Summary:

- Microchip Technology (MCHP, Financial) receives a strategic upgrade from BofA due to noteworthy earnings.

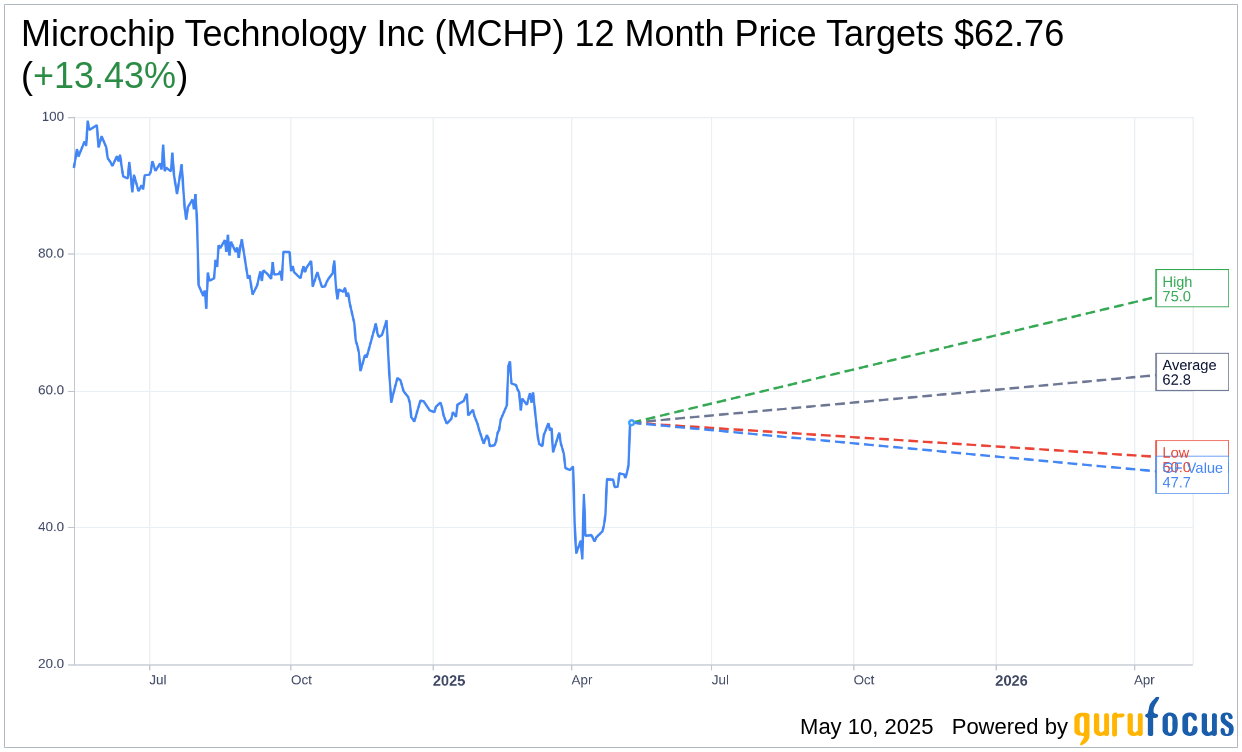

- Analysts project a 13.43% upside with an average price target of $62.76.

- GF Value metric suggests a potential downside of 13.74% from the current price.

Microchip Technology (MCHP) has been in the spotlight following a noteworthy upgrade by BofA, shifting from an Underperform to a Neutral rating. This change comes on the heels of an impressive quarterly earnings report. BofA has also adjusted its price target to $56, reflecting optimism around the company's potential earnings growth and a revival in sales under the leadership of CEO Steve Sanghi.

Wall Street Analysts Forecast

In the realm of analyst projections, Microchip Technology Inc (MCHP, Financial) is holding a one-year average price target of $62.76, derived from insights by 21 analysts. The projections range from a high of $75.00 to a low of $50.00, indicating a robust interest in the stock's potential. This average target suggests a promising upside of 13.43% from the current trading price of $55.33. Extensive data on these forecasts can be explored further on the Microchip Technology Inc (MCHP) Forecast page.

The consensus from 24 brokerage firms currently rates Microchip Technology Inc (MCHP, Financial) at 2.1 on the brokerage recommendation scale, signifying an "Outperform" status. Ratings range from 1 to 5, with 1 representing a Strong Buy and 5 indicating a Sell recommendation.

Turning to GuruFocus estimates, the estimated GF Value for Microchip Technology Inc (MCHP, Financial) in the upcoming year is pegged at $47.73. This suggests a potential downside of 13.74% from its present price of $55.33. The GF Value is a calculated estimate of what the stock's fair value should be, taking into account historical trading multiples and the business's past and projected performance. For a deeper dive into this data, visit the Microchip Technology Inc (MCHP) Summary page.