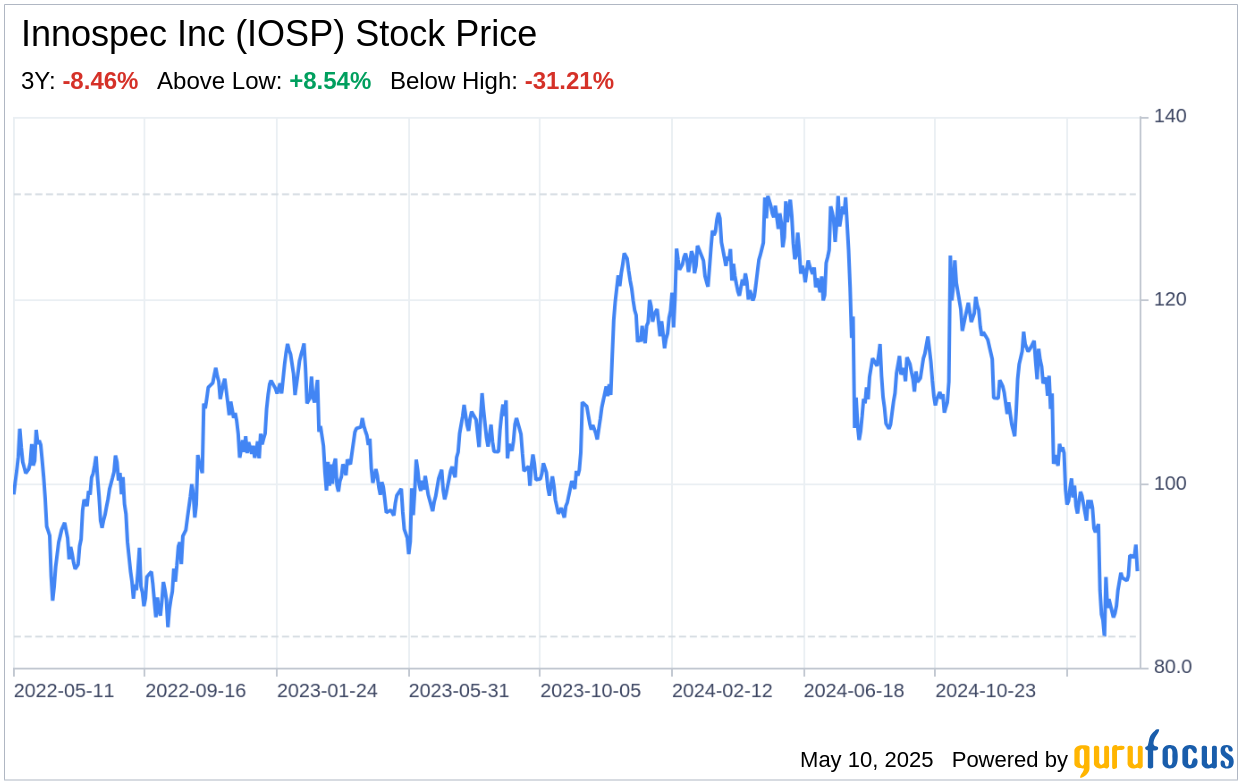

Innospec Inc (IOSP, Financial), a leading manufacturer and seller of specialty chemicals and fuel additives, has recently filed its 10-Q report on May 9, 2025. This SWOT analysis delves into the company's financial performance and strategic positioning, based on the latest quarterly figures. Innospec Inc reported net sales of $440.8 million, a decrease from the previous year's $500.2 million. Despite a reduction in net income from $41.4 million to $32.8 million, the company has shown resilience with a total comprehensive income of $51.5 million, bolstered by positive changes in cumulative translation adjustment. Operating activities generated $28.3 million in cash, down from $80.6 million, reflecting tighter working capital management and strategic investments. With a solid cash and cash equivalents position of $299.8 million, Innospec Inc is poised to navigate the competitive landscape and invest in future growth.

Strengths

Market Leadership in Fuel Specialties: Innospec Inc's Fuel Specialties segment remains its strongest business unit, generating the majority of the company's revenue. This segment's success is underpinned by its ability to innovate and deliver high-performance products that improve fuel efficiency, boost engine performance, and reduce emissions. The company's leading position in this niche market is a testament to its strong brand reputation and technical expertise.

Diverse Product Portfolio: Innospec Inc's diverse range of chemical and fuel additive products serves multiple industries, including personal care, oilfield services, and aerospace. This diversification reduces reliance on any single market and enables cross-selling opportunities. The company's Performance Chemicals segment, catering to the personal care industry, and its Oilfield Services segment, which supports oil and gas extraction, contribute to a balanced revenue stream and mitigate sector-specific risks.

Weaknesses

Declining Sales and Net Income: The recent financials indicate a downward trend in sales and net income, with net sales dropping by approximately 12% and net income decreasing by over 20% compared to the same period last year. This decline may signal underlying issues such as market saturation, pricing pressures, or operational inefficiencies that Innospec Inc needs to address to maintain profitability and shareholder value.

Operational Challenges: Innospec Inc's operating expenses, although reduced from the previous year, still represent a significant portion of its revenue. The company must continuously seek ways to optimize its cost structure, including selling, general, and administrative expenses, as well as research and development costs, to improve its operating margin and remain competitive in the market.

Opportunities

Expansion into Emerging Markets: Innospec Inc has the opportunity to expand its global footprint by targeting emerging markets with growing demand for specialty chemicals and fuel additives. By leveraging its existing product portfolio and developing new solutions tailored to these markets, the company can tap into new revenue streams and diversify its customer base.

Strategic Acquisitions: The company's strong balance sheet, with substantial cash reserves, positions it well to pursue strategic acquisitions. By acquiring complementary businesses or technologies, Innospec Inc can enhance its product offerings, enter new markets, and achieve economies of scale, driving long-term growth.

Threats

Market Volatility: Innospec Inc operates in a highly competitive and volatile market, where fluctuations in raw material costs and changes in customer demand can impact profitability. The company must navigate these challenges by implementing effective hedging strategies and maintaining agile supply chain management to mitigate the impact of market volatility on its operations.

Regulatory Changes: The chemical industry is subject to stringent regulations that can affect production processes, product formulations, and market access. Innospec Inc must stay ahead of regulatory changes to ensure compliance and avoid potential fines or disruptions to its business operations.

In conclusion, Innospec Inc (IOSP, Financial) exhibits a strong market presence, particularly in its Fuel Specialties segment, and benefits from a diverse product portfolio. However, the company faces challenges in reversing the trend of declining sales and net income, and must address operational inefficiencies to improve its financial performance. Opportunities for growth lie in expanding into emerging markets and pursuing strategic acquisitions, while threats from market volatility and regulatory changes require vigilant risk management. Innospec Inc's forward-looking strategies, including investments in innovation and market expansion, will be crucial in leveraging its strengths and capitalizing on opportunities to overcome its weaknesses and mitigate threats.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.