Exploring the Investment Strategies of a Renowned Value Investor

Wallace Weitz (Trades, Portfolio) recently submitted the 13F filing for the first quarter of 2025, providing insights into his investment moves during this period. As the portfolio manager of Weitz Value Fund, Weitz Hickory Fund, and Weitz Partners Value Fund, which he started in 1983, Weitz has established a reputation for his unique approach to value investing. His strategy combines Benjamin Graham's principles of price sensitivity and a "margin of safety" with a focus on qualitative factors that allow companies to exert control over their destinies. This approach often prioritizes qualitative assessments over traditional metrics like historical book value or reported earnings.

Summary of New Buy

Wallace Weitz (Trades, Portfolio) added a total of one stock to his portfolio this quarter:

- The most significant addition was IDEXX Laboratories Inc (IDXX, Financial), with 60,300 shares, accounting for 1.35% of the portfolio and a total value of $25.32 million.

Key Position Increases

Wallace Weitz (Trades, Portfolio) also increased stakes in a total of 14 stocks, among them:

- The most notable increase was Microsoft Corp (MSFT, Financial), with an additional 88,625 shares, bringing the total to 134,475 shares. This adjustment represents a significant 193.29% increase in share count, a 1.77% impact on the current portfolio, and a total value of $50,480,570.

- The second largest increase was Bio-Techne Corp (TECH, Financial), with an additional 410,400 shares, bringing the total to 791,650. This adjustment represents a significant 107.65% increase in share count, with a total value of $46,414,440.

Summary of Sold Out

Wallace Weitz (Trades, Portfolio) completely exited three holdings in the first quarter of 2025, as detailed below:

- Fidelity National Information Services Inc (FIS, Financial): Wallace Weitz (Trades, Portfolio) sold all 272,500 shares, resulting in a -1.14% impact on the portfolio.

- Liberty Global Ltd (LBTYK, Financial): Wallace Weitz (Trades, Portfolio) liquidated all 792,933 shares, causing a -0.54% impact on the portfolio.

Key Position Reduces

Wallace Weitz (Trades, Portfolio) also reduced positions in 16 stocks. The most significant changes include:

- Reduced Veralto Corp (VLTO, Financial) by 261,199 shares, resulting in an -87.45% decrease in shares and a -1.37% impact on the portfolio. The stock traded at an average price of $99.82 during the quarter and has returned -1.68% over the past 3 months and -4.62% year-to-date.

- Reduced Meta Platforms Inc (META, Financial) by 37,840 shares, resulting in a -23.86% reduction in shares and a -1.15% impact on the portfolio. The stock traded at an average price of $645.17 during the quarter and has returned -16.36% over the past 3 months and 2.07% year-to-date.

