TD Cowen's analyst, Dan Brennan, has elevated the price target for Natera (NTRA, Financial) to $200, up from a previous target of $195, while maintaining a Buy rating. This decision follows the company's impressive performance, which the analyst describes as “solid.” Despite industry concerns over potential weather-related volume declines affecting peers in the first quarter, Natera's Signatera product saw a remarkable 52% growth year-over-year. This robust performance is expected to be positively received by investors.

Wall Street Analysts Forecast

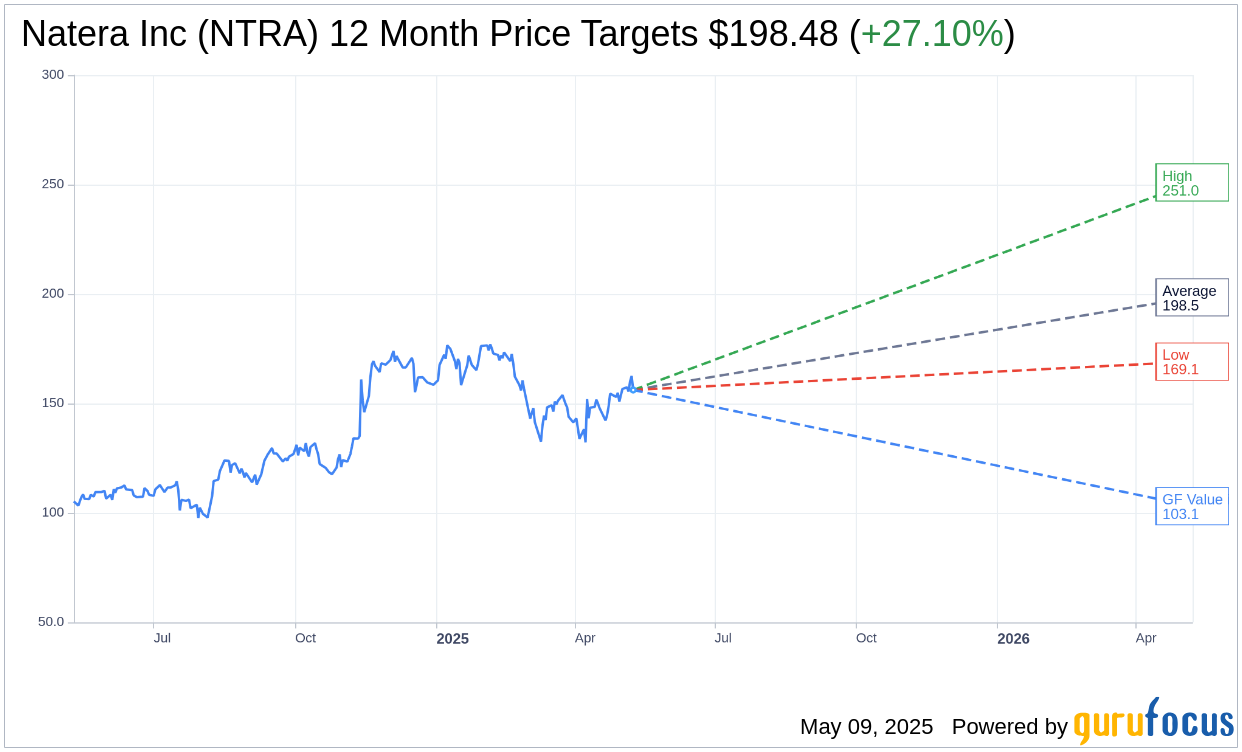

Based on the one-year price targets offered by 21 analysts, the average target price for Natera Inc (NTRA, Financial) is $198.48 with a high estimate of $251.00 and a low estimate of $169.12. The average target implies an upside of 27.10% from the current price of $156.16. More detailed estimate data can be found on the Natera Inc (NTRA) Forecast page.

Based on the consensus recommendation from 21 brokerage firms, Natera Inc's (NTRA, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Natera Inc (NTRA, Financial) in one year is $103.08, suggesting a downside of 33.99% from the current price of $156.16. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Natera Inc (NTRA) Summary page.

NTRA Key Business Developments

Release Date: May 08, 2025

- Revenue: $502 million in Q1 2025, up 37% from $368 million in Q1 2024.

- Gross Margin: 63% in Q1 2025, with an improvement of over 110 basis points from Q4 2024.

- Cash Flow: Generated $23 million in cash during Q1 2025.

- Revenue Guidance: Raised to $1.94 billion to $2.02 billion for 2025, a $70 million increase from prior guidance.

- Signatera Clinical Volumes: Grew 52% year-on-year, with a sequential increase of 16,500 units from Q4 2024.

- Units Processed: 855,000 units in Q1 2025, an 8% sequential increase from Q4 2024.

- Women's Health Volumes: Grew more than 40,000 units sequentially in Q1 2025.

- Organ Health Growth: Over 50% year-on-year growth in Q1 2025.

- Signatera ASP: Moved above $1,100 in Q1 2025.

- Balance Sheet: Nearly $1 billion in cash with no debt outside of a line of credit.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Natera Inc (NTRA, Financial) reported a 37% year-over-year revenue growth, reaching $502 million in Q1 2025.

- The company processed 855,000 units in the quarter, marking a significant increase in women's health volumes and a record quarter for Signatera.

- Gross margins improved to 63%, with a notable increase of over 110 basis points compared to Q4 2024.

- Natera Inc (NTRA) raised its revenue guidance for 2025 to a range of $1.94 billion to $2.02 billion, reflecting strong growth expectations.

- The company generated $23 million in cash during the quarter, even while investing heavily in growth initiatives.

Negative Points

- Natera Inc (NTRA) faces potential risks from weather disruptions, as seen with the wildfires in Southern California affecting operations.

- The company acknowledges challenges in achieving reimbursement for certain tests, impacting average selling prices (ASPs).

- There is uncertainty regarding the timing of new guidelines for microdeletions and carrier screening, which could impact future revenue.

- Despite strong growth, the company is still in the early stages of market penetration, with significant room for expansion.

- Natera Inc (NTRA) faces competition in the MRD testing market, which could impact its market share and growth trajectory.