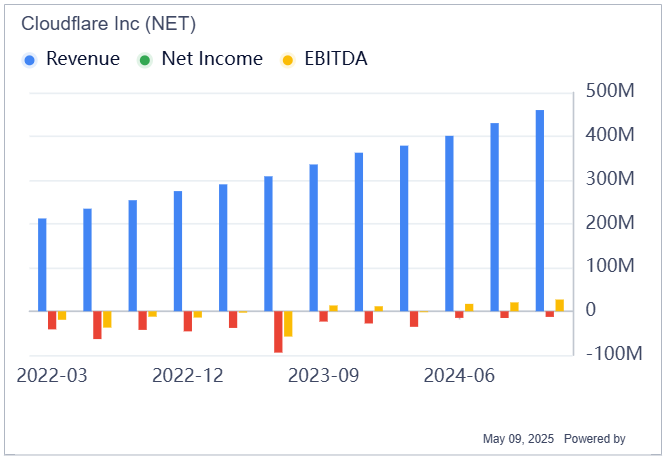

Cloudflare (NET, Financial) just scored the biggest contract in its history — a $100 million deal driven by its Workers developer platform. The 27% revenue surge to $479.1 million in Q1 highlights strong enterprise demand, but the numbers tell a more complicated story. Adjusted EPS held steady at $0.16, while net income stayed in the red and EBITDA barely moved, underscoring the ongoing struggle to turn growth into profit.

Despite the revenue boost, Cloudflare's margins dipped to 77%, raising questions about whether it can balance aggressive expansion with cost control. The number of large customers spending over $100,000 annually jumped 23% to 3,527, accounting for 69% of total revenue. Yet, as the chart shows, despite the consistent increase in revenue over time, profitability remains an issue — minimal EBITDA and consistently negative net income signal that growth is coming at a steep cost.

Looking forward, Cloudflare projects 25% revenue growth in fiscal 2025, targeting $2.09 billion to $2.094 billion in sales with a 13% non-GAAP operating margin. But with shares still 30% off their 52-week high, investors may need to decide whether the revenue gains are worth the persistent profitability squeeze.