Key Takeaways:

- Amplify Energy (AMPY, Financial) is anticipated to release Q1 earnings with a predicted EPS of $0.16.

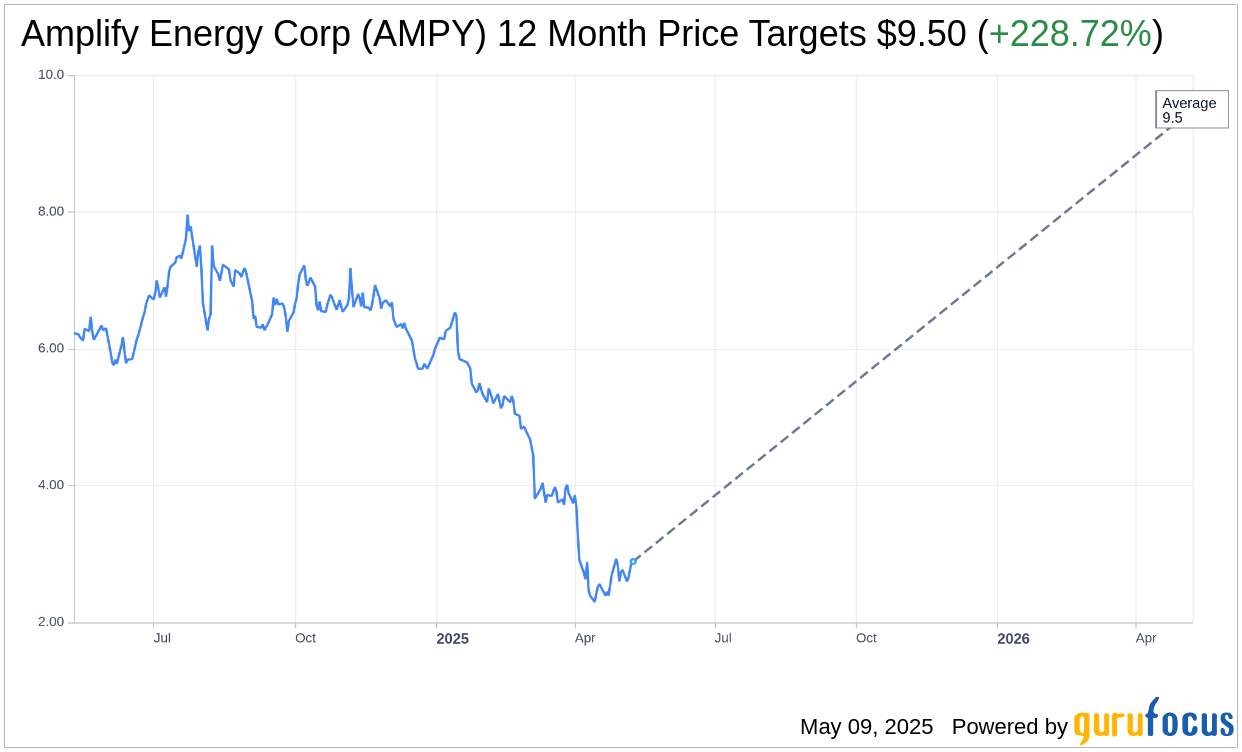

- The average analyst price target of $9.50 suggests a significant upside potential of over 228%.

- Current brokerage recommendations rate AMPY as "Outperform."

Amplify Energy Corp (NYSE: AMPY) is preparing to announce its first-quarter earnings on May 12th after the market closes. Analysts forecast earnings per share (EPS) at $0.16, with expected revenue around $73.87 million, representing a 3.2% decline compared to the same quarter last year. Although Amplify has historically surpassed revenue estimates, recent trends show a downward revision in EPS expectations.

Wall Street Analysts' Perspectives

According to predictions by analysts, the one-year price target for Amplify Energy Corp is set at $9.50. This forecast remains uniform among analysts, with no variation in high or low estimates. Based on the current trading price of $2.89, this target indicates a potential upside of 228.72%. For comprehensive data and analysis, visit the Amplify Energy Corp (AMPY, Financial) Forecast page.

The consensus from two brokerage firms positions Amplify Energy Corp's average recommendation at 2.0, reflecting an "Outperform" rating. This scale, where 1 denotes a Strong Buy and 5 indicates a Sell, suggests a favorable view of the stock's future performance.

Understanding GF Value and Its Implications

According to GuruFocus estimates, the projected GF Value for Amplify Energy Corp over the next year is $7.08. This suggests a potential upside of 144.98% from its current price of $2.89. The GF Value is a proprietary GuruFocus metric that indicates the stock's fair trading value, utilizing historical trading multiples, past business growth, and prospective performance estimates. For a detailed overview of Amplify Energy Corp's financials, visit the Amplify Energy Corp (AMPY, Financial) Summary page.