Garmin (GRMN, Financial) has broadened its Navigation Database to now cover the South Pacific, specifically targeting regions such as Australia, New Zealand, and nearby nations. Before this expansion, the database was exclusive to aircraft owners and operators in the Americas and Europe. This enhancement provides customers in these newly included areas the opportunity to access the latest aviation navigation data through Garmin's avionics.

The database is compatible with a wide range of Garmin aviation products, including integrated flight decks, navigators, and flight displays, among others. Customers can now choose from a variety of cost-effective update options available for database updates, such as single updates, annual bundles, and OnePak subscriptions, which apply to all compatible avionics within an aircraft.

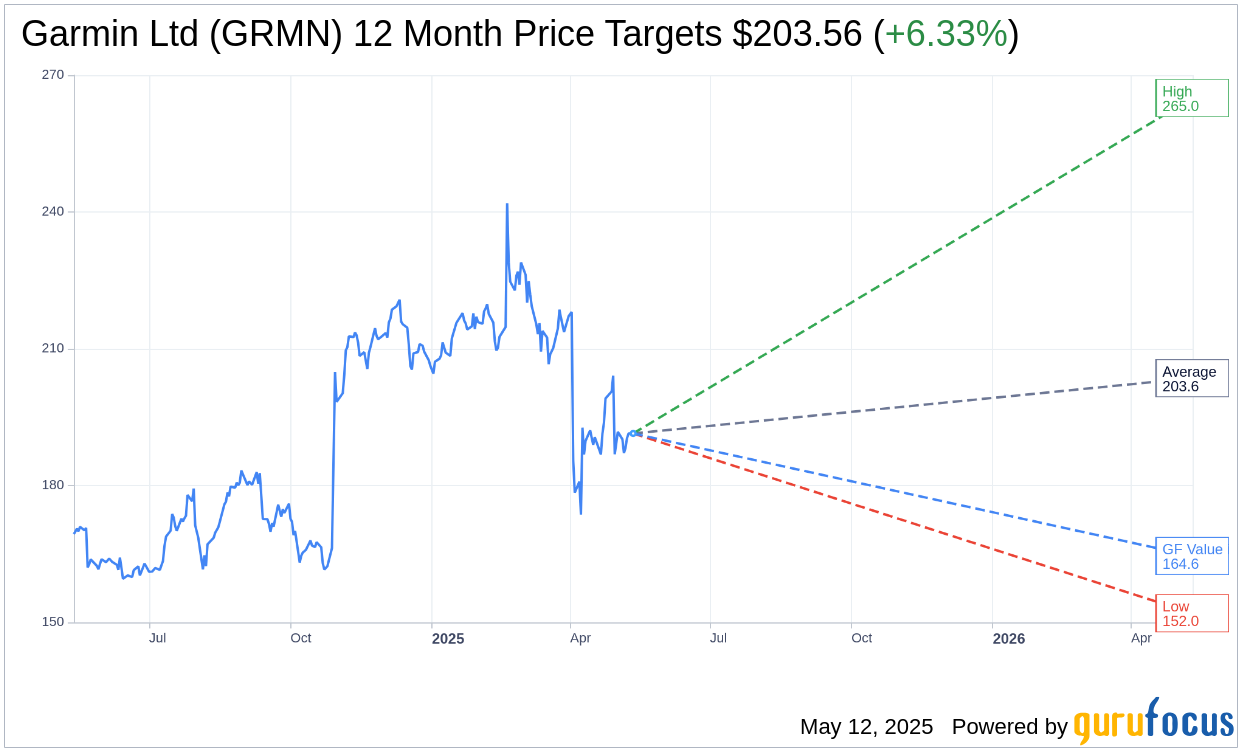

Wall Street Analysts Forecast

Based on the one-year price targets offered by 6 analysts, the average target price for Garmin Ltd (GRMN, Financial) is $203.56 with a high estimate of $265.00 and a low estimate of $152.00. The average target implies an upside of 6.33% from the current price of $191.43. More detailed estimate data can be found on the Garmin Ltd (GRMN) Forecast page.

Based on the consensus recommendation from 10 brokerage firms, Garmin Ltd's (GRMN, Financial) average brokerage recommendation is currently 3.0, indicating "Hold" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Garmin Ltd (GRMN, Financial) in one year is $164.56, suggesting a downside of 14.04% from the current price of $191.43. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Garmin Ltd (GRMN) Summary page.

GRMN Key Business Developments

Release Date: April 30, 2025

- Consolidated Revenue: Increased 11% to $1.54 billion, a new first quarter record.

- Gross Margin: 57.6%.

- Operating Margin: 21.7%.

- Operating Income: $333 million, up 12% year-over-year.

- Pro Forma EPS: $1.61, up 13% year-over-year.

- Fitness Segment Revenue: Increased 12% to $385 million.

- Outdoor Segment Revenue: Increased 20% to $438 million.

- Aviation Segment Revenue: Increased 3% to $223 million.

- Marine Segment Revenue: Decreased 2% to $319 million.

- Auto OEM Segment Revenue: Increased 31% to $169 million.

- Free Cash Flow: $381 million.

- Capital Expenditures: $40 million.

- Dividends Paid: Approximately $145 million.

- Share Repurchase: $27 million of company stock.

- Effective Tax Rate: 14.5%.

- Full Year Revenue Guidance: Estimated at approximately $6.85 billion.

- Full Year Gross Margin Guidance: Approximately 58.5%.

- Full Year Operating Margin Guidance: Approximately 24.8%.

- Full Year Pro Forma EPS Guidance: Approximately $7.80.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Garmin Ltd (GRMN, Financial) reported a record first quarter revenue of $1.54 billion, marking an 11% increase year-over-year.

- Three business segments achieved double-digit growth, with the auto OEM segment leading at 31%, followed by outdoor at 20%, and fitness at 12%.

- Gross and operating margins were strong at 57.6% and 21.7%, respectively, resulting in a record operating income of $333 million, up 12% year-over-year.

- The company launched several new products, including the Instinct 3 adventure watch series and the Force Pro trolling motor, enhancing its product portfolio.

- Garmin Ltd (GRMN) maintained its full-year pro forma EPS guidance at $7.80, despite potential tariff impacts, due to expected foreign exchange benefits and planned mitigations.

Negative Points

- The marine segment experienced a 2% revenue decline, attributed to the timing of promotions and continued market softness.

- The current global trade environment, particularly tariffs, poses a significant challenge, with an estimated $100 million gross impact on 2025 results.

- Approximately 25% of Garmin Ltd (GRMN)'s revenue is generated in the US from products manufactured outside the US, making it vulnerable to tariff changes.

- The company anticipates a modest reduction in demand due to the current trade environment and economic uncertainties.

- The auto OEM segment, despite strong growth in Q1, is expected to see moderated growth due to the anniversary of new model introductions and potential impacts from tariffs on carmakers.