Citi has elevated its price target for Emerson (EMR, Financial) from $127 to $133 while maintaining its Buy recommendation. The firm believes that Emerson's earnings performance could surpass investor expectations due to the company's robust profitability and substantial opportunities for self-improvement. Citi's analysts suggest that the recent negative revaluation of the stock has been overdone, especially considering Emerson's advantageous position to benefit from long-term growth trends and high-quality earnings. Despite broader concerns, Emerson continues to be one of Citi's preferred investment choices.

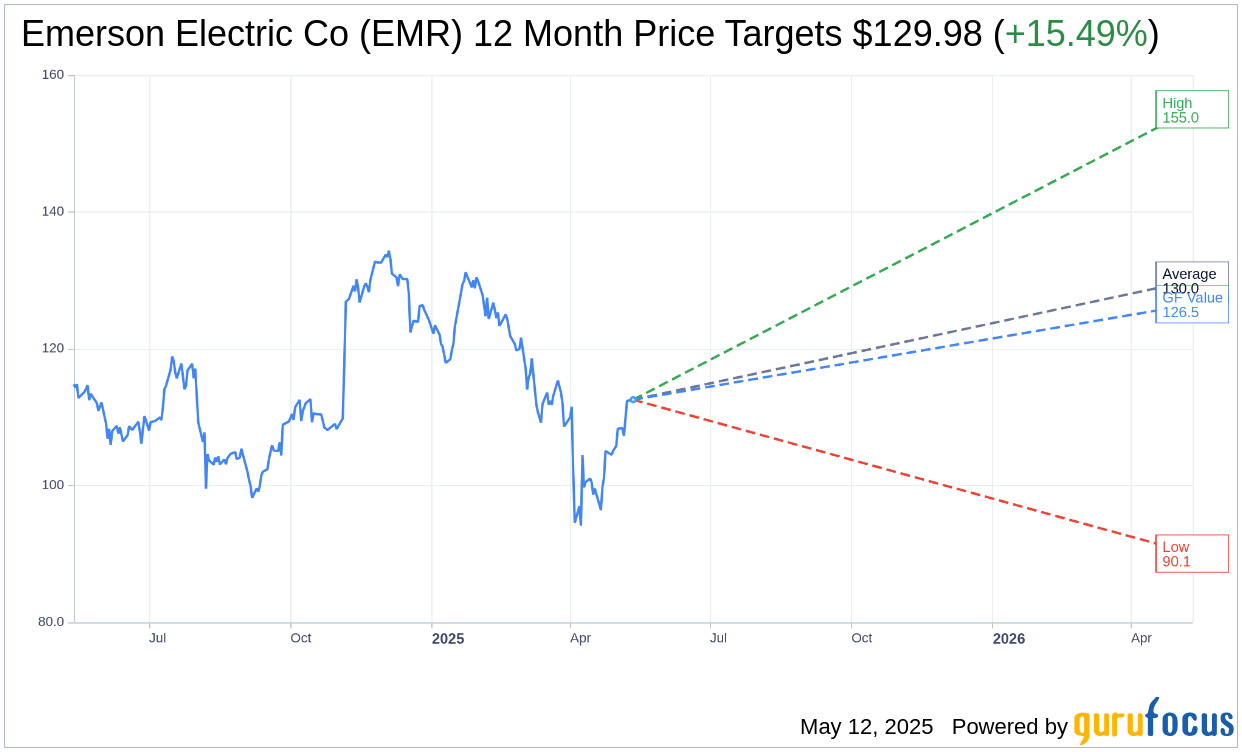

Wall Street Analysts Forecast

Based on the one-year price targets offered by 26 analysts, the average target price for Emerson Electric Co (EMR, Financial) is $129.98 with a high estimate of $155.00 and a low estimate of $90.06. The average target implies an upside of 15.49% from the current price of $112.55. More detailed estimate data can be found on the Emerson Electric Co (EMR) Forecast page.

Based on the consensus recommendation from 30 brokerage firms, Emerson Electric Co's (EMR, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Emerson Electric Co (EMR, Financial) in one year is $126.49, suggesting a upside of 12.39% from the current price of $112.55. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Emerson Electric Co (EMR) Summary page.

EMR Key Business Developments

Release Date: May 07, 2025

- Underlying Orders Growth: 4% growth, exceeding expectations.

- Process and Hybrid Businesses Growth: Up 6%.

- Discrete Businesses Growth: Turned positive with Test and Measurement up 8%.

- Adjusted Earnings Per Share (EPS): Exceeded guidance by $0.06, reaching $1.48, up 9% year-over-year.

- Gross Profit Margin: 53.5%, a 130 basis point improvement year-over-year.

- Adjusted Segment EBITDA Margin: 28%, a 200 basis point improvement versus the prior year.

- Free Cash Flow: $738 million, a margin of 17%, up 14% year-over-year.

- Backlog: Increased to $7.5 billion with a book to bill ratio of 1.04.

- Guidance for Adjusted EPS: Raised to $5.90 to $6.05 per share.

- Free Cash Flow Guidance: $3.1 billion to $3.2 billion.

- Shareholder Returns: Expecting to return $2.3 billion through dividends and share repurchase.

- Tariff Impact Mitigation: Gross exposure of $245 million in 2025 expected to be fully mitigated.

- Industrial Software Annual Contract Value (ACV): Up 11% year-over-year.

- Software and Control Growth: 7% driven by higher software sales.

- Intelligent Devices Performance: Flat due to safety and productivity and discrete automation.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Emerson Electric Co (EMR, Financial) delivered strong second-quarter results with underlying orders growth of 4%, exceeding expectations.

- The company reported record margin performance, with gross profit margin improving by 130 basis points year-over-year.

- Adjusted earnings per share exceeded guidance by $0.06, reflecting strong operational performance.

- Emerson Electric Co (EMR) completed the buy-in of AspenTech, which is expected to be modestly accretive to adjusted EPS in 2025.

- The company is confident in its plans for the year, raising the midpoint of its adjusted EPS guidance to between $5.90 and $6.05 per share.

Negative Points

- Emerson Electric Co (EMR) is operating in a period of unusual volatility, which poses risks to its business outlook.

- The company faces a gross exposure of $245 million in 2025 due to tariffs, although it expects to fully mitigate this impact.

- There is a muted recovery expected in factory automation, with continued declines in the automotive sector.

- The company noted pockets of reduced demand outlook, including muted expectations in China and weakened demand in safety and productivity.

- Emerson Electric Co (EMR) expects the second half of the year to have lower profitability due to the effect of tariffs and segment mix.