Goldman Sachs has elevated its rating for AB InBev (BUD, Financial) from Neutral to Buy, setting a new price target of $88, up from a previous $70.10. Analysts suggest that the company could regain its "best-in-class" status due to its strong presence in emerging markets. The firm predicts a 1.2% increase in volume, attributed to a stabilizing U.S. market and recovery in China. This is expected to drive a 4.5% growth in organic sales over the medium term, supported by a robust brand lineup spearheaded by Corona. Additionally, Goldman Sachs anticipates that AB InBev will achieve a 7% growth in organic EBITDA, approaching the higher end of its projected 4% to 8% range.

Wall Street Analysts Forecast

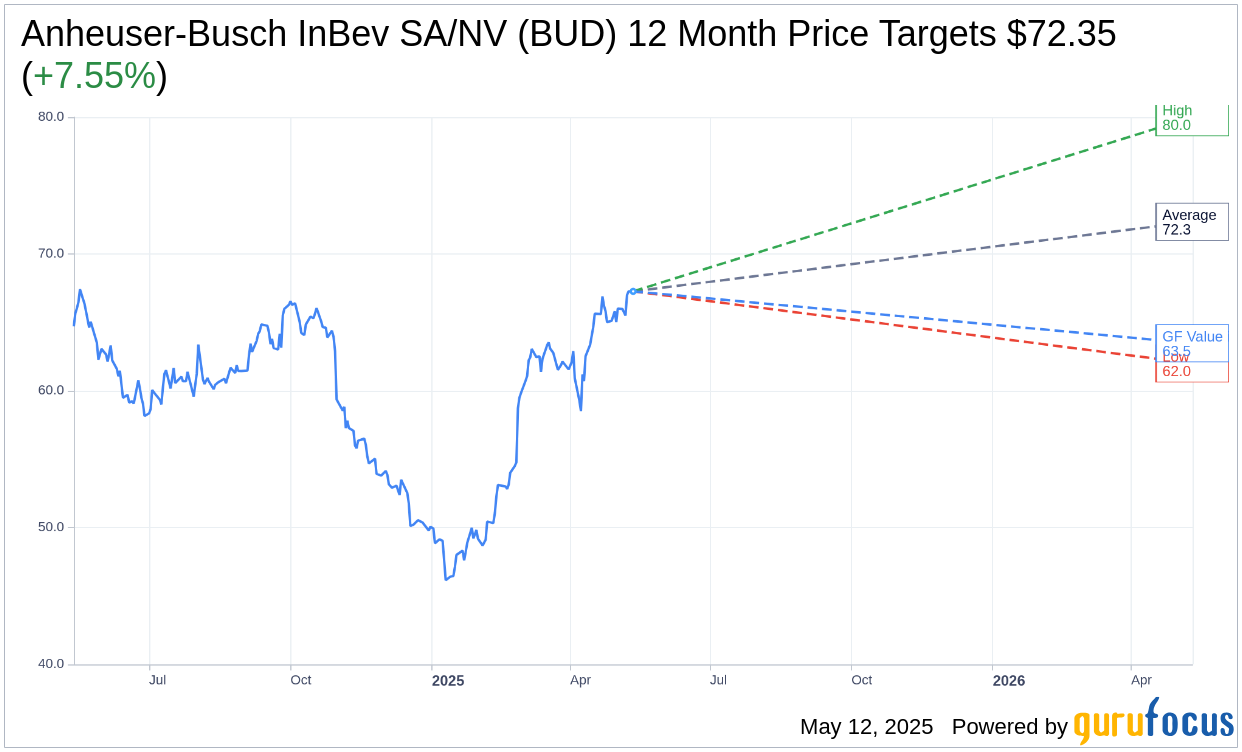

Based on the one-year price targets offered by 6 analysts, the average target price for Anheuser-Busch InBev SA/NV (BUD, Financial) is $72.35 with a high estimate of $80.00 and a low estimate of $62.00. The average target implies an upside of 7.55% from the current price of $67.27. More detailed estimate data can be found on the Anheuser-Busch InBev SA/NV (BUD) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Anheuser-Busch InBev SA/NV's (BUD, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Anheuser-Busch InBev SA/NV (BUD, Financial) in one year is $63.47, suggesting a downside of 5.65% from the current price of $67.27. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Anheuser-Busch InBev SA/NV (BUD) Summary page.

BUD Key Business Developments

Release Date: May 08, 2025

- EBITDA Growth: Increased by 7.9% with continued margin expansion.

- No-Alcohol Beer Revenue: Increased by 34% globally.

- GMV Increase: Grew by 53% to reach USD 645 million.

- Underlying EPS: Increased by 7% in US dollars and 20% in constant currency.

- Volume Decline: Decreased by 2.2% due to calendar-related factors.

- Revenue Growth: Increased by 1.5% with a revenue per liter increase of 3.7%.

- EBITDA Margin Improvement: Improved by 218 basis points.

- Corona Revenue Growth: Increased by 11.2% outside of Mexico.

- BEES GMV: Captured $11.6 billion, a 10% increase.

- Digital Platform Revenue: Increased by 12% to reach $117 million.

- Underlying EPS: $0.81 per share, a 7.1% increase in US dollars.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Anheuser-Busch InBev SA/NV (BUD, Financial) reported a 7.9% growth in EBITDA, reaching the top end of their outlook range with continued margin expansion.

- The no-alcohol beer portfolio outperformed globally, increasing revenues by 34%, led by the triple-digit growth of Corona Cero.

- The company's digital marketplace, BEES, captured $11.6 billion in GMV, a 10% increase versus last year, with 32 million orders transacted.

- In the US, Anheuser-Busch InBev SA/NV (BUD) gained volume market share in both the beer industry and spirits-based ready-to-drink category.

- The company achieved double-digit bottom-line growth in Middle Americas, South America, Africa, and Europe, driven by premiumization and margin recovery.

Negative Points

- Overall volume performance was impacted by calendar-related factors, resulting in a volume decline of 2.2%.

- Adverse weather and the later timing of Easter negatively impacted the overall industry performance in the first quarter.

- In China, Anheuser-Busch InBev SA/NV (BUD) underperformed due to softness in key regions and the on-trade channel.

- The company faces ongoing macroeconomic challenges in markets like Argentina, impacting consumer purchasing power.

- Despite strong brands, the shift to off-trade in China requires adjustments in sales force and market execution.