CIBC analyst Cosmos Chiu has increased the price target for Wheaton Precious Metals (WPM, Financial) from $95 to $105, while maintaining an Outperform rating. In a recent report, the analyst highlighted the company's first-quarter performance, emphasizing the effectiveness of its streaming model amid rising commodity prices. Wheaton Precious Metals is noted for having one of the strongest growth prospects among its competitors. The stock continues to be CIBC's preferred choice for investors looking to gain exposure to both gold and silver markets.

Wall Street Analysts Forecast

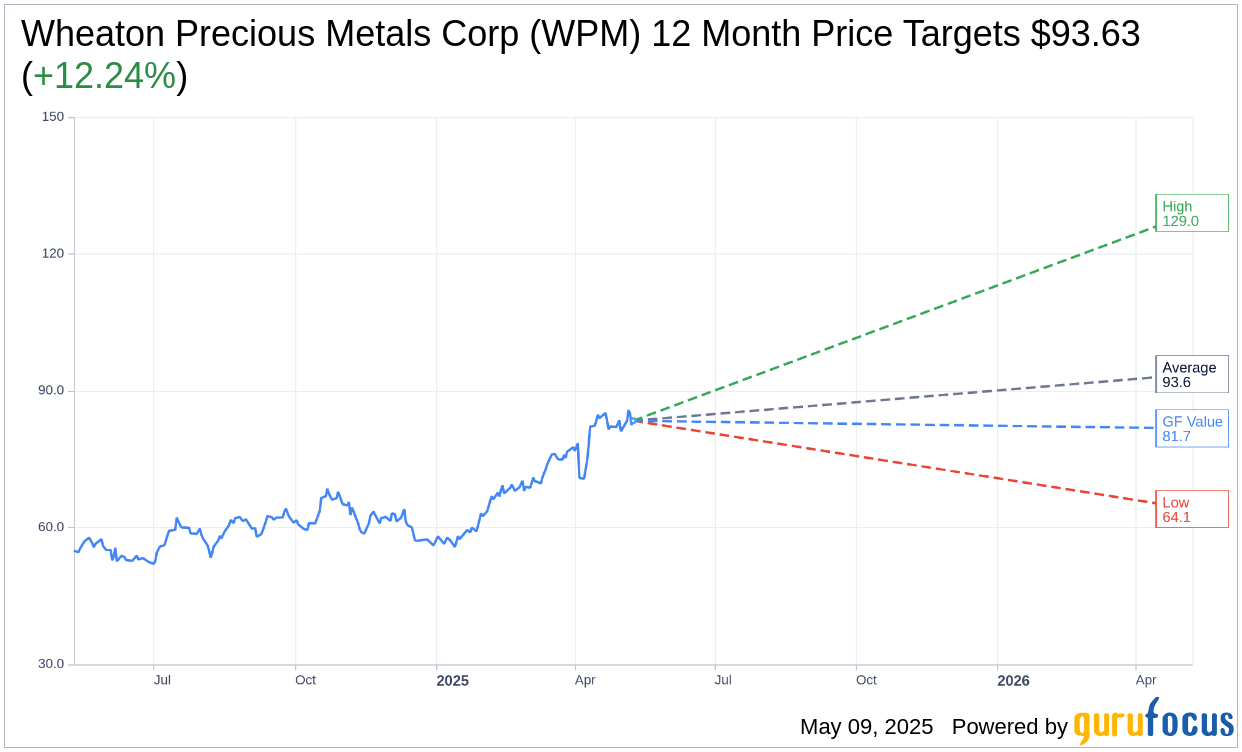

Based on the one-year price targets offered by 13 analysts, the average target price for Wheaton Precious Metals Corp (WPM, Financial) is $93.63 with a high estimate of $129.00 and a low estimate of $64.07. The average target implies an upside of 12.24% from the current price of $83.43. More detailed estimate data can be found on the Wheaton Precious Metals Corp (WPM) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, Wheaton Precious Metals Corp's (WPM, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Wheaton Precious Metals Corp (WPM, Financial) in one year is $81.74, suggesting a downside of 2.02% from the current price of $83.425. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Wheaton Precious Metals Corp (WPM) Summary page.

WPM Key Business Developments

Release Date: March 14, 2025

- Revenue: Record quarterly revenue of $381 million, a 21% increase over the prior year.

- Gross Margin: $247 million, a 40% increase over the comparable period of the prior year.

- Net Earnings: $88 million, impacted by a $109 million impairment charge.

- Adjusted Net Earnings: $199 million, a quarterly record, with adjusted earnings per share of $0.44, a 21% increase over the prior year.

- Annual Revenue for 2024: Approximately $1.3 billion, a 26% increase, representing a company record.

- Annual Gross Margin for 2024: Increased by $229 million to $803 million.

- Annual Adjusted Net Earnings for 2024: Increased by 20% to $640 million.

- Operating Cash Flow: Record quarterly cash flow from operations of $319 million, a 30% increase over the fourth quarter of 2023.

- Dividend: Increased by 6.5% to $0.165 per share, with over $280 million distributed in 2024.

- Gold Equivalent Ounces (GEOs) Production: 635,000 GEOs for 2024, exceeding annual guidance.

- Sales Volumes: 143,000 GEOs, an 8% decrease relative to the fourth quarter of 2023.

- General and Administrative Expenses: $10.5 million for Q4 2024, with total annual G&A of $40.7 million.

- Cash and Cash Equivalents: $818 million as of December 31, 2024.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Wheaton Precious Metals Corp (WPM, Financial) achieved record revenue, adjusted net earnings, and operating cash flows in 2024.

- Annual production exceeded the top end of guidance with 635,000 gold equivalent ounces produced.

- The company announced a 6.5% increase in its quarterly dividend, maintaining a leading payout ratio in the sector.

- Wheaton Precious Metals Corp (WPM) was recognized as one of the 2025 Global 100 most Sustainable Corporations and received an AAA ESG rating by MSCI.

- The company has a strong growth forecast, expecting a 40% increase in annual production to 870,000 gold equivalent ounces by 2029.

Negative Points

- Wheaton Precious Metals Corp (WPM) recognized an impairment charge of $109 million due to a decline in market cobalt prices.

- Gold production at Constancia decreased by approximately 18% in the fourth quarter of 2024 due to lower gold grades.

- Co-product production at Penasquito is expected to decline in 2025 as mining transitions to lower silver grade areas.

- General and administrative expenses are expected to increase to $50 million to $55 million in 2025, up from $40.7 million in 2024.

- The company faces challenges with the timing and ramp-up of new projects, which could impact production forecasts.