Key Highlights:

- Enbridge (ENB, Financial) posts a robust Q1 performance, driving stock up by 0.6%.

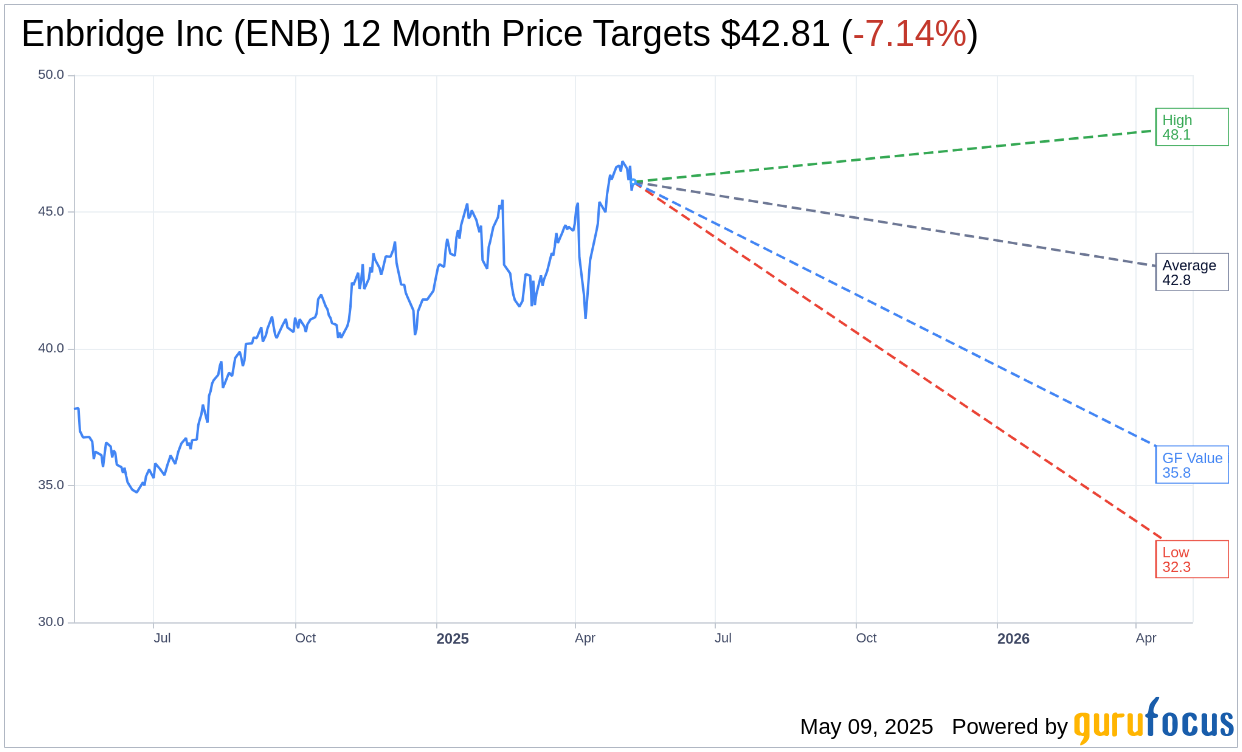

- Analysts predict potential fluctuations with price targets ranging from $32.31 to $48.11.

- GuruFocus estimates a significant downside in ENB's fair value over the next year.

Enbridge's Impressive Q1 Results

Enbridge Inc. (ENB) saw its stock climb by 0.6% after revealing a strong first-quarter performance that surpassed adjusted earnings forecasts. A key driver of this positive result was the Mainline crude pipeline system, which achieved a record throughput of 3.2 million barrels per day. This achievement significantly bolstered Enbridge's Q1 net profit, shooting up to C$2.26 billion, or C$1.04 per share, from C$1.42 billion, or C$0.67 per share, in the same quarter last year. Looking ahead, Enbridge plans to make a final investment decision later this year to expand the Mainline system by adding 150,000 barrels per day to cater to rising demand.

Analyst Price Targets and Recommendations

According to projections from 8 analysts, Enbridge's one-year price target averages at $42.81, with projections ranging between a high of $48.11 and a low of $32.31. This average estimate suggests an estimated downside of 7.14% from the current stock price of $46.10. For additional insights, please visit the Enbridge Inc (ENB, Financial) Forecast page.

The consensus among 14 brokerage firms positions Enbridge Inc's (ENB, Financial) average recommendation at 2.6, which corresponds to a "Hold" status. The recommendation scale ranges from 1 (Strong Buy) to 5 (Sell), offering investors a comprehensive overview of the stock's current valuation in the market.

GuruFocus GF Value Estimation

According to GuruFocus estimates, the one-year GF Value of Enbridge Inc (ENB, Financial) stands at $35.77, suggesting a potential downside of 22.41% from the current price of $46.1. This estimate reflects the fair value at which the stock should ideally trade, determined by historical trading multiples, business growth trends, and future performance forecasts. Explore more detailed analyses on the Enbridge Inc (ENB) Summary page.