Key Highlights:

- OpenAI and Microsoft are renegotiating their partnership terms, potentially influencing an OpenAI IPO.

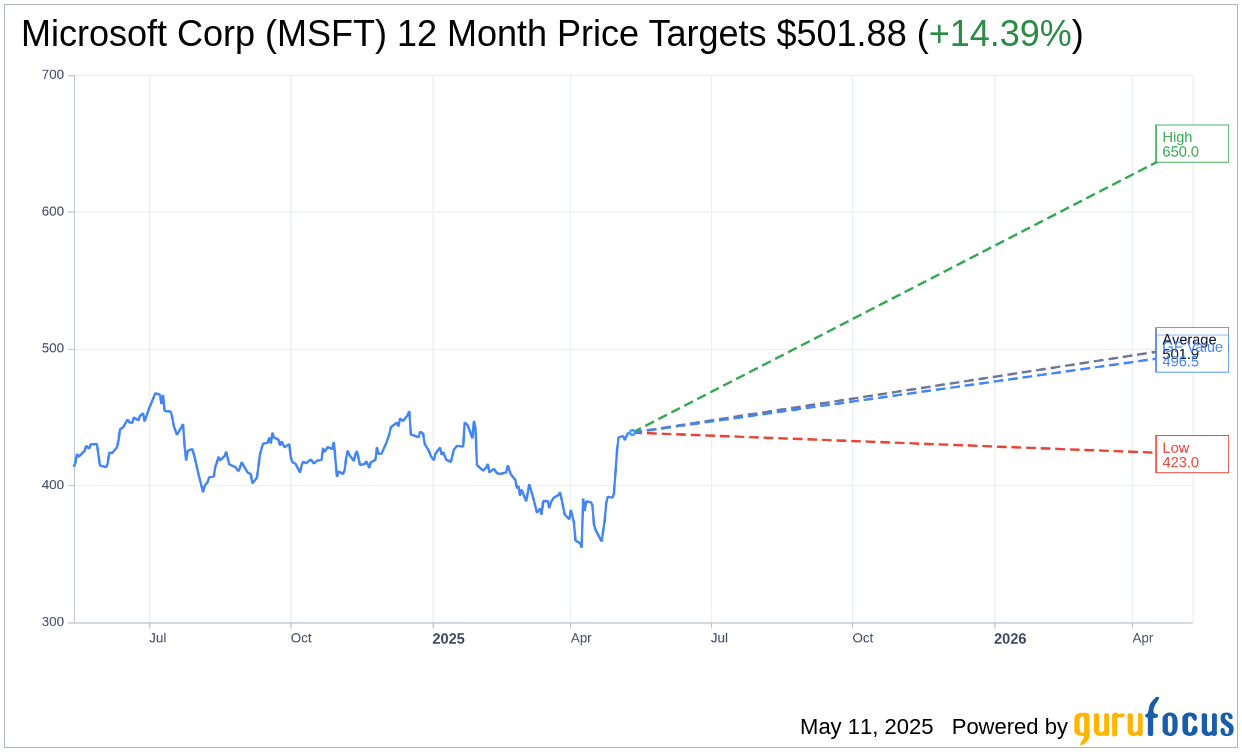

- Microsoft's (MSFT, Financial) stock shows a potential upside of 14.39% according to analysts' price targets.

- GuruFocus estimates suggest a 13.16% upside for Microsoft's stock based on GF Value.

OpenAI and Microsoft (MSFT) are currently re-evaluating their partnership and contractual agreements. This renegotiation is particularly significant as it involves Microsoft's substantial $13 billion investment and could impact their equity position in OpenAI's for-profit division. The existing contract remains effective until 2030, but potential changes might pave the way for OpenAI's anticipated initial public offering.

Wall Street Analysts' Forecast

According to a collection of one-year price targets from 49 analysts, Microsoft Corp (MSFT, Financial) boasts an average target price of $501.88. The projections range from a high of $650.00 to a low of $423.00, indicating an attractive potential upside of 14.39% from its current trading price of $438.73. For further information and detailed data, visit the Microsoft Corp (MSFT) Forecast page.

Additionally, consensus recommendations from 63 brokerage firms denote that Microsoft Corp (MSFT, Financial) maintains an average rating of 1.8, suggesting an "Outperform" status. This rating is part of a scale from 1 to 5, where 1 corresponds to a Strong Buy and 5 indicates a Sell.

GF Value and Investment Evaluation

GuruFocus's estimates indicate that the GF Value for Microsoft Corp (MSFT, Financial) within the next year stands at $496.47. This suggests a potential upside of 13.16% from the current price of $438.73. The GF Value represents GuruFocus's assessment of the fair trading value of the stock, calculated based on historical trading multiples, past business growth, and future business performance predictions. Investors seeking more comprehensive data should visit the Microsoft Corp (MSFT) Summary page.