On May 9, 2025, GAN Ltd (GAN, Financial) released its 8-K filing detailing its financial performance for the first quarter of 2025. GAN Ltd, a prominent provider of Software-as-a-Service solutions for online casino gaming and sports betting, operates through two segments: B2B and B2C. The B2B segment focuses on developing and marketing GameSTACK, GAN Sports, and iSight Back Office technology, while the B2C segment, including Coolbet, offers online sports betting and casino platforms in Europe, Latin America, and Canada.

Financial Performance and Challenges

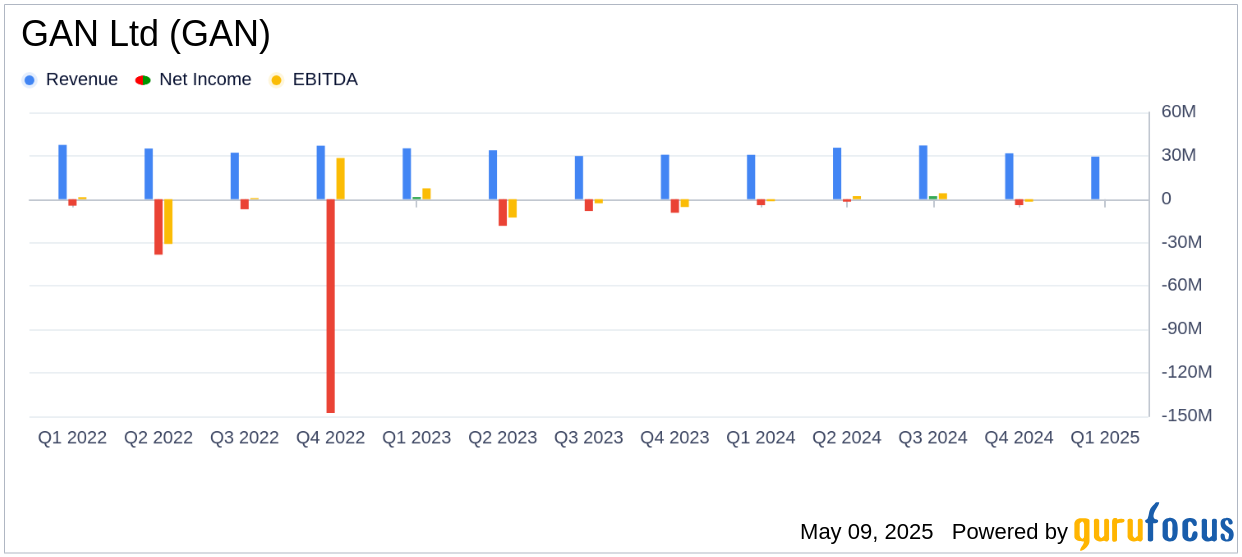

GAN Ltd reported total revenue of $29.4 million for Q1 2025, a 4% decrease from the previous year, falling short of the analyst estimate of $35.88 million. This decline was primarily due to a significant drop in the B2B segment revenue, which fell to $5.1 million from $12.3 million, largely attributed to the expiration of a multistate B2B commercial contract. In contrast, the B2C segment showed robust growth, with revenue increasing to $24.3 million from $18.3 million, driven by strong performance in Europe and Latin America.

Key Financial Achievements

The B2C segment's growth underscores GAN Ltd's strong market position in international markets, crucial for sustaining its competitive edge in the Travel & Leisure industry. Despite the overall revenue decline, the B2C segment contribution margin improved to 64.9% from 60.4%, highlighting efficient cost management and market expansion.

Income Statement and Key Metrics

GAN Ltd reported a net loss of $6.8 million, an increase from the $4.2 million loss in Q1 2024. This was primarily due to reduced B2B revenues, partially offset by higher B2C contributions and lower operating expenses. Operating expenses decreased to $23.7 million from $24.6 million, reflecting successful cost-saving initiatives. Adjusted EBITDA stood at $(1.5) million, down from $(0.6) million, influenced by the same factors affecting net loss.

Seamus McGill, GAN’s Chief Executive Officer, stated, “I’m pleased with the continued progress during the first quarter as we continue to execute on our business plan while refining our cost structure. Our B2C results were particularly strong and underscore the strength of our market position in European and Latin American markets.”

Balance Sheet and Cash Flow

As of March 31, 2025, GAN Ltd's cash position improved to $39.9 million from $38.7 million at the end of 2024, driven by favorable changes in working capital. This financial stability is vital for supporting ongoing operations and strategic initiatives, including the anticipated merger with SEGA SAMMY.

Analysis and Future Outlook

While GAN Ltd faces challenges in its B2B segment, the strong performance in the B2C segment provides a positive outlook. The planned merger with SEGA SAMMY, expected to close in Q2 2025, could further enhance GAN Ltd's market position and operational capabilities. Investors will be keenly watching how the company navigates these dynamics to drive future growth.

Explore the complete 8-K earnings release (here) from GAN Ltd for further details.