In the latest update from Oppenheimer, analyst Leland Gershell has maintained an "Outperform" rating for argenx (ARGX, Financial). As part of this update, the firm has also raised its price target for ARGX from $704.00 to $708.00 USD, reflecting a 0.57% increase.

The adjustment in the price target underscores Oppenheimer's continued confidence in the performance of argenx, a company that remains a key player in its industry. The unchanged "Outperform" rating indicates that Oppenheimer anticipates ARGX to perform better than the broader market averages in the near to medium term.

Investors will be watching argenx (ARGX, Financial) closely following this announcement, as the stock continues to attract attention due to its solid performance and potential for future growth. Oppenheimer's revised price target suggests optimism about ARGX's prospects in the coming months.

This report comes as part of a regular update by Oppenheimer, which closely monitors developments surrounding argenx and provides timely insights to investors. As the market evolves, ARGX remains a stock to watch, with Oppenheimer's endorsement providing additional credibility to its potential.

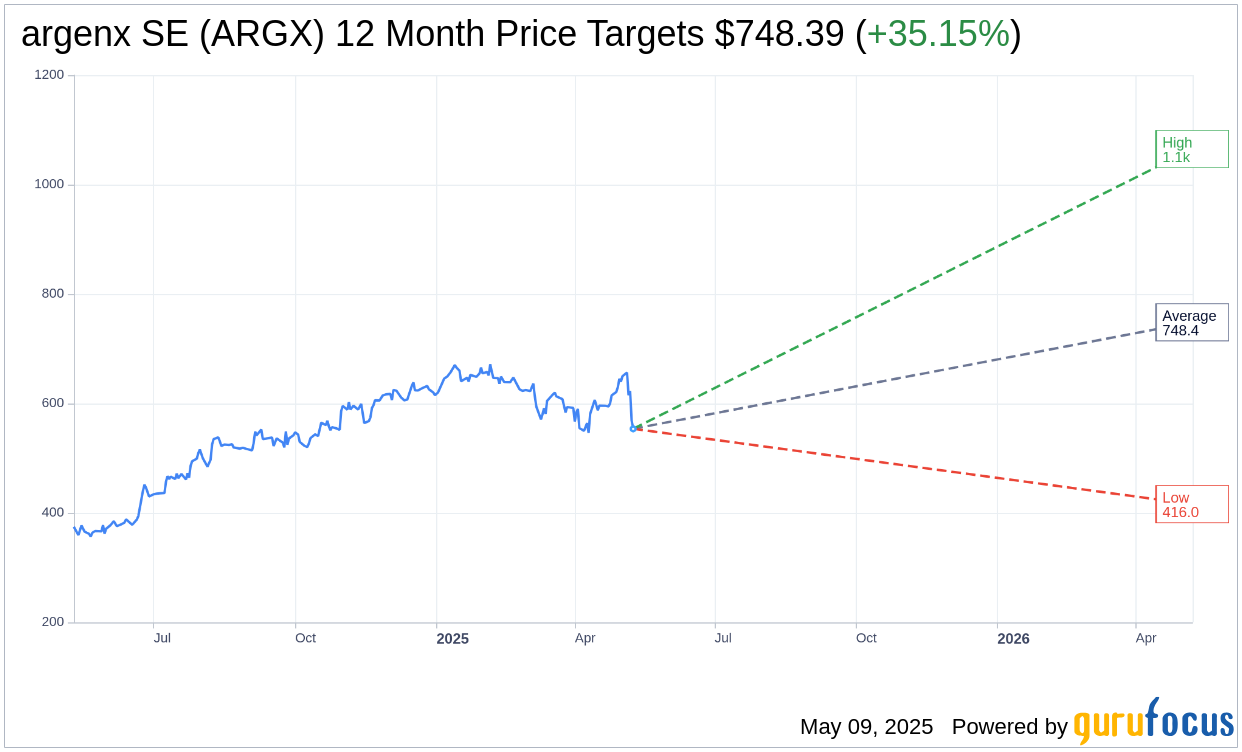

Wall Street Analysts Forecast

Based on the one-year price targets offered by 24 analysts, the average target price for argenx SE (ARGX, Financial) is $748.39 with a high estimate of $1,065.00 and a low estimate of $416.00. The average target implies an upside of 35.15% from the current price of $553.75. More detailed estimate data can be found on the argenx SE (ARGX) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, argenx SE's (ARGX, Financial) average brokerage recommendation is currently 1.6, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for argenx SE (ARGX, Financial) in one year is $1965.46, suggesting a upside of 254.94% from the current price of $553.75. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the argenx SE (ARGX) Summary page.