- Fidus Investment Corp (FDUS, Financial) maintains strong growth with a Q1 2025 adjusted net investment income of $18.5 million.

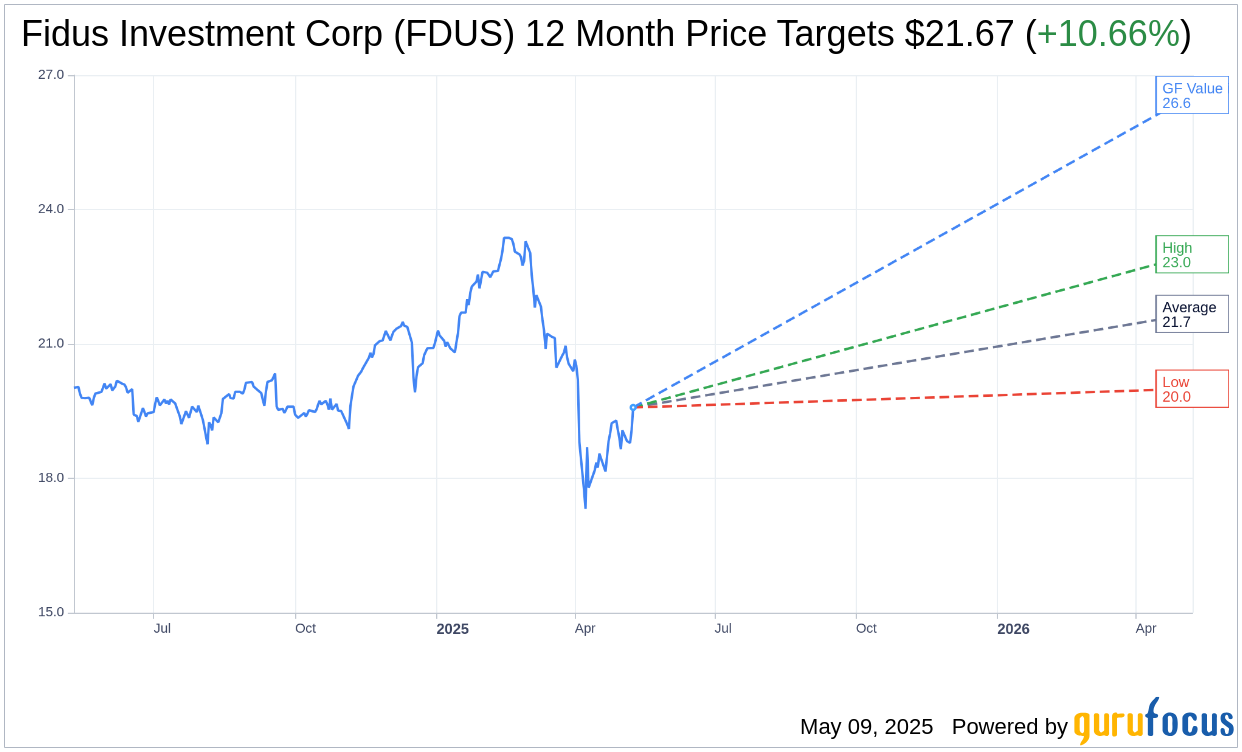

- Analysts forecast an upside potential of 10.66% with varied price targets.

- GuruFocus estimates suggest a potential GF Value upside of 35.65%.

Fidus Investment Corp (FDUS) reported a robust Q1 2025 performance, achieving an adjusted net investment income of $18.5 million, or $0.54 per share, consistent with the previous quarter's results. Despite experiencing a downturn in interest and fee income, Fidus effectively expanded its managed assets to $1.2 billion, marking a commendable 6% growth since the end of 2024. The company maintains a positive outlook on potential new investments, even amidst a cautious M&A landscape.

Wall Street Analysts Forecast

According to insights from three analysts, Fidus Investment Corp (FDUS, Financial) has an average one-year price target of $21.67. This forecast suggests potential highs of $23.00 and lows of $20.00, forecasting a notable 10.66% upside from its current price of $19.58. Investors can explore more in-depth estimates on the Fidus Investment Corp (FDUS) Forecast page.

Market Sentiment and GF Value Estimations

The consensus from five brokerage firms places Fidus Investment Corp (FDUS, Financial) at an average recommendation of 2.4, which corresponds to an "Outperform" rating. This scale ranges from 1, indicating a Strong Buy, to 5, representing a Sell.

Furthermore, according to GuruFocus estimates, the one-year projected GF Value for Fidus Investment Corp (FDUS, Financial) is $26.56. This positions the stock with a potential upside of 35.65% from its current valuation of $19.58. GF Value, a proprietary metric from GuruFocus, gauges the fair market value of a stock based on historical trading multiples, past business growth, and projected future performance. For a broader analysis, interested readers can check the Fidus Investment Corp (FDUS) Summary page.