On April 30, 2025, NEUBERGER BERMAN GROUP LLC (Trades, Portfolio) executed a significant transaction involving Rogers Corp (ROG, Financial), reducing its holdings by 557,903 shares. The shares were traded at a price of $61.81, resulting in a new total of 414,720 shares held by the firm. This transaction reflects a strategic decision by the firm, impacting its portfolio with a trade position of 0.02 and reducing its stake in Rogers Corp to 2.20% of the total shares. The move is indicative of the firm's ongoing portfolio management strategy, aligning with its investment philosophy.

About NEUBERGER BERMAN GROUP LLC (Trades, Portfolio)

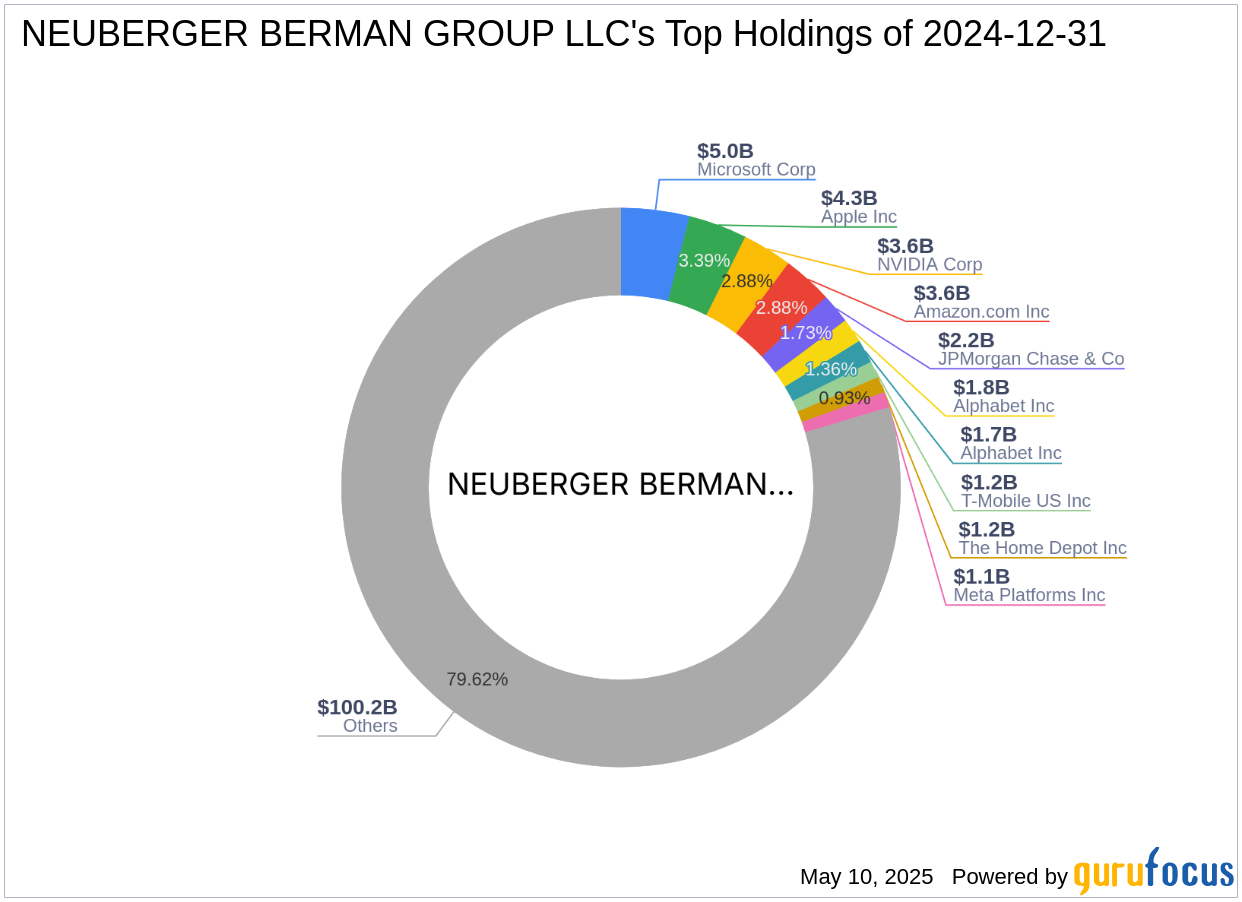

NEUBERGER BERMAN GROUP LLC is a well-regarded entity in the investment community, known for its expertise in value investing. The firm is headquartered at 1290 Avenue of the Americas, New York, NY, and manages an equity portfolio valued at $125.91 billion. Its top holdings include major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Microsoft Corp (MSFT, Financial), NVIDIA Corp (NVDA, Financial), and JPMorgan Chase & Co (JPM, Financial). The firm's investment strategy focuses on identifying undervalued opportunities, particularly within the technology and financial sectors, which are its primary areas of interest.

Rogers Corporation Overview

Rogers Corporation, a USA-based company, boasts a market capitalization of $1.22 billion. The company operates in three main business segments: Advanced Electronics Solutions, Elastomeric Material Solutions, and Other. These segments cater to various industries, including communications infrastructure, automotive, and consumer electronics. As of the latest data, Rogers Corp's stock is priced at $65.98, with a [GF Value](https://www.gurufocus.com/term/gf-value/ROG) of $109.32, suggesting it is significantly undervalued. This valuation presents a potential opportunity for investors seeking value in the market.

Impact of the Transaction

The reduction in shares of Rogers Corp by NEUBERGER BERMAN GROUP LLC (Trades, Portfolio) has a notable impact on the firm's portfolio. The current position of Rogers Corp in the firm's portfolio is 0.02, reflecting a strategic reallocation of assets. Despite the reduction, Rogers Corp still constitutes 2.20% of the total shares, indicating the firm's continued interest in the company. This transaction aligns with the firm's broader investment strategy, which involves adjusting holdings to optimize portfolio performance.

