Key Highlights:

- Mach Natural Resources (MNR, Financial) strengthens financial health with strategic debt refinancing and operational expansion.

- Analysts set an optimistic one-year price target, suggesting significant upside potential.

- Current consensus indicates a "Buy" recommendation from brokerage firms.

Mach Natural Resources (MNR) has demonstrated notable strategic financial progress in the first quarter of 2025. By improving its net debt-to-EBITDA ratio to a robust 0.7x, the company has positioned itself favorably within the industry. A key component of this financial advancement was the successful refinancing of $763 million in debt, which is projected to result in annual savings of $22 million. Coupled with a strategic $60 million acquisition aimed at enhancing natural gas drilling operations, MNR is poised for substantial growth, particularly within the Anadarko basin.

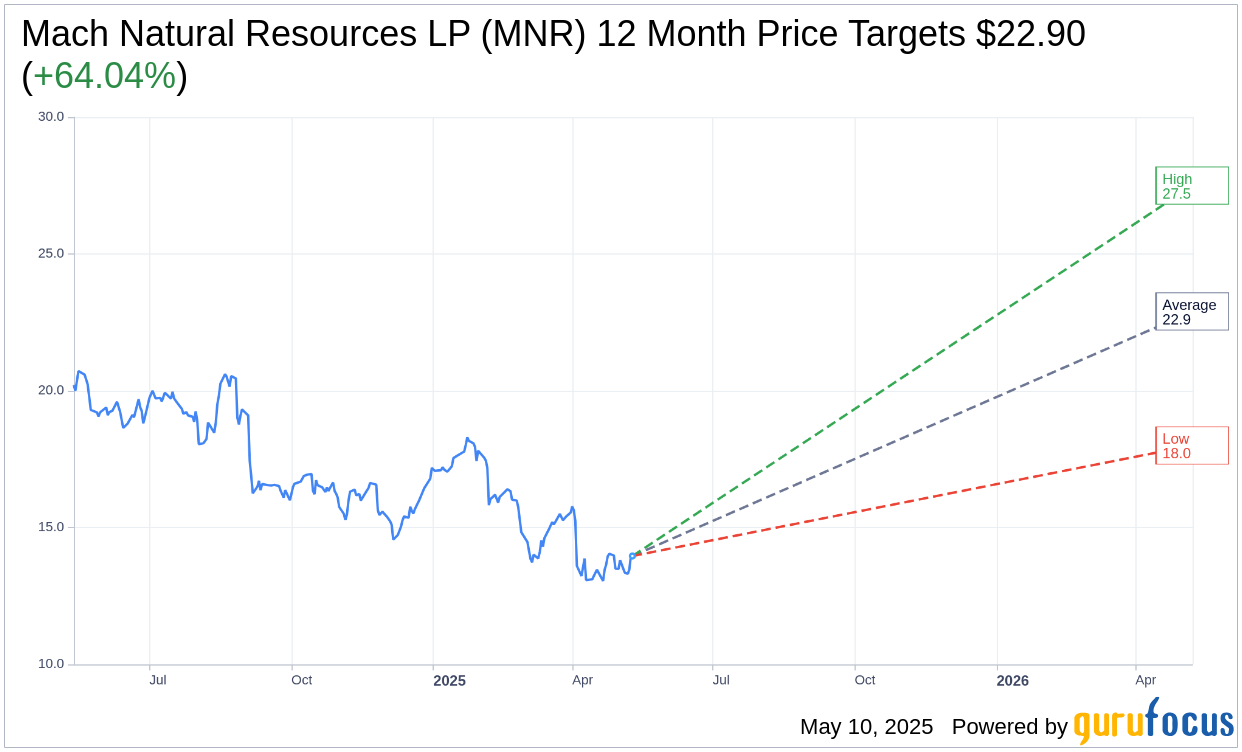

Wall Street Analysts Forecast

Mach Natural Resources LP (MNR, Financial) is attracting attention from industry analysts, who have set a one-year average target price of $22.90. The analysts' projections span a high estimate of $27.50 to a low estimate of $18.00. This average target indicates a notable upside potential of 64.04% from the current stock price of $13.96. For a more in-depth analysis, investors can visit the Mach Natural Resources LP (MNR) Forecast page.

The consensus from five brokerage firms assigns Mach Natural Resources LP an average brokerage recommendation of 1.4, which translates to a "Buy" rating. This rating scale, ranging from 1 to 5, suggests strong investor confidence, with 1 indicating a Strong Buy and 5 suggesting a Sell.