CIBC has adjusted its price target for Enerflex (EFXT, Financial), reducing it from $10 to $9.25 while maintaining a Neutral rating on the stock. This change reflects a more cautious outlook due to uncertainties in growth initiatives by U.S. operators, influencing the bank's revenue projections for Enerflex's Engineered Systems segment. Investors are advised to take these factors into account when considering this stock.

Wall Street Analysts Forecast

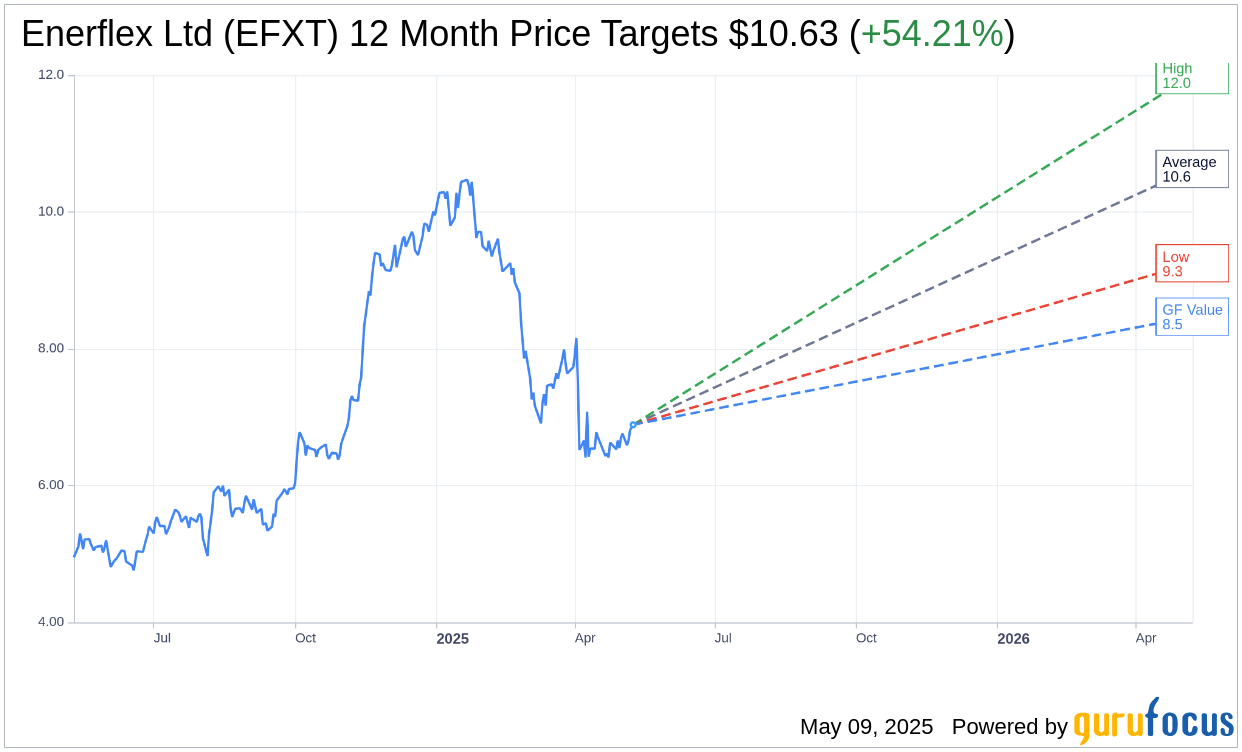

Based on the one-year price targets offered by 2 analysts, the average target price for Enerflex Ltd (EFXT, Financial) is $10.63 with a high estimate of $12.00 and a low estimate of $9.25. The average target implies an upside of 54.21% from the current price of $6.89. More detailed estimate data can be found on the Enerflex Ltd (EFXT) Forecast page.

Based on the consensus recommendation from 2 brokerage firms, Enerflex Ltd's (EFXT, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Enerflex Ltd (EFXT, Financial) in one year is $8.47, suggesting a upside of 22.93% from the current price of $6.89. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Enerflex Ltd (EFXT) Summary page.

EFXT Key Business Developments

Release Date: May 08, 2025

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Enerflex Ltd (EFXT, Financial) reported strong financial and operational results for Q1 2025, with energy infrastructure and aftermarket services contributing 70% of the gross margin.

- The company achieved a rapid deleveraging of its balance sheet, reducing its leverage ratio from 1.5 times at the end of Q4 2024 to 1.3 times by the end of Q1 2025.

- Enerflex Ltd (EFXT) added approximately 20,000 horsepower to its US contract compression fleet, with plans to exceed 475,000 horsepower by the end of the year.

- The international energy infrastructure business is supported by approximately $1.3 billion of contracted revenue with an average contract term of five years.

- The company reported a significant increase in free cash flow to $85 million in Q1 2025, compared to $72 million in Q1 2024, due to lower maintenance capital spend.

Negative Points

- Consolidated revenues decreased to $552 million in Q1 2025 from $638 million in Q1 2024.

- Bookings for the engineering systems segment were lower at $205 million in Q1 2025, partly due to accelerated customer activity in Q4 2024.

- There is increased near-term risk and uncertainty for the engineering systems product line due to commodity price volatility and evolving market conditions.

- Enerflex Ltd (EFXT) is facing potential impacts from tariffs and lower oil prices, which could affect its business operations.

- The company is undergoing a leadership transition, with an interim President and CEO and interim CFO in place, which may create uncertainty in strategic direction.