Stifel has revised its price target for CCC Intelligent Solutions (CCCS, Financial), reducing it from $14 to $13 while maintaining a Buy rating on the stock. The adjustment reflects the firm’s updated model following the first quarter earnings report, taking into account persistent challenges in claims volumes and the company's focus on managing costs effectively.

Wall Street Analysts Forecast

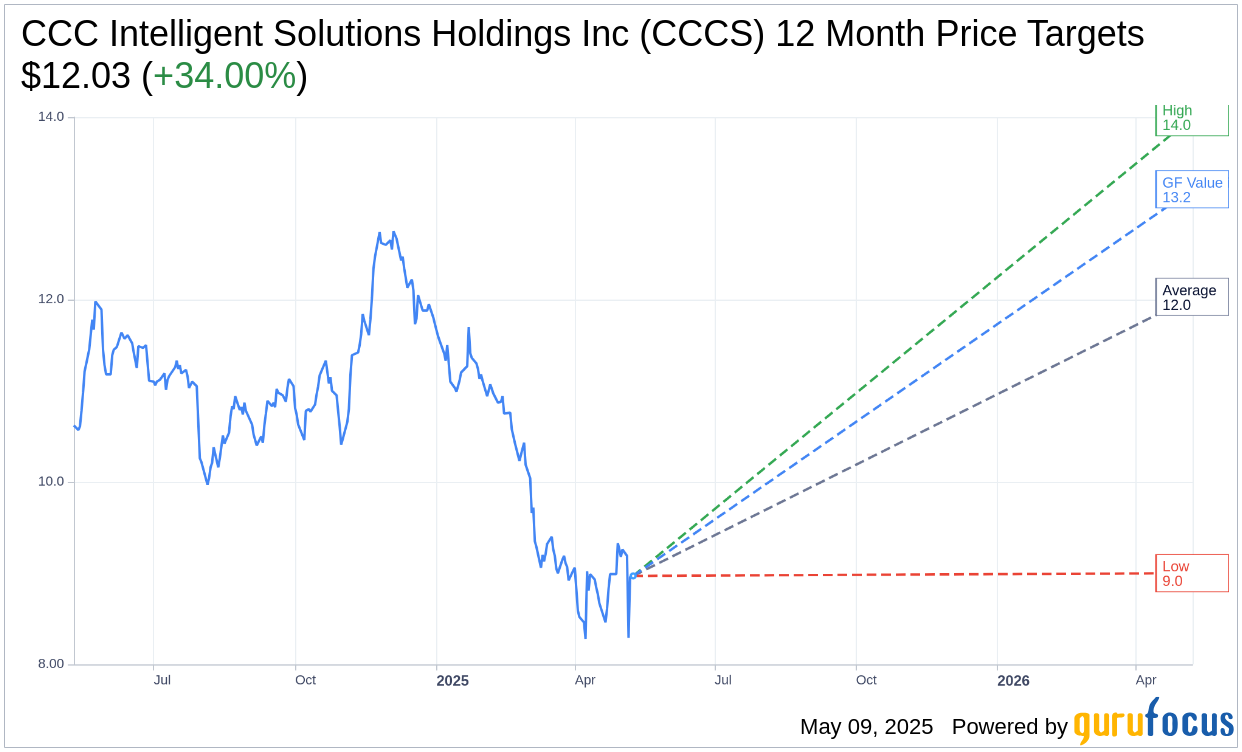

Based on the one-year price targets offered by 13 analysts, the average target price for CCC Intelligent Solutions Holdings Inc (CCCS, Financial) is $12.03 with a high estimate of $14.00 and a low estimate of $9.00. The average target implies an upside of 34.00% from the current price of $8.98. More detailed estimate data can be found on the CCC Intelligent Solutions Holdings Inc (CCCS) Forecast page.

Based on the consensus recommendation from 14 brokerage firms, CCC Intelligent Solutions Holdings Inc's (CCCS, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for CCC Intelligent Solutions Holdings Inc (CCCS, Financial) in one year is $13.21, suggesting a upside of 47.19% from the current price of $8.975. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the CCC Intelligent Solutions Holdings Inc (CCCS) Summary page.

CCCS Key Business Developments

Release Date: May 06, 2025

- Total Revenue: $251.6 million, up 10.7% year over year.

- Adjusted EBITDA: $99 million, with a margin of 39%.

- Gross Profit Margin: 77%, slightly down from 78% in Q1 2024.

- Free Cash Flow: $44 million, up 10% year over year.

- Cash and Cash Equivalents: $130 million at the end of the quarter.

- Net Leverage: 2.2 times adjusted EBITDA.

- Software Gross Dollar Retention (GDR): 99%.

- Software Net Dollar Retention (NDR): $107 million.

- Share Repurchase: 7 million shares for $72 million.

- Q2 2025 Revenue Guidance: $255.5 million to $257.5 million, 10% to 11% growth year over year.

- Full-Year 2025 Revenue Guidance: $1.046 billion to $1.056 billion, 11% growth at the midpoint.

- Full-Year 2025 Adjusted EBITDA Guidance: $420 million to $428 million, 40% margin at the midpoint.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- CCC Intelligent Solutions Holdings Inc (CCCS, Financial) reported strong financial results for Q1 2025, with total revenue reaching $252 million, marking an 11% year-over-year growth.

- The company achieved an adjusted EBITDA of $99 million, surpassing guidance, with an adjusted EBITDA margin of 39%.

- CCC Intelligent Solutions Holdings Inc (CCCS) crossed the $1 billion revenue run rate threshold for the first time, indicating robust business growth.

- The company continues to see strong demand for its emerging solutions, which contributed to 2% of revenue growth, driven by diagnostics, build sheets, and estimate STP.

- CCC Intelligent Solutions Holdings Inc (CCCS) successfully renewed and expanded contracts with key clients, including Caliber Collision and a major OEM, demonstrating its strategic role in the auto insurance economy.

Negative Points

- The company is facing headwinds from declining auto physical damage (APD) claims, which were down 9% year-over-year in Q1 2025, impacting revenue.

- CCC Intelligent Solutions Holdings Inc (CCCS) modestly reduced its full-year 2025 revenue guidance due to uncertainties in the macroeconomic environment affecting claim volumes and client buying behavior.

- The company noted that consumer economic sensitivity is leading to increased self-pay repairs, with consumer self-pay rising to about 25%, up from 11-12% three years ago.

- Stock-based compensation was high, accounting for 24% of revenue in Q1, with expectations to moderate to the low teens by the end of the year.

- The macroeconomic environment may lead to longer sales and implementation cycles, potentially impacting the velocity of new business for the remainder of 2025.