Archer Daniels (ADM, Financial) has been downgraded to Underperform by BofA, with the price target adjusted from $47 to $45. Although the company's first-quarter results provided some reassurance, with management sticking to their full-year 2025 EPS forecast of $4.00 to $4.75, the outcomes are expected to lean towards the lower end of the spectrum. BofA indicated that the optimism surrounding ADM's prospects might be "misplaced," as they revised their EPS estimate downward to $3.90. The firm expressed concerns about potential further earnings pressure, highlighting that recent results have sparked more questions than clarifications. They struggle to align management's positive comments with an EPS figure that remains above $4, raising doubts about future earnings strength.

Wall Street Analysts Forecast

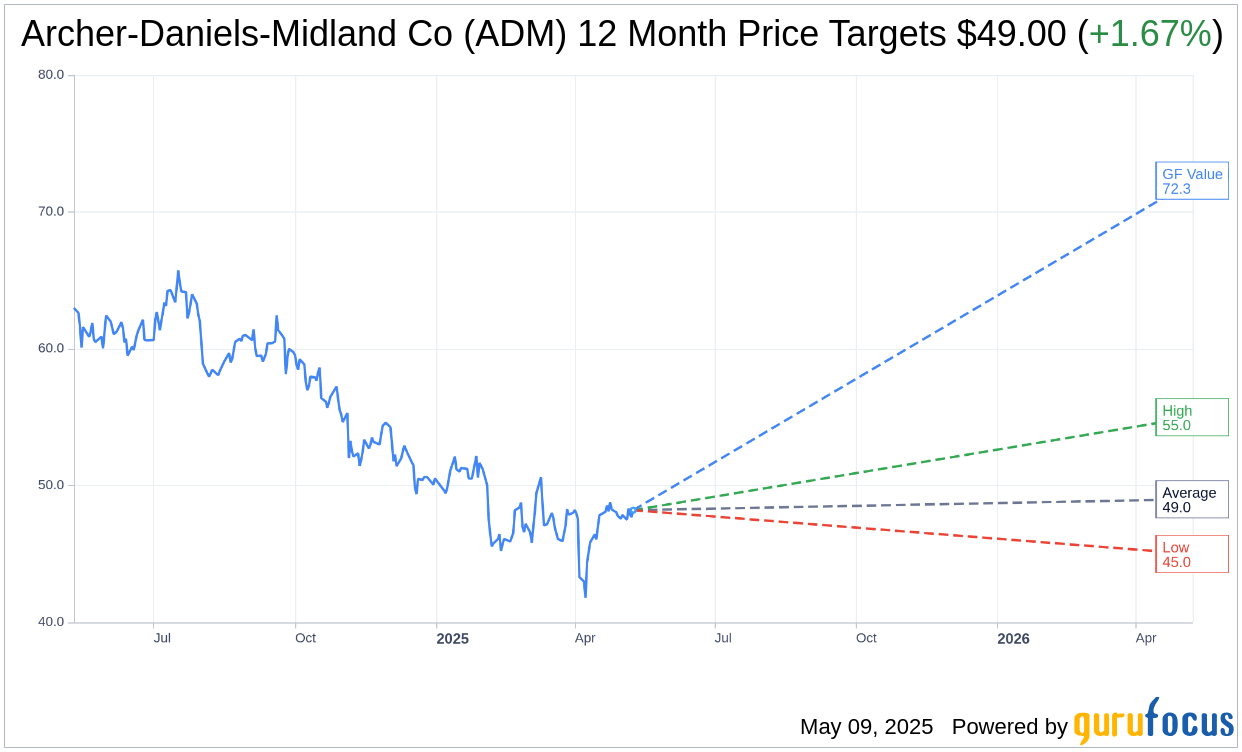

Based on the one-year price targets offered by 9 analysts, the average target price for Archer-Daniels-Midland Co (ADM, Financial) is $49.00 with a high estimate of $55.00 and a low estimate of $45.00. The average target implies an upside of 1.67% from the current price of $48.20. More detailed estimate data can be found on the Archer-Daniels-Midland Co (ADM) Forecast page.

Based on the consensus recommendation from 12 brokerage firms, Archer-Daniels-Midland Co's (ADM, Financial) average brokerage recommendation is currently 3.2, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Archer-Daniels-Midland Co (ADM, Financial) in one year is $72.29, suggesting a upside of 49.99% from the current price of $48.195. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Archer-Daniels-Midland Co (ADM) Summary page.

ADM Key Business Developments

Release Date: May 06, 2025

- Adjusted Earnings Per Share (EPS): $0.70 for the first quarter.

- Total Segment Operating Profit: $747 million for the quarter.

- Trailing Four Quarter Adjusted ROIC: 7%.

- Cash Flow from Operations Before Working Capital Changes: $439 million.

- AS&O Segment Operating Profit: $412 million, down 52% compared to the prior year quarter.

- Ag Services Subsegment Operating Profit: $159 million, down 31% versus the prior year quarter.

- Crushing Subsegment Operating Profit: $47 million, down 85% compared to the prior year quarter.

- Refined Products and Other Subsegment Operating Profit: $134 million, down 21% compared to the prior year quarter.

- Equity Earnings from Wilmar: $72 million, down 52% compared to the prior year quarter.

- Carbohydrate Solutions Segment Operating Profit: $240 million, down 3% compared to the prior year quarter.

- Starches and Sweeteners Subsegment Operating Profit: $207 million, down 21% compared to the prior year quarter.

- Vantage Corn Processors Subsegment Operating Profit: $33 million, up compared to the prior year quarter.

- Nutrition Segment Revenues: $1.8 billion, down 1% compared to the prior year quarter.

- Nutrition Segment Operating Profit: $95 million, up 13% versus the prior year quarter.

- Human Nutrition Subsegment Operating Profit: $75 million, down 1% compared to the prior year quarter.

- Animal Nutrition Subsegment Operating Profit: $20 million, higher than the prior year quarter.

- Cash Returned to Shareholders: $247 million in the form of dividends in the quarter.

- Full Year Adjusted EPS Guidance: Expected to be between $4 to $4.75 per share, likely at the lower end of the range.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- ADM reported adjusted earnings per share of $0.70, aligning with market expectations.

- The carbohydrate solutions team delivered solid results, supported by positive margins in sweeteners and strong execution in ethanol.

- Nutrition segment operating profit increased by 13% year-over-year, driven by improvements in flavors and animal nutrition.

- ADM achieved the lowest total recordable incident rate in its history, highlighting a strong focus on safety.

- The company made significant progress on its cost-saving target, aiming for $500 million to $750 million in savings over the next three to five years.

Negative Points

- AS&O segment operating profit was down 52% compared to the prior year, impacted by lower margins across all subsegments.

- Trade policy uncertainty, particularly with Canada and China, created volatility and negatively affected canola meal and oil margins.

- Crushing subsegment operating profit decreased by 85%, with significantly lower global soybean and canola crush execution margins.

- Refined products and other subsegment operating profit fell by 21% due to lower biodiesel and refining margins.

- The company expects to be at the lower end of its full-year adjusted EPS guidance due to current market conditions.