Citi has increased its price target for Cummins (CMI, Financial) from $320 to $350, maintaining a Buy rating on the shares. This update follows the company’s first-quarter report, where the firm remains optimistic about Cummins' earnings trajectory. Citi expects double-digit earnings growth in 2026 and 2027, spurred by market recovery and margin improvements in key areas. Moreover, the ongoing robust performance of its Power Systems segment is a positive sign. The firm is also confident in Cummins' capacity to effectively manage tariff impacts over the upcoming 6 to 12 months.

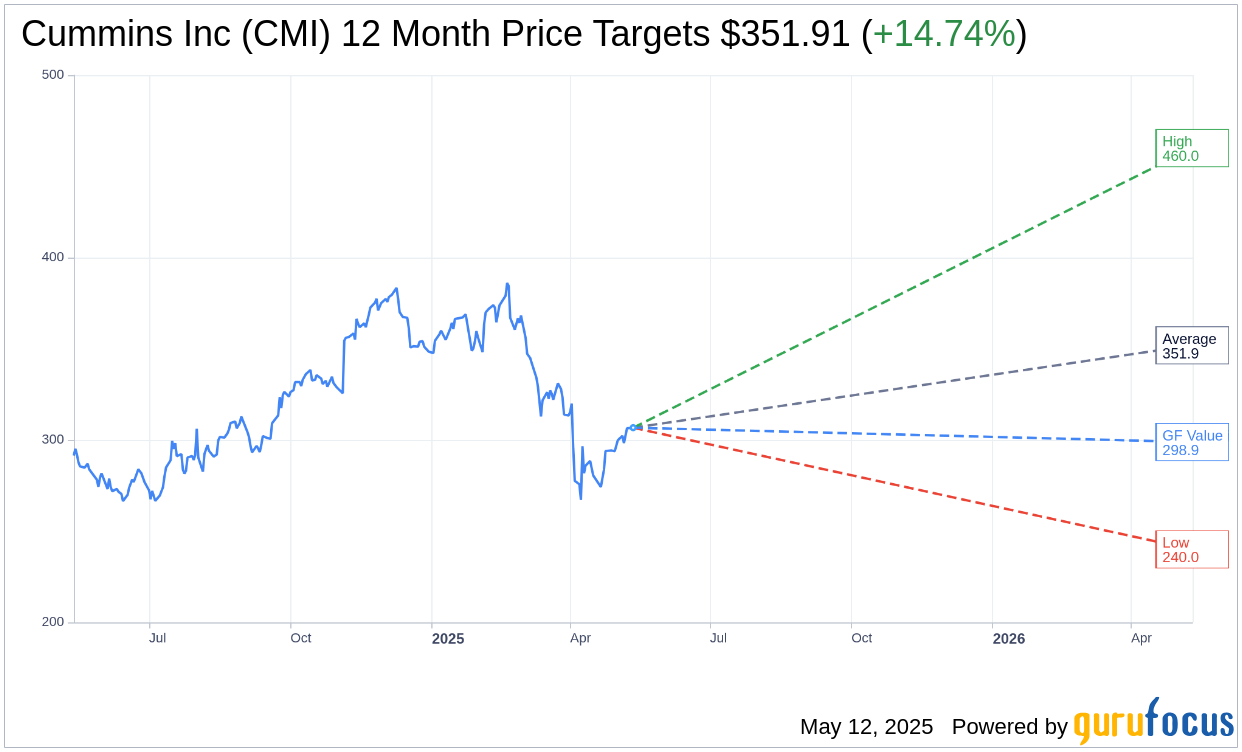

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Cummins Inc (CMI, Financial) is $351.91 with a high estimate of $460.00 and a low estimate of $240.00. The average target implies an upside of 14.74% from the current price of $306.71. More detailed estimate data can be found on the Cummins Inc (CMI) Forecast page.

Based on the consensus recommendation from 24 brokerage firms, Cummins Inc's (CMI, Financial) average brokerage recommendation is currently 2.5, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Cummins Inc (CMI, Financial) in one year is $298.90, suggesting a downside of 2.55% from the current price of $306.71. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Cummins Inc (CMI) Summary page.

CMI Key Business Developments

Release Date: May 05, 2025

- Revenue: $8.2 billion, a decrease of 3% compared to Q1 2024.

- EBITDA: $1.5 billion or 17.9% of sales, compared to $2.6 billion or 30.6% a year ago.

- North America Revenue: Decreased by 1% compared to 2024.

- International Revenue: Decreased by 5% compared to Q1 2024.

- China Revenue: $1.8 billion, an increase of 9%.

- India Revenue: $725 million, a decrease of 14% from Q1 2024.

- Gross Margin: $2.2 billion or 26.4% of sales, up from 24.5% last year.

- Net Earnings: $824 million or $5.96 per diluted share.

- Operating Cash Flow: Outflow of $3 million compared to an inflow of $276 million a year ago.

- Engine Segment Revenue: $2.8 billion, a decrease of 5% from a year ago.

- Power Systems Segment Revenue: $1.6 billion, an increase of 19%.

- Distribution Segment Revenue: Increased 15% to $2.9 billion.

- Component Segment Revenue: $2.7 billion, a decrease of 20%.

- Accelerator Revenue: Increased 11% to $103 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Cummins Inc (CMI, Financial) delivered strong results in the first quarter, led by record performance in the power systems segment.

- The company introduced the X10 engine, replacing the L9 and X12 platforms, offering improved performance, durability, and efficiency.

- Cummins Inc (CMI) announced the acquisition of First Mode's assets, enhancing its retrofit hybrid solutions for mining and rail operations.

- The company reported a 68% increase in sales of power generation equipment in China, driven by accelerating data center demand.

- Cummins Inc (CMI) achieved a gross margin improvement, driven by favorable pricing, higher aftermarket, and operational improvements.

Negative Points

- Revenues for the first quarter were $8.2 billion, a decrease of 3% compared to the first quarter of 2024.

- EBITDA was $1.5 billion or 17.9%, down from $2.6 billion or 30.6% a year ago, partly due to the absence of a one-time gain from the previous year.

- The company faces heightened uncertainty due to trade tariffs, impacting its ability to provide reliable forecasts for the year.

- North America truck market showed softening, with heavy-duty unit sales down 21% from 2024.

- International revenues decreased by 5% in the first quarter of 2025 compared to a year ago, with a notable decline in India.