Summary:

- Palantir Technologies (PLTR, Financial) has revised its full-year revenue forecast upwards, reflecting strong performance.

- Analysts provide mixed price targets, with an average indicating a potential downside from current levels.

- GuruFocus' GF Value estimate suggests the stock might be overvalued at current prices.

Palantir Technologies (PLTR) has recently delighted investors by exceeding earnings expectations and updating its full-year revenue forecast to an impressive range of $3.89 billion to $3.9 billion. This boosts from the former projection of $3.74 billion to $3.76 billion, and importantly, it surpasses analysts' predictions, which were set at $3.75 billion.

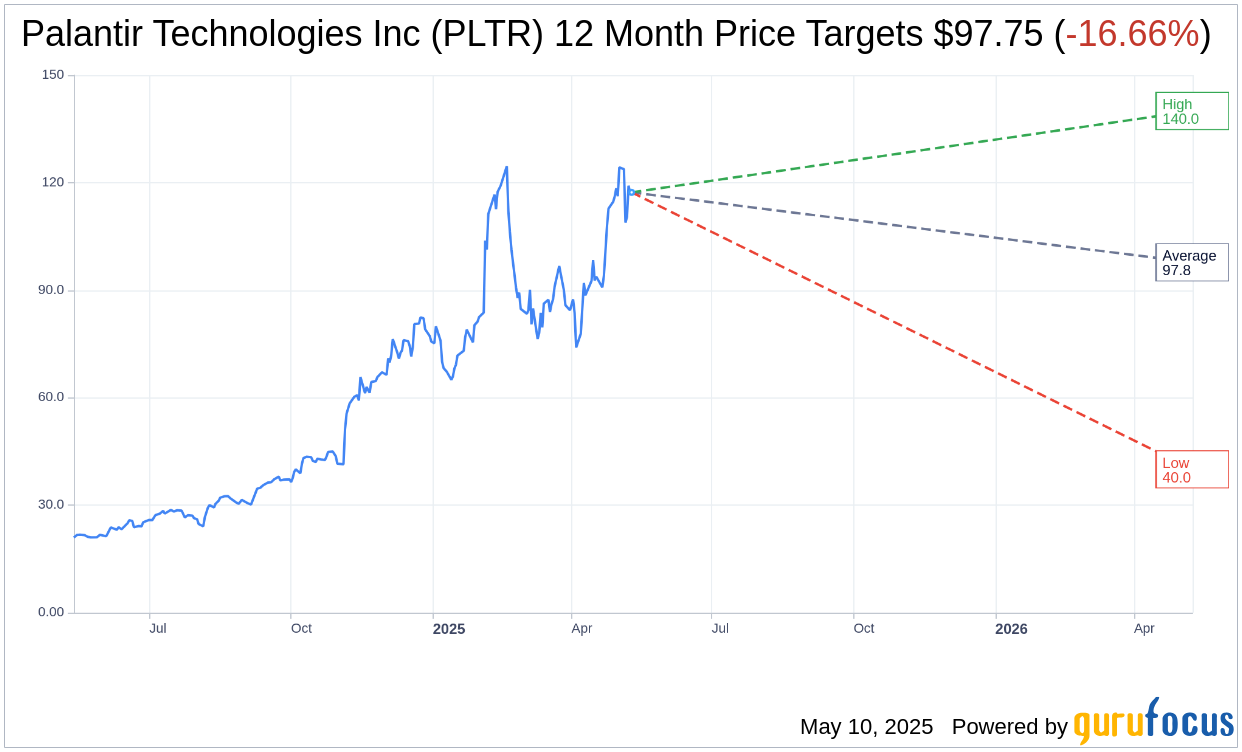

Wall Street Analysts Forecast

According to insights from 20 analysts over the next year, Palantir Technologies Inc (PLTR, Financial) has an average target price of $97.75. While some forecasts reach as high as $140.00, others are more conservative, with the lowest estimates at $40.00. This average target suggests a potential decline of 16.66% from the stock's current trading price of $117.30. For more in-depth analysis, visit the Palantir Technologies Inc (PLTR) Forecast page.

The consensus from 24 brokerage firms offers a "Hold" rating for Palantir with an average recommendation score of 2.9 on a scale where 1 represents a Strong Buy and 5 indicates a Sell.

Assessing GF Value Estimates

From GuruFocus' analytical perspective, the projected GF Value for Palantir Technologies Inc (PLTR, Financial) after one year is estimated at $27.94. This figure denotes a potential decline of 76.18% from the current price of $117.3, highlighting a significant concern about overvaluation. The GF Value is derived from historical trading multiples, past growth trends, and future business performance estimates. Detailed information is available on the Palantir Technologies Inc (PLTR) Summary page.