards to consider potential macroeconomic challenges and the rescheduling of the GTA 6 release from fall 2025 to May 2026.

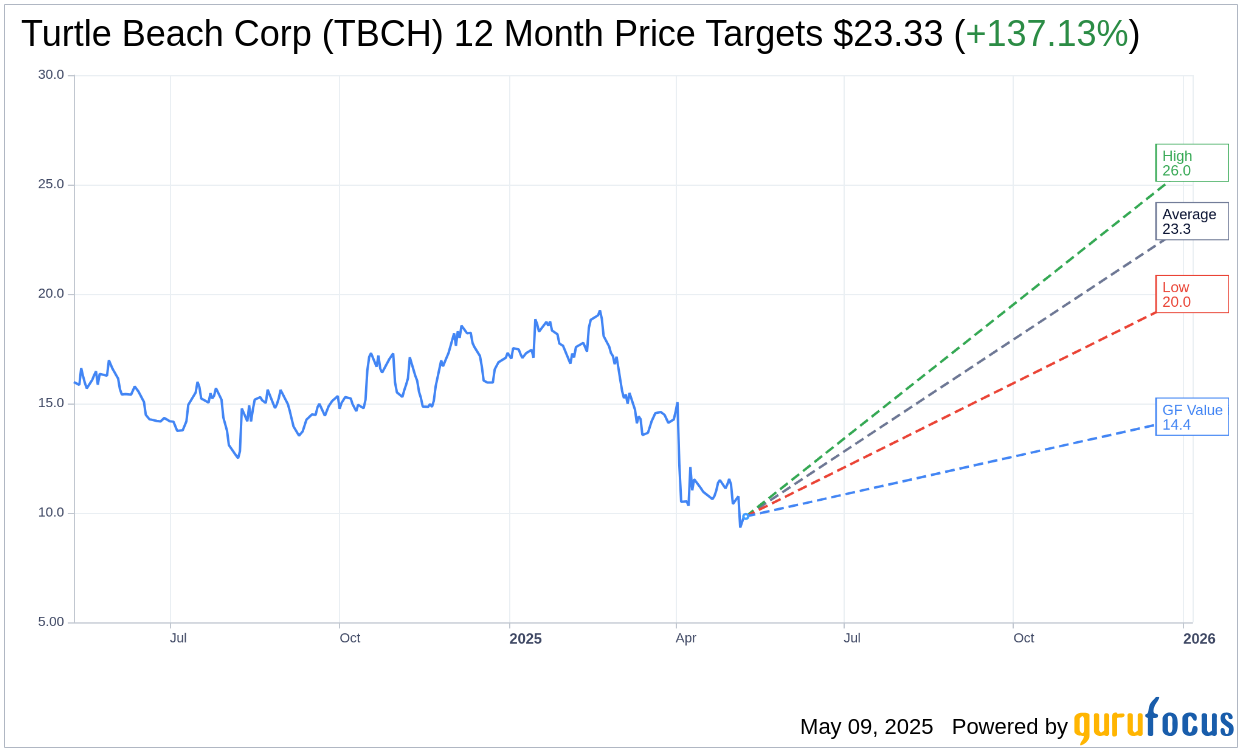

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Turtle Beach Corp (TBCH, Financial) is $23.33 with a high estimate of $26.00 and a low estimate of $20.00. The average target implies an upside of 137.13% from the current price of $9.84. More detailed estimate data can be found on the Turtle Beach Corp (TBCH) Forecast page.

Based on the consensus recommendation from 6 brokerage firms, Turtle Beach Corp's (TBCH, Financial) average brokerage recommendation is currently 1.5, indicating "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Turtle Beach Corp (TBCH, Financial) in one year is $14.40, suggesting a upside of 46.34% from the current price of $9.84. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Turtle Beach Corp (TBCH) Summary page.

TBCH Key Business Developments

Release Date: May 08, 2025

- Revenue: $63.9 million, up 14% year over year.

- Adjusted EBITDA: $4.1 million, increased from $1.4 million a year ago.

- Gross Margin: Improved by 470 basis points to 36.6%.

- Operating Expenses: $21.8 million, 34% of revenue, down from 42% in the prior year.

- Net Debt: $43.6 million, with $55.2 million of outstanding debt and $11.7 million of cash.

- Cash Flow from Operations: Over $40 million, nearly 50% increase year over year.

- Share Repurchase: $1.8 million returned to shareholders in Q1; new authorization of up to $75 million over the next two years.

- Full-Year 2025 Revenue Guidance: Revised to $340 million to $360 million.

- Full-Year 2025 Adjusted EBITDA Guidance: Revised to $47 million to $53 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- First-quarter revenue grew by 14% year over year to $63.9 million.

- Adjusted EBITDA increased to $4.1 million, up from $1.4 million a year ago.

- Gross margins improved substantially by nearly 470 basis points year on year to 36.6%.

- The company executed the largest share repurchase program in its history, repurchasing nearly $30 million worth of stock.

- A new share repurchase program of up to $75 million has been authorized over the next two years.

Negative Points

- The US gaming accessories market declined by 16% year over year in Q1.

- The anticipated release of Grand Theft Auto 6 has been delayed to spring 2026, impacting expected demand for new accessories.

- Tariffs have introduced complexities and uncertainties, affecting the company's operations.

- Full-year 2025 revenue guidance has been revised down to $340 million to $360 million due to macroeconomic uncertainties.

- Gross margins are expected to face pressure in the second quarter due to lower revenue and tariff impacts.