On May 8, 2025, Sutro Biopharma Inc (STRO, Financial) released its 8-K filing detailing the financial results for the first quarter of 2025. Sutro Biopharma Inc is a clinical-stage drug discovery, development, and manufacturing company focused on biopharmaceutical products, particularly next-generation protein therapeutics for cancer and autoimmune disorders. The company leverages its proprietary XpressCF platform to develop products like STRO-001 and STRO-002, targeting multiple myeloma, non-Hodgkin lymphoma, ovarian, and endometrial cancers.

Performance Overview and Strategic Shifts

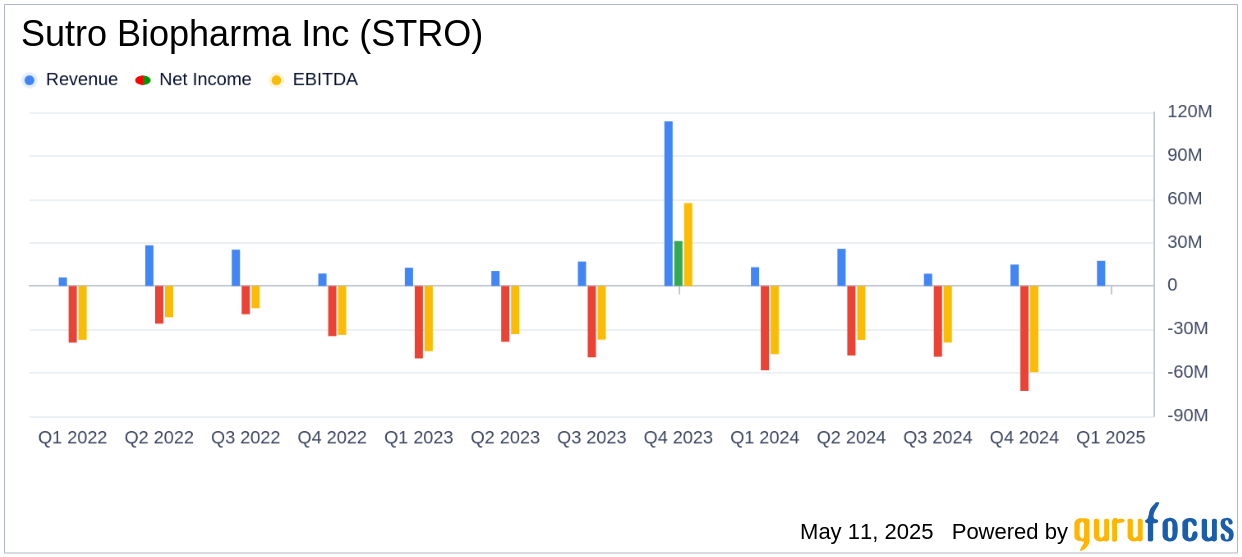

Sutro Biopharma Inc reported a revenue of $17.4 million for Q1 2025, exceeding the analyst estimate of $11.61 million. However, the company's earnings per share (EPS) was -$0.91, falling short of the estimated -$0.71. This discrepancy highlights the ongoing challenges in managing operational costs and restructuring expenses.

The company has strategically shifted its focus from luvelta to its pipeline of wholly-owned novel exatecan and dual-payload ADCs, prioritizing STRO-004 as its lead clinical candidate. This decision is supported by promising preclinical data, indicating potential best-in-class efficacy.

Financial Achievements and Industry Implications

Sutro Biopharma Inc's revenue growth is primarily attributed to its collaboration with Astellas, which underscores the importance of strategic partnerships in the biotechnology industry. The company's cash, cash equivalents, and marketable securities totaled $249.0 million as of March 31, 2025, providing a cash runway into early 2027, excluding additional anticipated milestones.

Key Financial Metrics and Analysis

The income statement reveals total operating expenses of $85.9 million, with research and development (R&D) expenses at $51.6 million and general and administrative (G&A) expenses at $13.3 million. Restructuring costs amounted to $21.0 million, reflecting the company's strategic realignment efforts.

The balance sheet shows total assets of $321.4 million and total liabilities of $347.2 million, resulting in a stockholders' deficit of $25.8 million. This financial position highlights the challenges of managing liabilities while investing in innovative drug development.

| Financial Metric | Q1 2025 | Q1 2024 |

|---|---|---|

| Revenue | $17.4 million | $13.0 million |

| Net Loss | $(75.97) million | $(58.21) million |

| EPS | $(0.91) | $(0.95) |

Commentary and Future Prospects

“In the first quarter, we announced a strategic decision to shift Sutro’s product candidate focus from luvelta to our pipeline of wholly-owned novel exatecan and dual-payload ADCs. As part of this review, we selected STRO-004—a next-generation Tissue Factor-targeting exatecan/Topo 1 ADC—as our lead clinical candidate, supported by strong preclinical data that point to its best-in-class potential,” said Jane Chung, Sutro’s Chief Executive Officer.

Sutro Biopharma Inc's strategic focus on next-generation ADCs and its robust pipeline, supported by its XpressCF platform, position the company to address complex, hard-to-drug targets. The anticipated filing of three new INDs over the next three years, starting with STRO-004, reflects the company's commitment to advancing innovative cancer therapeutics.

Explore the complete 8-K earnings release (here) from Sutro Biopharma Inc for further details.