Madrigal Pharmaceuticals (MDGL, Financial) has announced promising two-year results from the Phase 3 MAESTRO-NAFLD-1 trial of their drug, Rezdiffra, aimed at addressing compensated MASH cirrhosis. Participants in this open-label study exhibited notable improvements across key liver health indicators, including liver stiffness, liver fat, fibrosis biomarkers, liver volume, and CSPH risk scores—a measure of clinically significant portal hypertension.

Data showed that 65% of patients with baseline CSPH moved to lower risk categories by the end of the study. Additionally, among those with probable CSPH at the start, 57% transitioned to no/low CSPH risk, while only 14% progressed to CSPH over two years. The reduction in CSPH risk was statistically significant compared to initial levels. Furthermore, applying the modified Baveno criteria, which includes magnetic resonance elastography and the Enhanced Liver Fibrosis test, confirmed these risk category shifts.

Safety outcomes aligned with earlier research, showing that Rezdiffra maintains a favorable safety profile with few patients discontinuing because of adverse effects. Common side effects included diarrhea, COVID-19, and nausea, with two unrelated deaths reported. Overall, Rezdiffra was well-tolerated throughout the study duration.

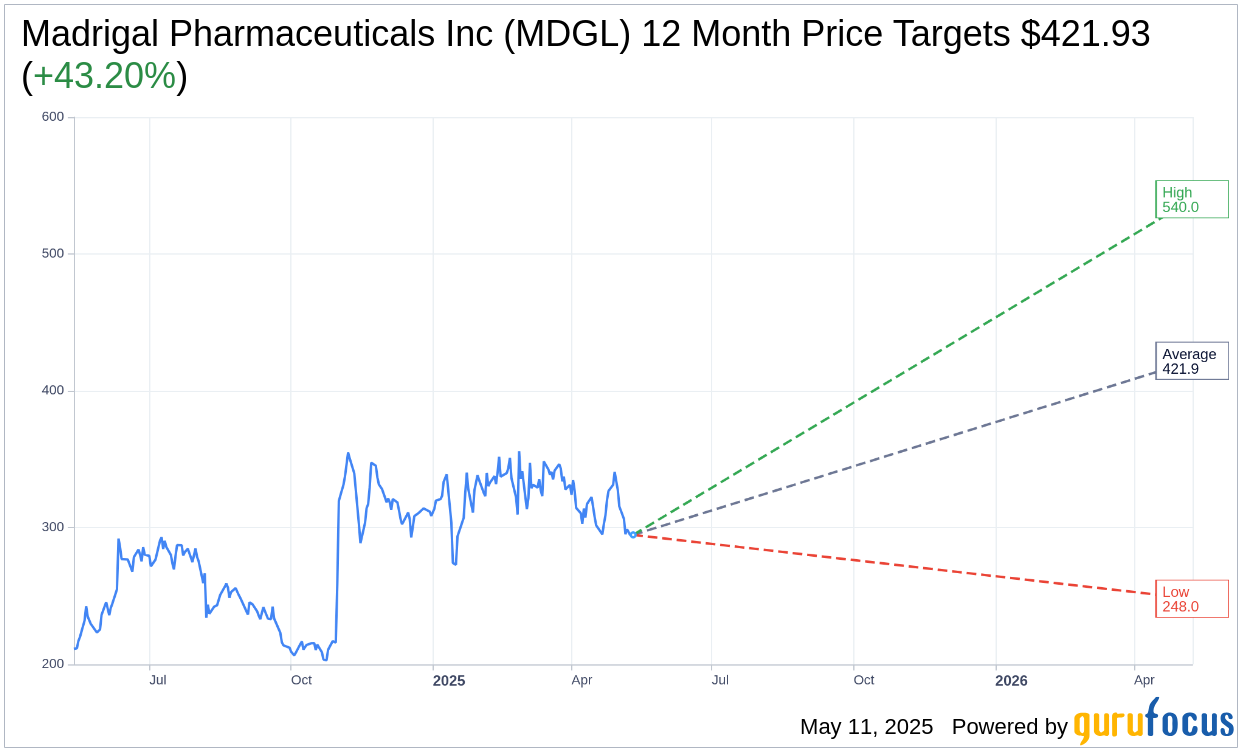

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for Madrigal Pharmaceuticals Inc (MDGL, Financial) is $421.93 with a high estimate of $540.00 and a low estimate of $248.00. The average target implies an upside of 43.20% from the current price of $294.64. More detailed estimate data can be found on the Madrigal Pharmaceuticals Inc (MDGL) Forecast page.

Based on the consensus recommendation from 16 brokerage firms, Madrigal Pharmaceuticals Inc's (MDGL, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

MDGL Key Business Developments

Release Date: May 01, 2025

- Net Sales: $137.3 million in Q1 2025, up 33% from Q4 2024.

- Patient Growth: Over 17,000 patients on Rezdiffra by end of Q1 2025, up from 11,800 in Q4 2024.

- Prescriber Penetration: 70% of 6,000 top target prescribers have prescribed Rezdiffra.

- R&D Expenses: $44.2 million in Q1 2025, down from $71.2 million in Q1 2024.

- SG&A Expenses: $167.9 million in Q1 2025, up from $80.8 million in Q1 2024.

- Cash Position: $848.1 million in cash, cash equivalents, restricted cash, and marketable securities at the end of Q1 2025.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Madrigal Pharmaceuticals Inc (MDGL, Financial) reported strong first quarter 2025 net sales of $137 million, up 33% quarter over quarter.

- Rezdiffra, the first FDA-approved treatment for MASH, achieved over 80% commercial payer coverage and treated more than 17,000 patients in its first year.

- The company has successfully built a strong base of prescribers, with 70% of their top 6,000 targets having prescribed Rezdiffra.

- Madrigal Pharmaceuticals Inc (MDGL) is expanding its leadership in MASH with compelling two-year F4c data and ongoing pivotal outcomes trials.

- The company is well-positioned financially, ending the first quarter with $848.1 million in cash and marketable securities, supporting ongoing and future launches.

Negative Points

- SG&A expenses increased significantly to $167.9 million in Q1 2025, up from $80.8 million in Q1 2024, primarily due to commercial launch activities.

- The company anticipates gross-to-net discounts to increase throughout 2025 as they begin contracting with payers.

- There is uncertainty regarding the impact of potential competition from semaglutide (SEMA) once it gains label expansion for NASH.

- The European launch of Rezdiffra faces challenges, including responding to regulatory questions and potential differences in non-invasive testing acceptance compared to the FDA.

- Madrigal Pharmaceuticals Inc (MDGL) is actively seeking business development opportunities, which may impact cash flow and require careful financial management.