Next Technology Holding Inc (NXTT, Financial) filed its 10-Q on May 9, 2025, revealing a company that operates with a dual strategy of providing AI-enabled software development services and acquiring and holding Bitcoin. The financial overview for the three months ended March 31, 2025, shows a staggering net income of $193.4 million, primarily attributed to a fair value gain on digital assets amounting to $245.3 million. Despite not generating service revenue during this period, the company's strategic Bitcoin investments have yielded significant returns, contributing to a robust balance sheet. However, the company's general and administrative expenses increased to $449,858, up from $330,145 in the previous year, indicating a rise in operational costs.

Now, let's delve into the SWOT analysis of Next Technology Holding Inc (NXTT, Financial) to understand its internal strengths and weaknesses, as well as the external opportunities and threats it faces.

Strengths

Impressive Financial Performance: NXTT's financial strength is evident in its substantial net income growth, driven by its strategic Bitcoin investments. The company's ability to generate a significant fair value gain on digital assets demonstrates its adeptness in navigating the cryptocurrency market and capitalizing on its volatility for financial gain. This financial prowess provides NXTT with a solid foundation to invest in its core software development services and explore new opportunities.

Innovative AI-Enabled Services: NXTT's focus on AI-enabled software development services positions it at the forefront of technological innovation. By offering cutting-edge SAAS solutions to a diverse range of businesses, NXTT taps into the growing demand for intelligent automation and data-driven decision-making tools. This not only enhances its brand reputation but also creates a loyal customer base that relies on its expertise in delivering high-quality software solutions.

Weaknesses

Operational Cost Pressures: The increase in general and administrative expenses indicates rising operational costs that NXTT must manage effectively. As the company expands its services and Bitcoin holdings, it will need to keep a tight rein on expenses to maintain profitability. This requires strategic cost management and operational efficiency to prevent cost overruns from eroding its financial strength.

Revenue Concentration Risks: The lack of service revenue in the reported period points to a potential risk of revenue concentration in digital asset gains. NXTT's reliance on the performance of its Bitcoin investments could expose it to financial instability if the cryptocurrency market faces a downturn. Diversifying revenue streams and strengthening its core software development services will be crucial for long-term sustainability.

Opportunities

Expanding Market for AI Solutions: The global market for AI-enabled software solutions is expanding rapidly, presenting NXTT with ample opportunities to grow its customer base and revenue. By continuing to innovate and offer superior SAAS products, NXTT can capture a larger market share and establish itself as a leader in the AI software development space.

Leveraging Bitcoin Assets: NXTT's Bitcoin acquisition strategy provides it with a unique opportunity to leverage its digital assets for strategic investments and partnerships. As the company holds a significant amount of Bitcoin, it can use these assets to fund new projects, enter into collaborations, or even consider strategic acquisitions that align with its growth objectives.

Threats

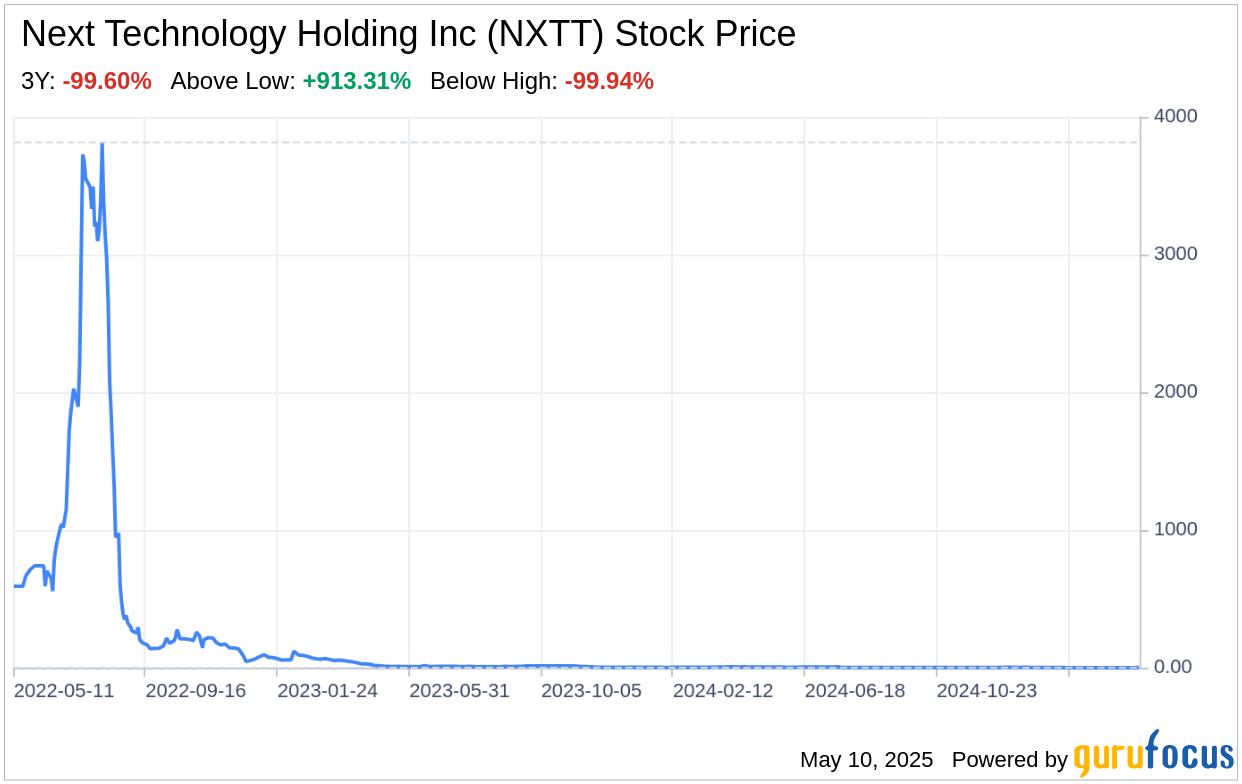

Cryptocurrency Market Volatility: The volatile nature of the cryptocurrency market poses a significant threat to NXTT's financial stability. Fluctuations in Bitcoin prices can lead to unpredictable gains or losses, impacting the company's bottom line. NXTT must navigate this uncertainty carefully and consider hedging strategies to mitigate the risks associated with its Bitcoin holdings.

Competitive Pressures: The software development industry is highly competitive, with numerous players vying for market share. NXTT faces the challenge of differentiating its offerings and maintaining a competitive edge in a crowded market. Continuous innovation, customer-focused solutions, and strategic marketing efforts will be key to staying ahead of competitors.

In conclusion, Next Technology Holding Inc (NXTT, Financial) exhibits a strong financial position bolstered by its strategic Bitcoin investments and innovative AI-enabled software services. However, it must address operational cost pressures and diversify its revenue sources to mitigate the risks associated with cryptocurrency market volatility. The company's opportunities lie in expanding its market presence in the AI solutions space and leveraging its Bitcoin assets for growth. NXTT must remain vigilant of the competitive landscape and market fluctuations to ensure sustained success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.