Summary:

- Advanced Micro Devices (AMD, Financial) received a recommendation upgrade to "hold" from Cavenagh Research.

- Despite growth in AI capital expenditure, AMD's 2025 revenue and EBIT projections are reduced.

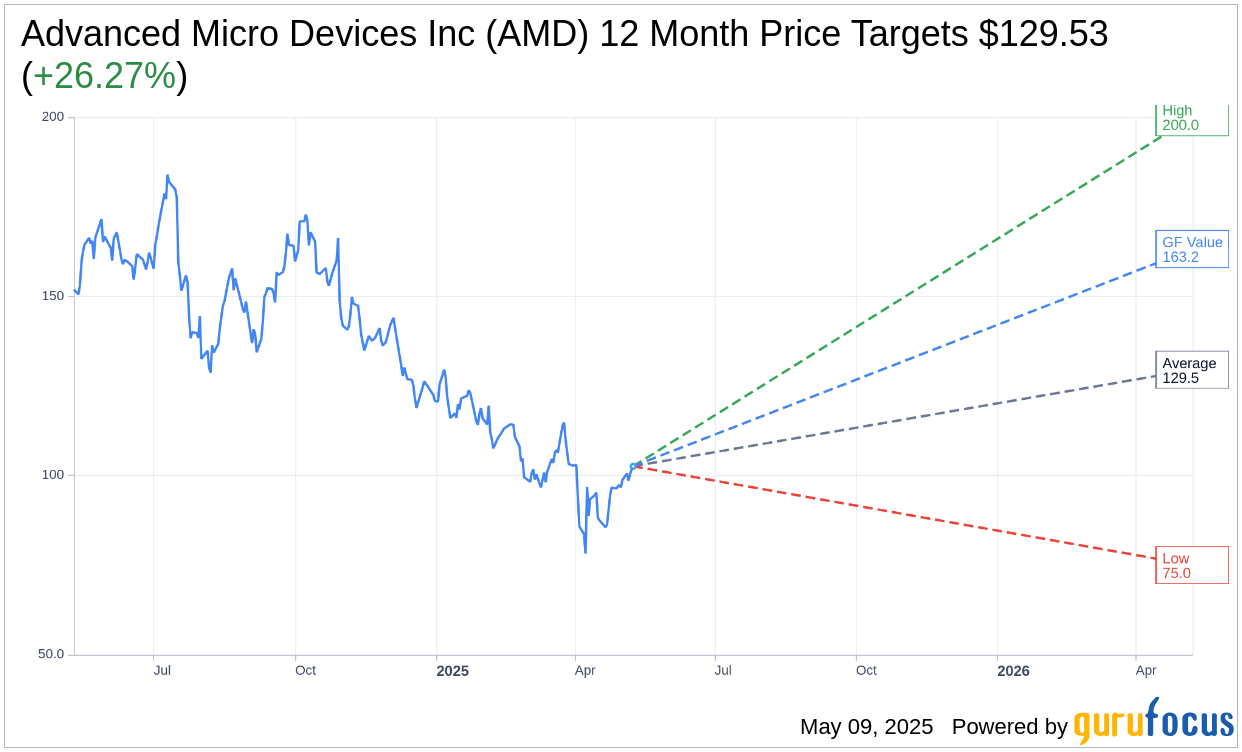

- Analysts predict an average upside of 26.27% with a price target of $129.53.

Advanced Micro Devices (AMD) has recently been upgraded by Cavenagh Research, shifting its recommendation from "sell" to "hold." Despite a flourishing AI capital expenditure atmosphere, AMD's forecasts for 2025 revenue and EBIT have been adjusted downward by 3% and 11% respectively, indicating ongoing competitive pressures from Nvidia (NVDA). The price target for AMD has been updated to $96.

Wall Street Analysts Forecast

An analysis of the one-year price forecasts from 41 analysts suggests an average target price for Advanced Micro Devices Inc (AMD, Financial) at $129.53, with estimates ranging from a high of $200.00 to a low of $75.00. This average target reflects a potential upside of 26.27% from the current trading price of $102.58. For more detailed projections, visit the Advanced Micro Devices Inc (AMD) Forecast page.

The consensus recommendation from 52 brokerage firms places Advanced Micro Devices Inc (AMD, Financial) at an average brokerage recommendation of 2.2, categorizing it as "Outperform." The rating scale used ranges from 1 to 5, where 1 signifies a Strong Buy and 5 denotes Sell.

According to GuruFocus estimates, the projected GF Value for Advanced Micro Devices Inc (AMD, Financial) in one year is $163.19, which suggests an upside of 59.09% from the current share price of $102.58. The GF Value represents GuruFocus' valuation of the fair market price of the stock, derived from its historical trading multiples, past growth patterns, and anticipated future performance. For additional insights, visit the Advanced Micro Devices Inc (AMD) Summary page.