Zebra Technologies is showcasing its latest advancements in intelligent automation tailored for manufacturing and warehouse sectors. These new solutions are being unveiled at Booth 3207 during Automate 2025, taking place from May 12-15 at Huntington Place in Detroit.

The company aims to improve operational efficiency by offering tools that enhance data utilization, enabling manufacturers and warehouse managers to better address and prioritize challenges. These innovations are expected to elevate productivity and throughput significantly, transforming frontline operations.

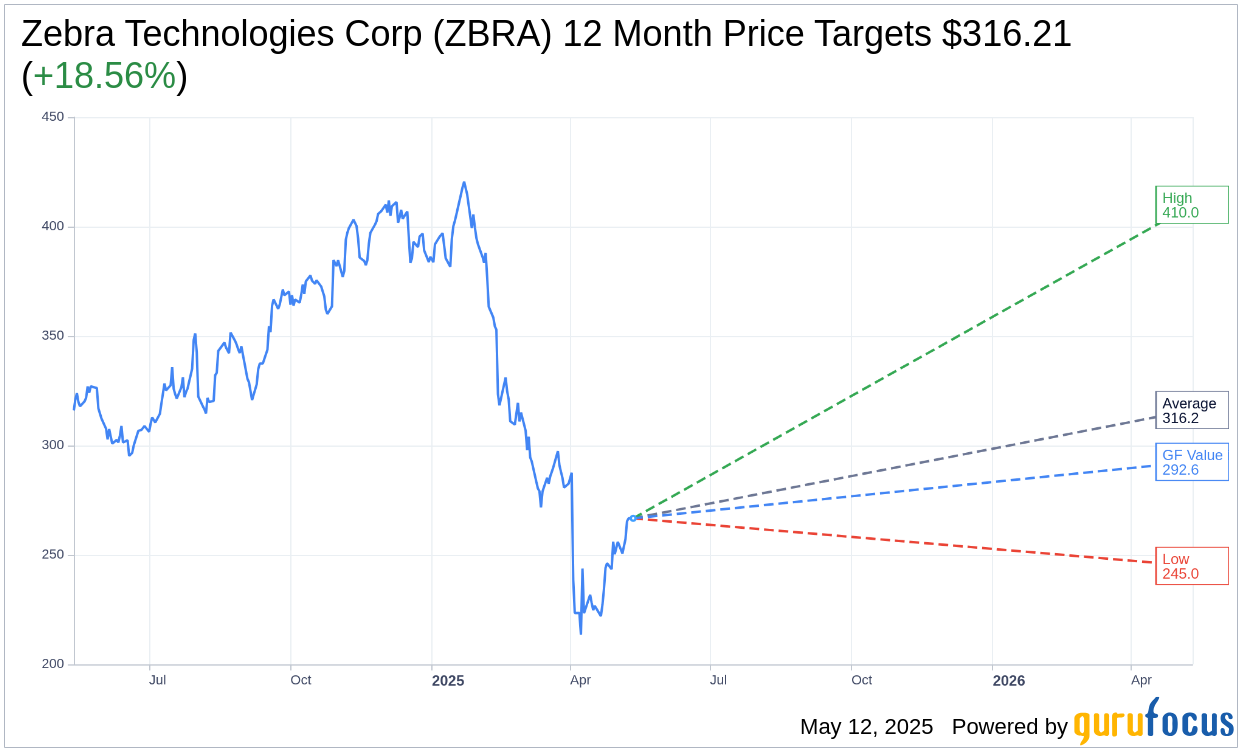

Wall Street Analysts Forecast

Based on the one-year price targets offered by 16 analysts, the average target price for Zebra Technologies Corp (ZBRA, Financial) is $316.21 with a high estimate of $410.00 and a low estimate of $245.00. The average target implies an upside of 18.56% from the current price of $266.71. More detailed estimate data can be found on the Zebra Technologies Corp (ZBRA) Forecast page.

Based on the consensus recommendation from 19 brokerage firms, Zebra Technologies Corp's (ZBRA, Financial) average brokerage recommendation is currently 2.3, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Zebra Technologies Corp (ZBRA, Financial) in one year is $292.55, suggesting a upside of 9.69% from the current price of $266.71. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Zebra Technologies Corp (ZBRA) Summary page.

ZBRA Key Business Developments

Release Date: April 29, 2025

- Revenue: Sales exceeded $1.3 billion, a 12% increase compared to the prior year.

- Adjusted EBITDA Margin: 22.3%, a 240 basis point increase from the previous year.

- Non-GAAP Diluted Earnings Per Share: $4.02, a 42% increase year-over-year.

- Gross Margin: Increased 150 basis points to 49.6%.

- Free Cash Flow: $158 million generated in the first quarter.

- Net Debt to Adjusted EBITDA Leverage Ratio: 1.2x at the end of Q1.

- Stock Repurchase: $125 million repurchased in Q1 and an additional $75 million in April.

- Asset Intelligence and Tracking Segment Sales: Increased 18%.

- Enterprise Visibility and Mobility Segment Sales: Grew 9%.

- Regional Sales Growth: North America 7%, EMEA 18%, Asia Pacific 13%, Latin America 18%.

- Tariff Impact: $70 million gross profit impact expected for the full year 2025.

- Full Year Sales Guidance: 3% to 7% growth, net neutral impact from FX and recent acquisitions.

- Full Year Free Cash Flow Expectation: At least $700 million.

For the complete transcript of the earnings call, please refer to the full earnings call transcript.

Positive Points

- Zebra Technologies Corp (ZBRA, Financial) reported a 12% year-over-year increase in sales, exceeding $1.3 billion for the quarter.

- The company achieved an adjusted EBITDA margin of 22.3%, marking a 240 basis point increase from the previous year.

- Non-GAAP diluted earnings per share rose by 42% to $4.02, surpassing the high end of their outlook.

- Zebra Technologies Corp (ZBRA) experienced strong broad-based growth across all major product categories and regions.

- The company has made significant progress in diversifying its supply chain beyond China, enhancing its agility and resilience.

Negative Points

- Zebra Technologies Corp (ZBRA) is facing a $70 million gross profit impact from tariffs for the full year, which is $50 million higher than prior guidance.

- The manufacturing vertical continues to lag behind other sectors, showing only high single-digit growth.

- The company is experiencing macroeconomic uncertainty, particularly related to global trade policies and tariffs.

- Despite strong demand, the Services and Software recurring revenue business grew only slightly in the quarter.

- Zebra Technologies Corp (ZBRA) has not raised its full-year sales guidance due to the fluid global trade environment and related uncertainties.