Truist analyst Michael Swartz has upped his price target for Fox Factory (FOXF, Financial) from $24 to $28 while maintaining a Buy rating on the stock. This adjustment follows Fox Factory's strong first-quarter results and their reaffirmed guidance for the fiscal year 2025. Despite facing ongoing macroeconomic and tariff-related challenges, the company appears to be making positive strides, according to Swartz's latest research note.

Wall Street Analysts Forecast

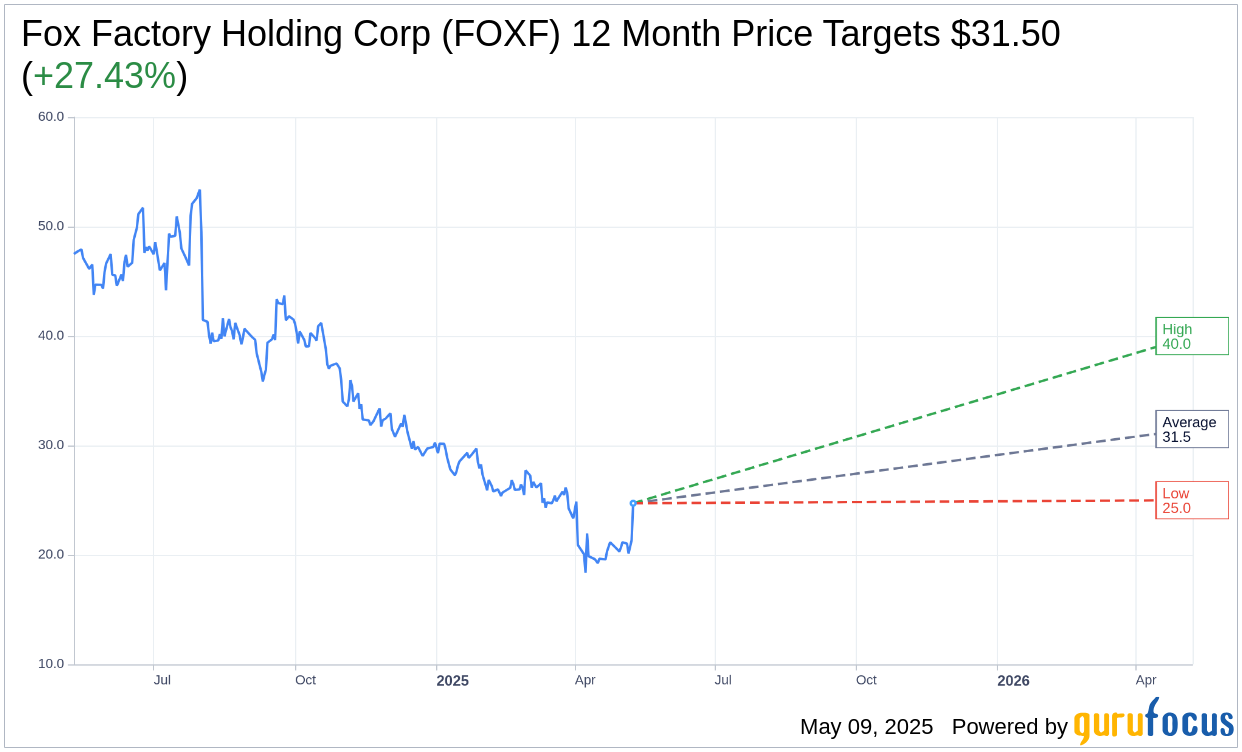

Based on the one-year price targets offered by 8 analysts, the average target price for Fox Factory Holding Corp (FOXF, Financial) is $31.50 with a high estimate of $40.00 and a low estimate of $25.00. The average target implies an upside of 28.78% from the current price of $24.46. More detailed estimate data can be found on the Fox Factory Holding Corp (FOXF) Forecast page.

Based on the consensus recommendation from 8 brokerage firms, Fox Factory Holding Corp's (FOXF, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Fox Factory Holding Corp (FOXF, Financial) in one year is $84.57, suggesting a upside of 245.75% from the current price of $24.46. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Fox Factory Holding Corp (FOXF) Summary page.

FOXF Key Business Developments

Release Date: February 27, 2025

- Total Net Sales: $352.8 million in Q4 2024, up 6.1% from $332.5 million in Q4 2023.

- Gross Margin: Increased to 28.9% in Q4 2024 from 27.7% in Q4 2023.

- Adjusted Gross Margin: Increased to 29.2% from the prior year quarter.

- Operating Expenses: $90.6 million, or 25.7% of net sales in Q4 2024, compared to $81 million, or 24.4% of net sales in Q4 2023.

- Net Loss: $0.1 million in Q4 2024, compared to net income of $4.1 million in Q4 2023.

- Adjusted Net Income: $12.8 million, or $0.31 per diluted share, compared to $20.3 million, or $0.48 per diluted share, in Q4 2023.

- Adjusted EBITDA: $40.4 million in Q4 2024, compared to $38.8 million in Q4 2023.

- Adjusted EBITDA Margin: 11.5% in Q4 2024, compared to 11.7% in Q4 2023.

- Debt Paydown: $63 million during Q4 2024.

- Full Year Net Sales: $1.39 billion for fiscal 2024, compared to $1.46 billion in fiscal 2023.

- Full Year Net Income: $6.6 million, or $0.16 per diluted share, for fiscal 2024, compared to $120.8 million, or $2.85 per diluted share, in fiscal 2023.

- Full Year Adjusted Net Income: $55.4 million, or $1.33 per diluted share, for fiscal 2024, compared to $167.5 million, or $3.95 per diluted share, in fiscal 2023.

- Full Year Adjusted EBITDA: $167 million for fiscal 2024, compared to $261 million in fiscal 2023.

- Working Capital Improvement: $55 million improvement driven by inventory optimization.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Fox Factory Holding Corp (FOXF, Financial) delivered on financial commitments with sales and adjusted earnings per share in line with guidance.

- The company made significant progress in its $25 million cost reduction initiative, resulting in $63 million of debt paydown during the fourth quarter.

- Sequential adjusted EBITDA margin improvements were noted in both the Aftermarket Applications Group (AAG) and Powered Vehicle Group (PVG) by 250 and 310 basis points, respectively.

- Fox Factory Holding Corp (FOXF) expanded its OEM customer base, adding new partnerships with BMW, Ducati, and Triumph for 2025.

- The company launched new products, including the AGwagon and a suspension package with Grand Design RV, showcasing innovation and expansion into new markets.

Negative Points

- Fox Factory Holding Corp (FOXF) experienced uneven demand across OEM customers, impacting sales performance.

- The automotive sector faced headwinds from ongoing OEM production issues, with subdued growth in the premium truck category.

- The power sports sector continued to face challenges, with OEMs managing production levels to address dealer inventory and sell-through.

- Net sales in the Aftermarket Applications Group (AAG) were down compared to the prior year quarter, reflecting ongoing market pressures.

- The company reported a net loss in the fourth quarter of fiscal 2024, primarily driven by increased interest expenses.