Summary Highlights:

- Albertsons Companies (ACI, Financial) remains appealing despite merger setbacks, with steady sales growth projections.

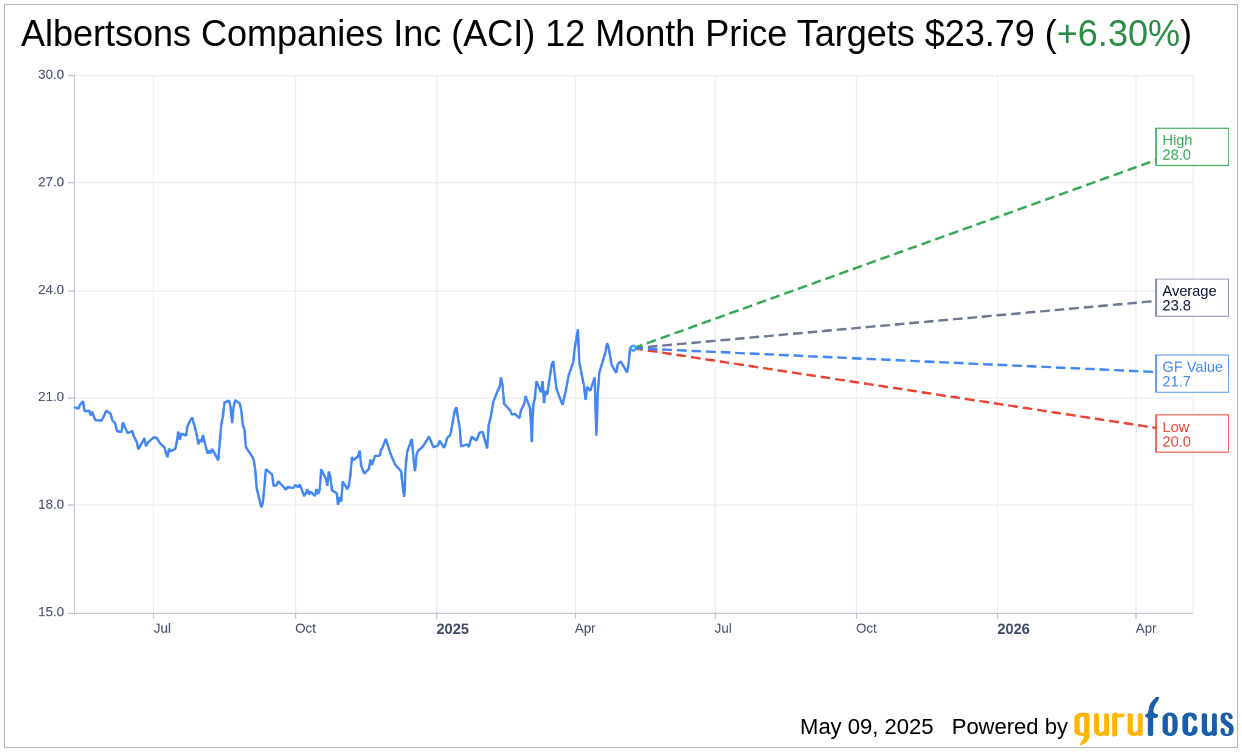

- Analysts suggest a potential 6.3% stock price increase, yet GuruFocus estimates a 3.15% downside risk.

- The company maintains an "Outperform" rating, reflecting robust long-term prospects.

Albertsons Companies: A Stable Player in Consumer Staples

Albertsons Companies Inc. (NYSE: ACI) continues to be a compelling investment opportunity within the consumer staples sector. Despite the recent collapse of its proposed merger with Kroger, the grocery chain remains resilient. Albertsons projects a sales growth rate of 1.5% to 2.5% for this fiscal year, showcasing its capability to maintain stable financial performance. However, it's important to note the expected slight dip in EBITDA to the range of $3.8 to $3.9 billion.

Wall Street's Perspective on ACI

Wall Street analysts have set one-year price targets for Albertsons Companies Inc. (ACI, Financial), providing investors with a glimpse of its potential upside. With an average target price of $23.79, analysts predict a possible increase of 6.30% from the current share price of $22.38. The price forecasts range widely, with a high estimate reaching $28.00 and a low estimate at $20.00. For a more comprehensive breakdown of these estimates, visit the Albertsons Companies Inc (ACI) Forecast page.

Brokerage Recommendations

In terms of brokerage recommendations, Albertsons Companies Inc. holds an average rating of 2.4 from 21 firms, categorizing it under the “Outperform” status. The scale utilized stretches from 1, indicating a Strong Buy, to 5, representing a Sell. This favorable outlook further underscores the stock's healthy long-term potential.

GuruFocus Valuation Insights

According to GuruFocus estimates, the GF Value for Albertsons Companies Inc (ACI, Financial) over the next year is projected at $21.67. This suggests a downside risk of 3.15% from the current trading price of $22.375. The GF Value represents GuruFocus' calculation of the stock’s fair value, derived from its historical trading multiples, past growth trajectories, and future performance estimates. For further details, visit the Albertsons Companies Inc (ACI) Summary page.