Financial Performance and Valuation of Rogers Corp

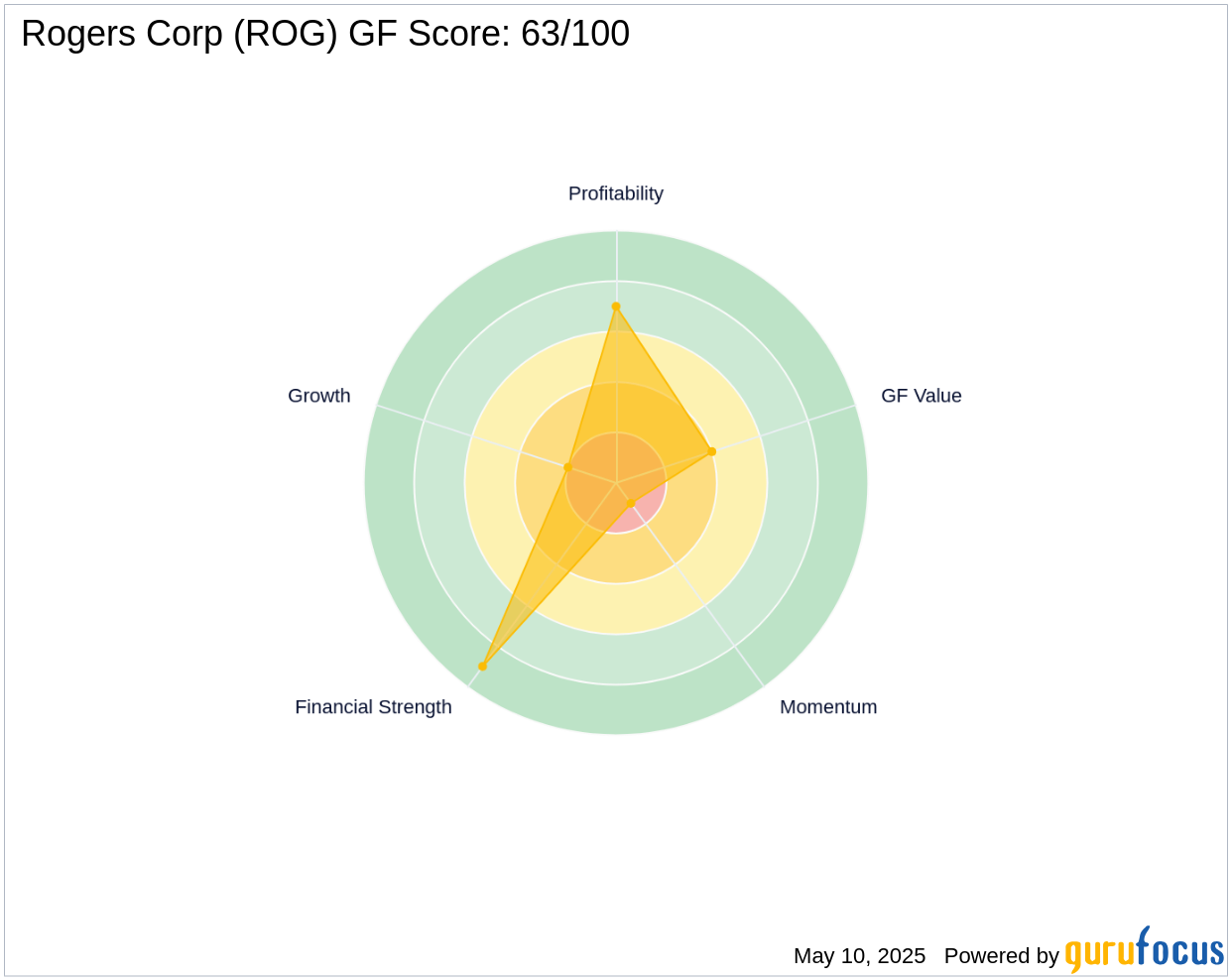

Rogers Corp's financial metrics reveal a [PE percentage](https://www.gurufocus.com/term/pe/ROG) of 72.51 and a [GF Score](https://www.gurufocus.com/term/gf-score/ROG) of 63/100, indicating areas of both strength and concern. The company's [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/ROG) is 7/10, while its [Growth Rank](https://www.gurufocus.com/term/rank-growth/ROG) is 2/10, highlighting challenges in growth. The [Balance Sheet Rank](https://www.gurufocus.com/term/rank-balancesheet/ROG) is strong at 9/10, suggesting solid financial strength. However, the [Operating Margin](https://www.gurufocus.com/term/operating-margin/ROG) growth has declined by 14.00%, and the [Piotroski F-Score](https://www.gurufocus.com/term/fscore/ROG) is 4, indicating potential financial distress.

Market Performance and Future Outlook

Rogers Corp has experienced a year-to-date price change of -33.29%, yet the stock has gained 6.75% since the transaction. The company's future potential is underscored by its [GF Valuation](https://www.gurufocus.com/term/gf-value/ROG), which suggests significant undervaluation. Despite recent challenges, Rogers Corp's position in the hardware industry and its strategic business segments offer potential for recovery and growth.

Other Notable Investors in Rogers Corp

In addition to NEUBERGER BERMAN GROUP LLC (Trades, Portfolio), other prominent investors hold shares in Rogers Corp. Notably, Joel Greenblatt (Trades, Portfolio) is among the gurus with a stake in the company. GAMCO Investors is identified as the largest holder of Rogers Corp shares among gurus, reflecting continued interest and confidence in the company's long-term prospects.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.