- Telecom Italia (TIIAY, Financial) experiences a notable 2.7% increase in group revenues, reaching 3.3 billion euros.

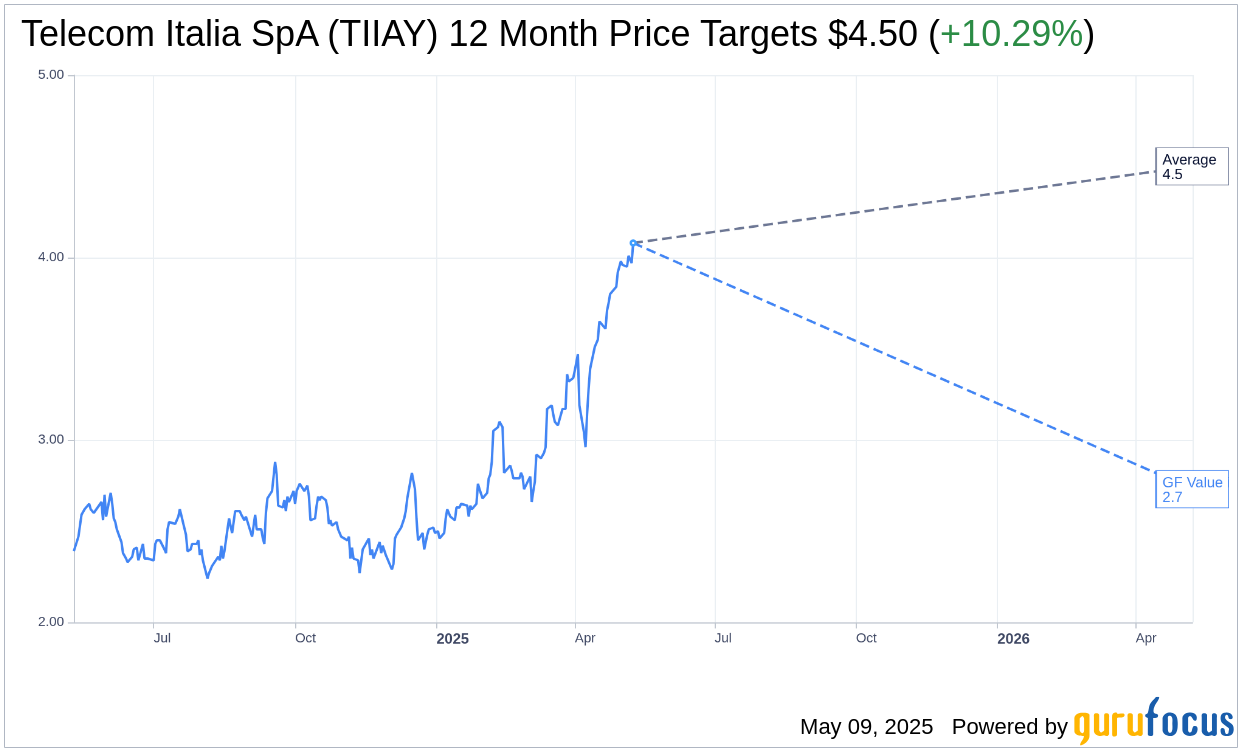

- Analysts maintain a "Buy" recommendation with a price target offering a 10.29% upside potential.

- GF Value suggests a downward trend of 33.09%, indicating a potential risk when evaluated against current stock prices.

Telecom Italia SpA (TIIAY) reported impressive growth in their recent financials, with group revenues increasing to 3.3 billion euros, a 2.7% improvement compared to the previous year. Domestically, the company achieved revenues of 2.2 billion euros, while their operations in Brazil marked a 4.9% growth, reaching 1.0 billion euros. The company also witnessed a robust 5.7% rise in EBITDA, which now stands at 1.0 billion euros, underscoring the strength across its primary markets.

Wall Street Analysts' Insights and Forecasts

According to forecasts from one Wall Street analyst, Telecom Italia SpA (TIIAY, Financial) is expected to reach an average target price of $4.50 within the year. This target represents both the high and low estimates, translating into a 10.29% potential upside from the current trading price of $4.08. Investors seeking a deeper dive into these projections can visit the Telecom Italia SpA (TIIAY) Forecast page.

With insights from two brokerage firms, the average recommendation for Telecom Italia SpA stands at 1.5, categorizing it as a "Buy". The recommendation scale spans from 1 to 5, where a rating of 1 indicates a Strong Buy, while a 5 suggests a Sell.

Assessing GF Value: A Cautionary Perspective

GuruFocus suggests that the GF Value of Telecom Italia SpA (TIIAY, Financial) will likely be $2.73 in the coming year, implying a notable downside of 33.09% from the current price of $4.08. This GF Value is a reflection of GuruFocus' assessment of the fair value based on historical trading multiples, past business growth, and future performance forecasts. For more comprehensive data, the Telecom Italia SpA (TIIAY) Summary page offers additional insights.