Truist has boosted its price target for Macom (MTSI, Financial) from $125 to $136, maintaining a Buy rating on the stock. This adjustment follows the company's impressive performance in the first quarter and a promising outlook for the second quarter. According to an analyst, the telecom sector is experiencing a noticeable upswing, driven by the accelerating recovery in 5G infrastructure, although the industrial sector remains behind in its momentum.

Wall Street Analysts Forecast

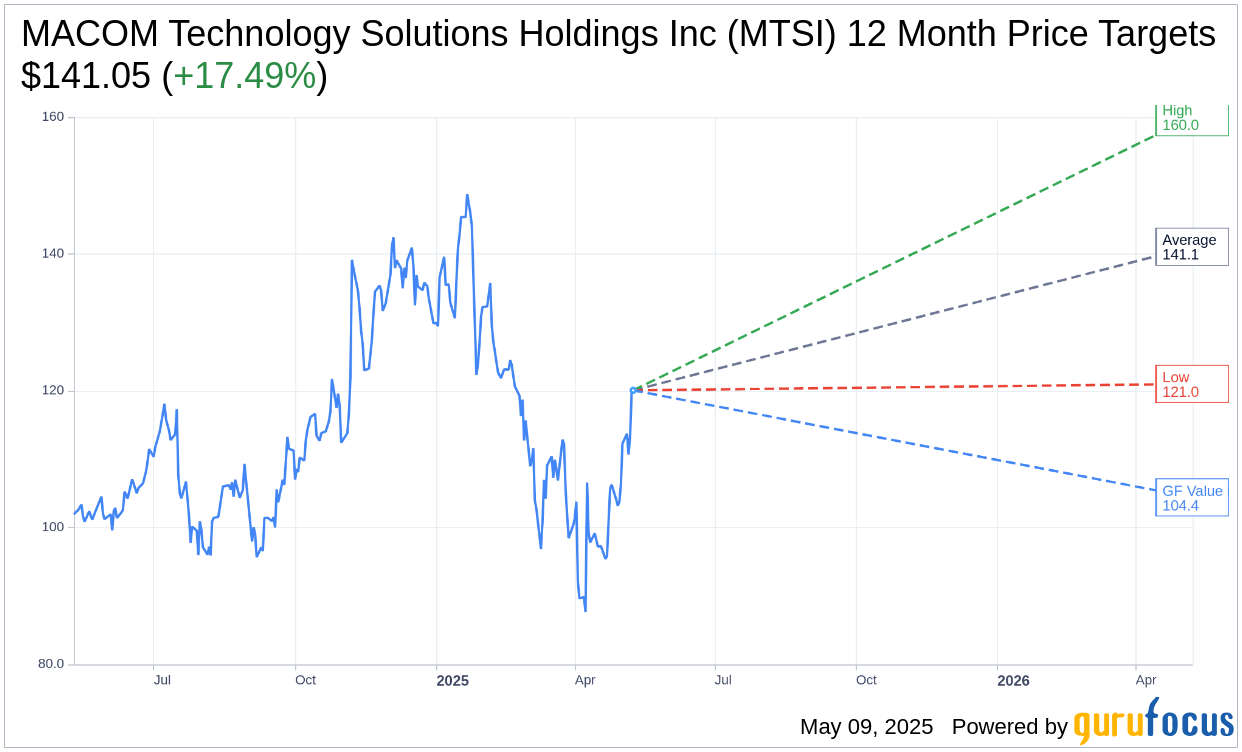

Based on the one-year price targets offered by 14 analysts, the average target price for MACOM Technology Solutions Holdings Inc (MTSI, Financial) is $141.05 with a high estimate of $160.00 and a low estimate of $121.00. The average target implies an upside of 17.49% from the current price of $120.06. More detailed estimate data can be found on the MACOM Technology Solutions Holdings Inc (MTSI) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, MACOM Technology Solutions Holdings Inc's (MTSI, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for MACOM Technology Solutions Holdings Inc (MTSI, Financial) in one year is $104.42, suggesting a downside of 13.03% from the current price of $120.06. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the MACOM Technology Solutions Holdings Inc (MTSI) Summary page.

MTSI Key Business Developments

Release Date: February 06, 2025

- Revenue: $218 million for Q1 fiscal 2025.

- Adjusted EPS: $0.79 per diluted share.

- Free Cash Flow: Approximately $63 million for Q1.

- Cash and Short-term Investments: Approximately $657 million at quarter end.

- Revenue by End Market: Industrial and defense: $97.4 million; Data Center: $65.3 million; Telecom: $55.4 million.

- Sequential Revenue Growth: Data Center up 16%, Telecom up 7%, Industrial and Defense up 5%.

- Book-to-Bill Ratio: 1.1:1 for Q1.

- Adjusted Gross Profit: $125.3 million or 57.5% of revenue.

- Adjusted Operating Expense: $69.9 million.

- Adjusted Operating Income: $55.4 million.

- Adjusted Net Income: $59.5 million.

- Accounts Receivable: $91.8 million, down from $105.7 million in Q4 2024.

- Inventory: $198.4 million at quarter end.

- Cash Flow from Operations: Approximately $66.7 million for Q1.

- Capital Expenditures: $5.3 million for Q1.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- MACOM Technology Solutions Holdings Inc (MTSI, Financial) reported a record high revenue of $218 million for the first fiscal quarter of 2025, with an adjusted EPS of $0.79 per diluted share.

- The company achieved a strong free cash flow of approximately $63 million in Q1, contributing to a cash and short-term investments balance of $657 million.

- The data center market segment showed significant growth, with revenues up 16% sequentially, driven by strong demand for 800 gig optical products.

- MACOM's book-to-bill ratio was 1.1:1, indicating strong order activity and a record-level backlog.

- The company is strategically positioned to capture market share in its targeted end markets, with plans to introduce new product lines and technologies in 2025.

Negative Points

- Gross margins for the first quarter were below targets at 57.5%, impacted by lower wafer volumes and underabsorbed costs in the Lowell fab.

- The telecom market segment experienced some weakness, affecting overall utilization and contributing to lower gross margins.

- Despite strong growth in the data center segment, there is a potential slowdown in 800 gig demand as customers transition to 1.6T, which could impact future growth rates.

- The company faces challenges in maintaining high utilization rates in its Lowell fab, which is crucial for improving gross margins.

- There is uncertainty regarding the impact of government funding and CHIPS Act initiatives on MACOM's long-term investment plans and financial performance.