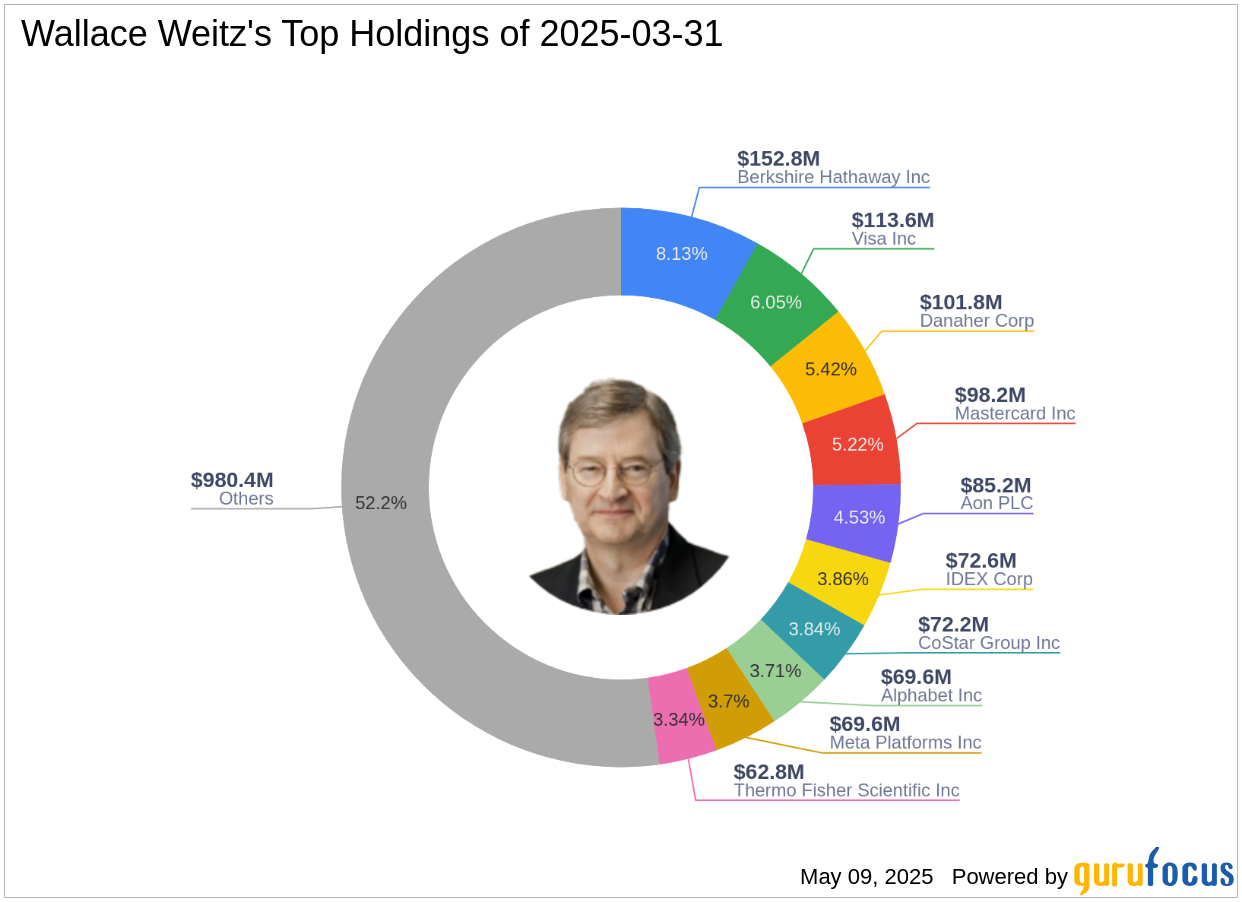

Portfolio Overview

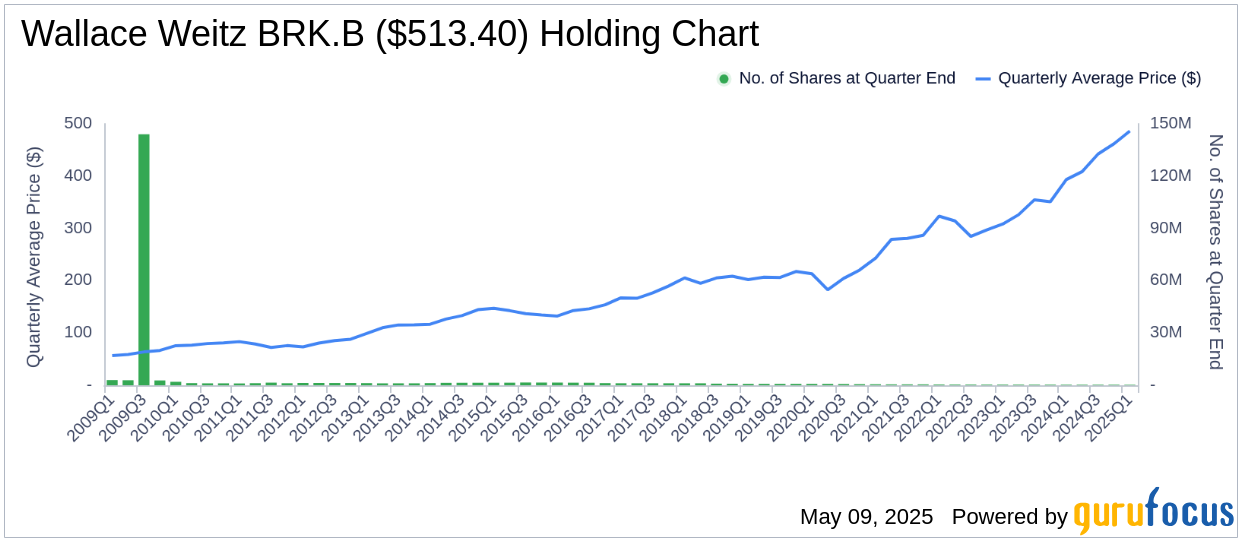

At the first quarter of 2025, Wallace Weitz (Trades, Portfolio)'s portfolio included 44 stocks. The top holdings included 8.13% in Berkshire Hathaway Inc (BRK.B, Financial), 6.05% in Visa Inc (V, Financial), 5.42% in Danaher Corp (DHR, Financial), 5.22% in Mastercard Inc (MA, Financial), and 4.53% in Aon PLC (AON, Financial).

