Key Takeaways:

- Perpetua Resources (PPTA, Financial) is making strategic moves with plans for a loan from the U.S. Export-Import Bank.

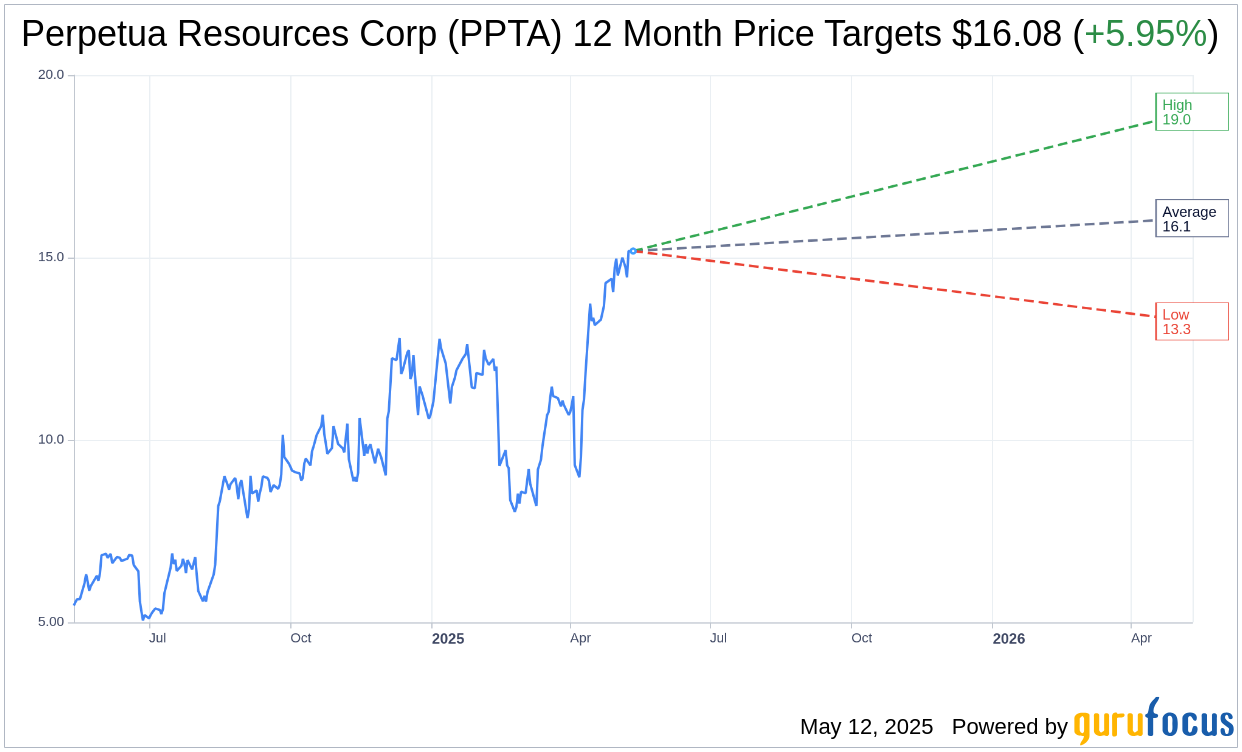

- Analysts anticipate potential upside, with a one-year average price target set at $16.08.

- The company holds an "Outperform" rating from brokerage firms, denoting positive market sentiment.

Financial Overview and Strategic Initiatives

Perpetua Resources (PPTA) reported a Q1 GAAP EPS of -$0.12, signaling current financial challenges yet highlighting its strategic position in the commodities market. As a leading U.S. antimony producer, Perpetua's Stibnite Gold project has garnered attention, having been prioritized by the Trump administration. In a bid to strengthen its financial foundation, the company is preparing to apply for a loan with the U.S. Export-Import Bank in the upcoming second quarter.

Wall Street Analysts' Forecasts and Recommendations

The future looks promising for Perpetua Resources, with analysts providing a bullish outlook. According to assessments by 3 financial analysts, the company's one-year average price target is set at $16.08, with predictions ranging from a low of $13.25 to a high of $19.00. This translates into a potential upside of 5.95% from the current share price of $15.18. Investors can access further detailed projections by visiting the Perpetua Resources Corp (PPTA, Financial) Forecast page.

Brokerage Firms' Recommendations

Perpetua Resources Corp (PPTA, Financial) currently enjoys a consensus brokerage recommendation of 2.0. This "Outperform" status is indicative of strong market performance expectations, as informed by the collective insights of 2 brokerage firms. The recommendation scale spans from 1 to 5, with 1 representing a Strong Buy, and 5 indicated a Sell, positioning PPTA as a favorable investment choice.