Chuck E. Cheese has joined forces with Dippin’ Dots to introduce an exclusive ice cream flavor named Chuck E.’s Cookie Crunch. This unique flavor is available solely at Chuck E. Cheese locations across the United States. This collaboration represents the first instance where a Dippin’ Dots flavor carries the well-known character's name and becomes a permanent offering at the entertainment centers nationwide.

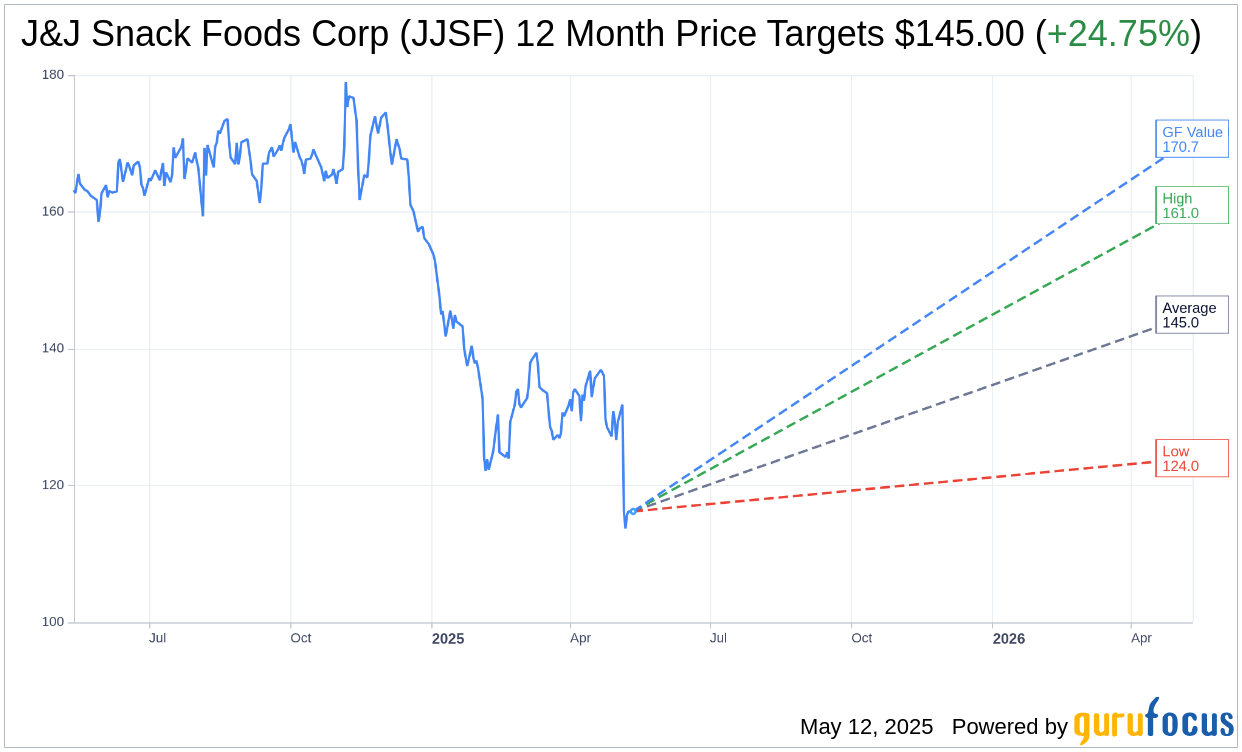

Wall Street Analysts Forecast

Based on the one-year price targets offered by 3 analysts, the average target price for J&J Snack Foods Corp (JJSF, Financial) is $145.00 with a high estimate of $161.00 and a low estimate of $124.00. The average target implies an upside of 24.75% from the current price of $116.23. More detailed estimate data can be found on the J&J Snack Foods Corp (JJSF) Forecast page.

Based on the consensus recommendation from 5 brokerage firms, J&J Snack Foods Corp's (JJSF, Financial) average brokerage recommendation is currently 2.2, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for J&J Snack Foods Corp (JJSF, Financial) in one year is $170.72, suggesting a upside of 46.88% from the current price of $116.23. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the J&J Snack Foods Corp (JJSF) Summary page.

JJSF Key Business Developments

Release Date: May 06, 2025

- Total Net Sales: Declined 1% to $356.1 million.

- Gross Margin: Declined by 320 basis points to 26.9%.

- Adjusted EBITDA: $26.2 million.

- Adjusted EPS: $0.35 per share.

- Frozen Beverage Sales: Decreased less than 1%.

- Food Service Sales: Decreased 1.7%.

- Retail Sales: Grew 1.8%.

- Cost of Goods Sold: Increased 3.5% to $260.4 million.

- Operating Expenses: $89.7 million, or 25.2% of sales.

- Net Earnings: $4.8 million, down from $13.3 million in the prior year quarter.

- Earnings Per Diluted Share: Fell to $0.25 from $0.69.

- Cash Position: $48.5 million with no long-term debt.

- Share Repurchase: Approximately 39,000 shares for $5 million at an average price of $128 per share.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Retail sales grew by 1.8% in the quarter, with frozen novelties showing a strong 14.7% growth, led by the Doxsters brand.

- The launch of Dippin' Dots Sundays reached $1 million in sales during the quarter, indicating successful product innovation.

- J&J Snack Foods Corp (JJSF, Financial) has increased Dippin' Dots theater presence by over 30% since the end of fiscal 2024.

- The company is optimistic about a strong summer lineup in theaters, which is expected to boost frozen beverage sales.

- J&J Snack Foods Corp (JJSF) is actively innovating its product portfolio to include more 'better for you' options, such as high-protein pretzels and frozen novelties with added health benefits.

Negative Points

- Total net sales for the fiscal second quarter declined by 1% to $356.1 million, primarily due to lower sales in frozen beverage and food service segments.

- Gross margin declined by 320 basis points to 26.9%, impacted by theater channel weakness and input cost inflation.

- The frozen beverage segment was negatively affected by foreign exchange headwinds and underperforming movie releases.

- Food service sales declined by 1.7%, with a significant impact from the loss of limited time offer churro volumes.

- The company experienced continued input cost inflation, particularly related to chocolate in the bakery business, which was not fully offset by price increases.