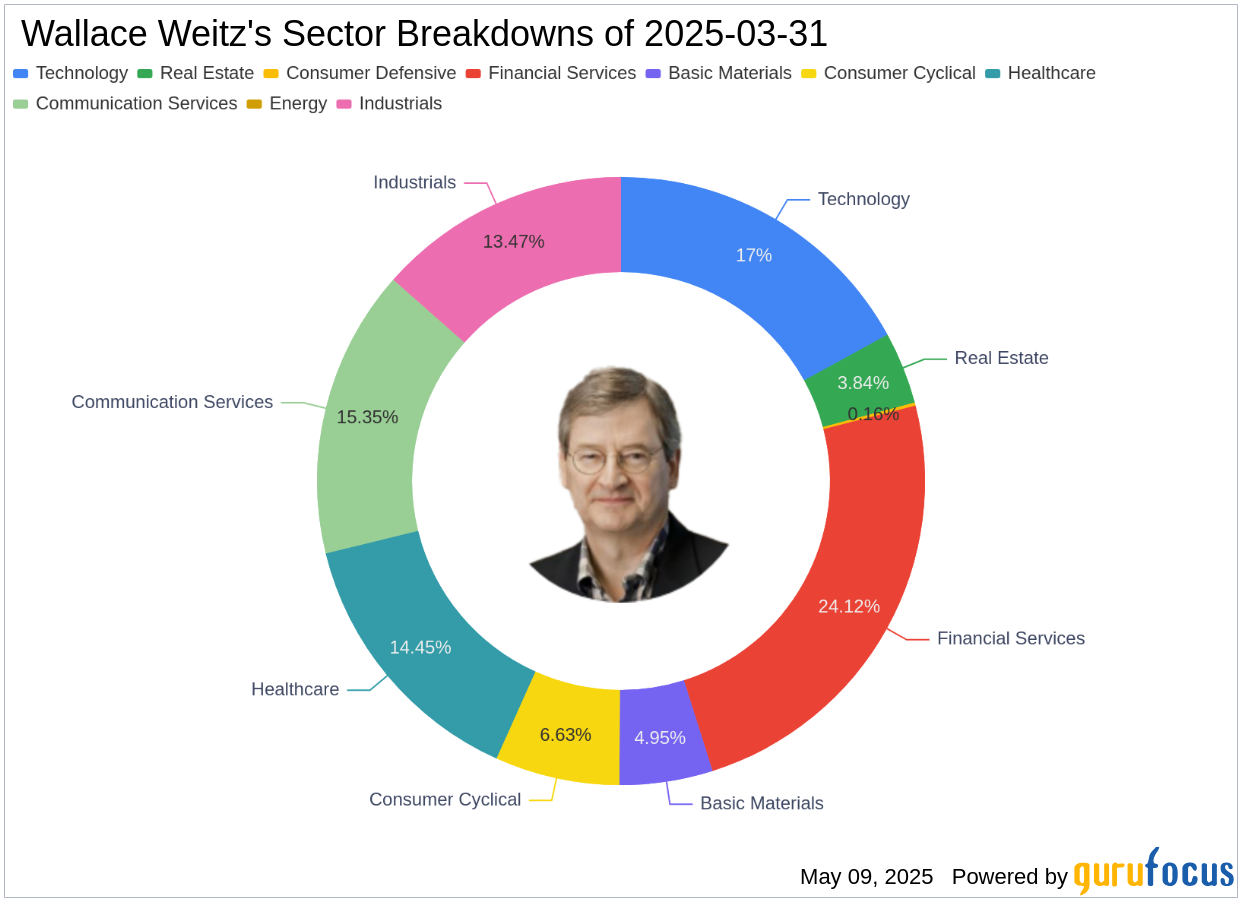

The holdings are mainly concentrated in 9 of the 11 industries: Financial Services, Technology, Communication Services, Healthcare, Industrials, Consumer Cyclical, Basic Materials, Real Estate, and Consumer Defensive.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: