DATA Communications Management Corp (TSX:DCM, Financial) is set to release its Q1 2025 earnings on May 13, 2025. The consensus estimate for Q1 2025 revenue is $122.23 million, and the earnings are expected to come in at $0.08 per share. The full year 2025's revenue is expected to be $491.22 million and the earnings are expected to be $0.40 per share. More detailed estimate data can be found on the Forecast page.

DATA Communications Management Corp (TSX:DCM, Financial) Estimates Trends

Over the past 90 days, revenue estimates for DATA Communications Management Corp (TSX:DCM) have declined from $519.91 million to $491.22 million for the full year 2025 and from $532.50 million to $512.12 million for 2026. Similarly, earnings estimates have decreased from $0.55 per share to $0.40 per share for 2025 and from $0.92 per share to $0.50 per share for 2026.

DATA Communications Management Corp (TSX:DCM, Financial) Reported History

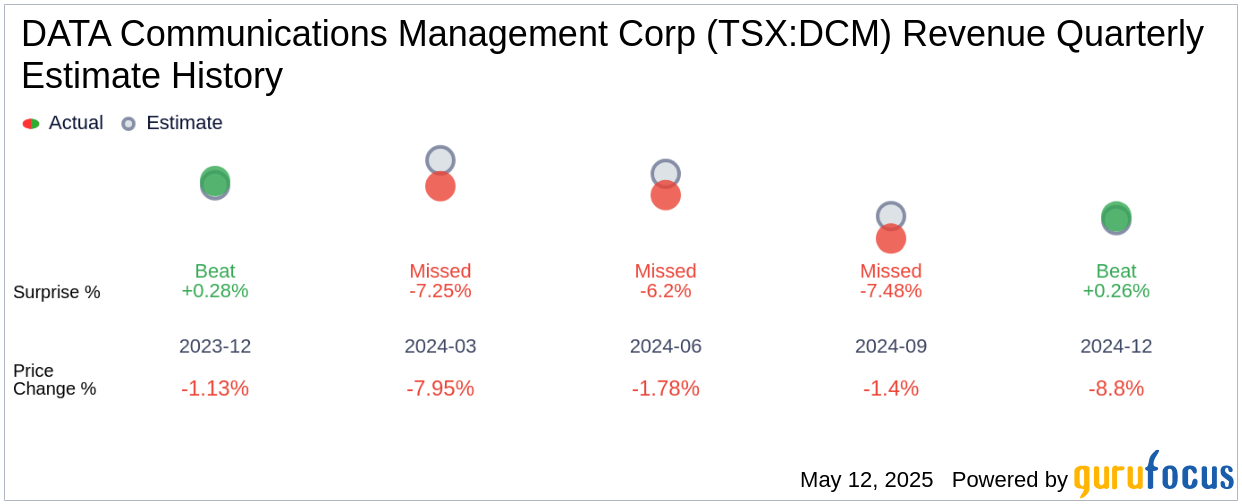

In the previous quarter ending December 31, 2024, DATA Communications Management Corp's (TSX:DCM) actual revenue was $116.23 million, which beat analysts' revenue expectations of $115.93 million by 0.26%. However, the actual earnings were $0.01 per share, missing analysts' expectations of $0.095 per share by 89.47%. Following the release of the results, DATA Communications Management Corp (TSX:DCM) saw a decrease of 8.80% in one day.

DATA Communications Management Corp (TSX:DCM, Financial) 12 Month Price Targets

Based on the one-year price targets offered by 4 analysts, the average target price for DATA Communications Management Corp (TSX:DCM) is $4.00, with a high estimate of $4.50 and a low estimate of $3.50. The average target implies an upside of 132.56% from the current price of $1.72.

According to GuruFocus estimates, the estimated GF Value for DATA Communications Management Corp (TSX:DCM, Financial) in one year is $2.62, suggesting an upside of 52.33% from the current price of $1.72.

Based on the consensus recommendation from 4 brokerage firms, DATA Communications Management Corp's (TSX:DCM, Financial) average brokerage recommendation is currently 1.5, indicating a "Buy" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.